Thailand Cuts Key Rate To Record Low, Relaxes Capital Outflow Rules

05 Noviembre 2019 - 10:07PM

RTTF2

Thailand's central bank slashed its key interest rate to a

record low on Wednesday, in a bid to support growth and inflation,

and relaxed the rules to boost capital outflows to ease the

pressure on the Thai baht. The Monetary Policy Committee voted 5-2

to cut the policy rate by 25 basis points to 1.25 percent, the bank

said in a statement. The reduction was in line with economists'

expectations.

Th policy rate was left unchanged in the previous policy session

in September.

The previous change in the rate was a quarter-point reduction in

August, which was the first such move in over four years. The last

time the policy rate at this record level was in June 2010. "Most

members viewed that a more accommodative monetary policy stance

would contribute to economic growth and support the rise of

headline inflation toward the target," the central bank said. The

two dissenting members sought to leave the rate unchanged as they

viewed that under the "already accommodative monetary policy at

present, the policy rate cut might not lend additional support to

economic growth, compared with potentially increased financial

stability risks."

Further, they pointed out the "need to preserve the limited

policy space for coping with potentially increasing risks in the

future."

"In deliberating their policy decision, the Committee assessed

that the Thai economy would expand at a lower rate than previously

assessed and further below its potential due to a decline in

exports which affected employment and domestic demand," the bank

said.

The BoT projected headline inflation to be below the lower bound

of the inflation target. Core inflation was expected to slow due to

subdued demand-pull inflationary pressures.

Policymakers expressed concern over the strong baht that might

affect the economy to a larger degree amid heightened uncertainties

pertaining to the external front, the bank said.

The Ministry of Finance and the central bank jointly announced

on Wednesday a relaxation of regulations that included allowing

exporters to keep foreign currency proceeds overseas.

Under the relaxed rules, retail investors are allowed to invest

in foreign securities without going through a Thai intermediary

institution and businesses and individuals can transfer funds

abroad more freely.

The relaxed rules will take effect on November 8. "The Committee

still saw a need to continue to closely monitor developments of

exchange rates and capital flows and would consider implementing

appropriate measures in addition if necessary," the bank said.

Exports are projected to recover more slowly than expected earlier

due to the global trade tensions and tourism is also seen expanding

at a low rate.

Despite fiscal stimulus, private consumption is also expected to

slow due to moderate household income, a sharp decline in

employment, mainly in the export-oriented sectors, and high

household debt levels.

Investment growth is also seen lower, but is expected to be

boosted by the relocation of production base to Thailand and

public-private partnership projects. Rate-setters assessed that the

Thai economy would face higher risks in the following period,

especially external risks from trade tensions, the economic outlook

of China and advanced economies that could affect domestic demand,

as well as geopolitical risks. Given the weak growth and inflation

outlook, Capital Economics economist Gareth Leather expects the BoT

to slash the policy rate next year, could be the last in the

current easing cycle, that would take it to a fresh low of 1

percent. ING's Prakash Sakpal said the latest reduction marked the

end of a relatively short-easing cycle of an otherwise hawkish

Asian central bank, thus shifting the onus on to fiscal policy.

"With the policy interest rate already at its record low level,

there isn't much policy space left on the monetary side," Sakpal

said.

"Nor would further rate cuts be a sure-fix for the economy

plagued by years of political uncertainty dampening domestic

demand, while headwinds to any export-led recovery are getting

stronger."

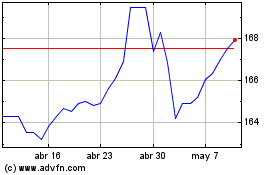

Euro vs Yen (FX:EURJPY)

Gráfica de Divisa

De Mar 2024 a Abr 2024

Euro vs Yen (FX:EURJPY)

Gráfica de Divisa

De Abr 2023 a Abr 2024