Robin Hood, New York's largest poverty-fighting organization, held

its annual Investors Conference on October 28 and 29, 2019 at

Spring Studios in Manhattan. The event, now in its seventh year,

was presented by J.P. Morgan.

The conference brought together leaders in finance, biotech,

gaming and entertainment, health care and politics to share

actionable, money-making insights with the 600-person audience.

Since its inception in 2013, the event has raised nearly $40

million through sponsorships and ticket sales. As with every

donation to Robin Hood, 100 percent of ticket sales go directly to

the poverty fight.

“This Investors Conference convenes legendary titans of industry

with actionable insights to support Robin Hood’s work lifting

households out of poverty,” said Robin Hood CEO Wes Moore. “Our

27-year history of partnership with J.P. Morgan is a major asset to

empower Robin Hood to work with communities to create mobility from

poverty.”

“J.P. Morgan has partnered with Robin Hood for nearly three

decades and we are proud to support its mission to fight poverty in

New York City,” said Mary Callahan Erdoes, CEO of J.P. Morgan Asset

& Wealth Management. "Our work together on the Robin Hood

Investors Conference helps broaden the impact of Robin Hood’s key

programs, ensuring that every dollar raised goes to directly fund

schools, food pantries, homeless shelters, job training centers,

health facilities, legal clinics and more.”

The two-day conference was led by Robin Hood’s Investors

Conference Committee comprised of Lee S. Ainslie III, Managing

Partner of Maverick Capital Management, LLC; Anthony Bozza,

co-founder & Managing Partner of Lakewood Capital Management;

Elissa Doyle, Chief Communications Officer and Head of ESG

Engagement at Third Point LLC; Mary Callahan Erdoes, CEO of J.P.

Morgan’s Asset & Wealth Management; John A. Griffin, founder of

Blue Ridge Capital; Paul Tudor Jones II, founder, co-chairman, and

chief investment officer of Tudor Investment Corporation; Joel S.

Marcus, chairman, CEO, and founder of Alexandria Real Estate

Equities, Inc.; Stephanie Ruhle, anchor and journalist at MSNBC

& NBC News; and Barry Sternlicht, chairman and CEO of Starwood

Capital Group.

The conference's agenda included "fireside chats" and panels

featuring Bill Ackman of Pershing Square Capital Management, LP in

conversation with Stephanie Ruhle of MSNBC & NBC News, Angela

Aldrich of Bayberry Capital Partners, Grant Bowman of Hunter

Capital, Steven A. Cohen of Point72 and the Steven and Alexandra

Cohen Foundation, Joe Cornell of Bluegrass Capital, Niall Ferguson

of Stanford University, Tony Florence of NEA, Dr. Alexandria Forbes

of MeiraGTx, Jonathan D. Gray of Blackstone, Jamie Hodari of

Industrious, Ben Horowitz of Andreessen Horowitz, Rebecca Kaden of

Union Square Ventures, Vivian Lau of One Tusk Investment Partners,

Anton Levy of General Atlantic, Allan Lichtman of American

University, Dr. Sharon Mates of Intra-Cellular Therapies, Inc.,

DeShay McCluskey of AltraVue Capital, Adam Parker of Center Lake

Capital Management, Charles Phillips of Infor, author Tony Seba,

Dr. Shoshana Shendelman of Applied Therapeutics, Inc., Edward

Shenderovich of Knotel, Ryan Simonetti of Convene, David M. Solomon

of Goldman Sachs, and David S. Vogel of Voloridge Investment

Management.

Additionally, Anthony T. Bozza of Lakewood Capital Management,

Tony Davis of Inherent Group, Scott Ferguson of Sachem Head Capital

Management, John Khoury of Long Pond Capital LP, Matthew Knauer of

Nokota Management LP, Marko Kolanovic of J.P. Morgan, Alberto G.

Musalem of Evince Asset Management LP, Larry Robbins of Glenview

Capital Management, Alex Sacerdote of Whale Rock Capital Management

LLC, Whitney Tilson of Empire Financial Research, Boaz Weinstein of

Saba Capital Management LP, and Lauren Taylor Wolfe of Impactive

Capital presented their best investment ideas.

About Robin HoodFounded in 1988, Robin Hood

finds, fuels, and creates the most impactful and scalable solutions

lifting families out of poverty in New York City, with models that

can work across the country. Robin Hood invests nearly $120 million

annually to provide legal services, housing, meals, workforce

development training, education programs, and more to families in

poverty in New York City. Robin Hood tracks every program with

rigorous metrics, and since Robin Hood’s Board of Directors covers

all overhead, 100 percent of every donation goes directly to the

poverty fight. Learn more at www.robinhood.org; and follow Robin

Hood on Facebook, Twitter, Instagram.

About JPMorgan Chase & Co.JPMorgan Chase

& Co. (NYSE: JPM) is a leading global financial services firm

with assets of $2.8 trillion and operations worldwide. The Firm is

a leader in investment banking, financial services for consumers

and small businesses, commercial banking, financial transaction

processing, and asset management. A component of the Dow Jones

Industrial Average, JPMorgan Chase & Co. serves millions of

customers in the United States and many of the world’s most

prominent corporate, institutional and government clients under its

J.P. Morgan and Chase brands. Information about JPMorgan Chase

& Co. is available at www.jpmorganchase.com.

Please direct any inquiries to press@robinhood.org.

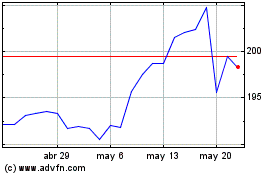

JP Morgan Chase (NYSE:JPM)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

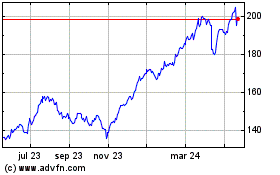

JP Morgan Chase (NYSE:JPM)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024