JPMorgan Deal Shows Possible Path to Smaller Fannie and Freddie

08 Noviembre 2019 - 7:29AM

Noticias Dow Jones

By Sam Goldfarb

A recent move by JPMorgan Chase & Co. to shed risk on some

of its mortgage loans is stirring hope that the tactic could help

reduce the government's role in the $11 trillion mortgage

market.

JPMorgan last month became the first U.S. bank to issue

credit-risk transfers tied to a pool of mortgages. The bondlike

instruments have been embraced by the government-controlled

mortgage guarantors Fannie Mae and Freddie Mac since their

introduction in 2013.

Like the credit-risk transfers issued by Fannie and Freddie,

those sold by JPMorgan pay investors a stream of income. In

exchange, investors will shoulder losses up to a certain level if

homeowners default on loans in the underlying pool of

mortgages.

In essence, JPMorgan has bought a type of insurance on loans it

had already made to borrowers with high credit scores. That, in

turn, should allow it to hold less capital against those loans.

The deal is notable because some analysts think that a new

market for credit-risk transfers issued by banks could make it at

least a little more likely that banks would hold mortgages rather

than selling them to Fannie and Freddie. By extension, such an

outcome would make taxpayers less exposed to mortgage defaults.

Fannie and Freddie don't make loans but buy them from lenders

and bundle them into securities. They typically carry a guarantee

that Fannie and Freddie will pay investors if the underlying

mortgages default, leaving investors with only the risk that the

bonds will lose value if interest rates rise.

As it stands, nearly half of U.S. mortgages are guaranteed by

Fannie and Freddie. Under government control since the start of the

2008 financial crisis, Fannie and Freddie have always carried at

least the implicit backing of the government, which has been

critical to preserving America's popular 30-year fixed-rate

mortgage.

For years, both Republicans and Democrats have considered

options for replacing the mortgage giants or introducing more

competition in the housing finance market in an effort to protect

taxpayers.

In September, the Trump administration outlined a plan to return

Fannie and Freddie to the private market and reduce their market

share while continuing to provide them with a government backstop.

Among its ideas: reducing the amount of capital that banks would

need to hold against a pool of mortgages if they issue credit-risk

transfers.

James Dimon, the chief executive of JPMorgan, has for many years

been critical of government regulations that he says have made it

overly difficult for banks to hold mortgages. He has, though,

offered praise for the Trump administration's proposals.

In the specific case of last month's deal, the roughly $750

million of mortgages linked to JPMorgan's credit-risk transfers

were likely never going to be sold to Fannie and Freddie, in part

because the average loan in the pool was too large, analysts

said.

The loans, in general, were made to borrowers with high credit

scores and low leverage, making defaults relatively unlikely. The

maturities of the risk-transfer securities matched those of the

underlying mortgages.

Investors in credit-risk transfers issued by banks are taking an

additional risk that the banks themselves could become insolvent,

analysts said. That could make it uneconomical for all but the

largest and most creditworthy banks to issue the securities.

Still, some have welcomed JPMorgan's deal as a step in a

positive direction.

Credit-risk transfers could be "the next little big thing" for

banks, said Chris Helwig, a managing director at Amherst Pierpont

Securities.

At a minimum, it could help some banks shed risk and free up

capital that they can allocate elsewhere, he said. It also "opens

the door for banks to put more loans on their balance sheets."

To receive our Markets newsletter every morning in your inbox,

click here.

--Ben Eisen contributed to this article.

Write to Sam Goldfarb at sam.goldfarb@wsj.com

(END) Dow Jones Newswires

November 08, 2019 08:14 ET (13:14 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

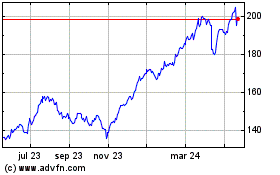

JP Morgan Chase (NYSE:JPM)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

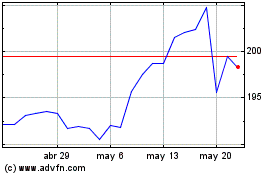

JP Morgan Chase (NYSE:JPM)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024