By Sarah Krouse

The advent of faster 5G wireless service could be a boon for the

fledgling U.S. mobile sports-betting industry.

In particular, the technology is expected to make it easier for

fans to make wagers during games -- such as whether a quarterback

will complete his next pass, or a basketball player will make free

throws -- as the action unfolds.

The U.S. Supreme Court opened the door to legal sports betting

in the U.S. in 2018 when it struck down federal prohibitions on

such wagering and left it up to states to set their own rules.

Since then New Jersey, along with 11 other states and the District

of Columbia, have legalized sports betting over smartphones,

according to the American Gaming Association.

Now, wireless carriers are rolling out 5G networks in select

U.S. cities, lighting up professional football stadiums and

basketball arenas with the faster service. The technology allows

more devices to be connected at a time and promises to reduce

latency (the amount of time that machines take to respond to each

other), which could keep fans on their phones longer and encourage

more of them to wager while they watch. Outside stadiums, 5G

service could enable fans to make mobile bets while simultaneously

streaming games on their phones.

"Can you pull it off on 4G? Maybe. But can you pull it off on

5G? For sure," Tim Sullivan, chief executive of the New Jersey

Economic Development Authority, says of in-game betting.

Staking a claim

The confluence of 5G and mobile sports betting is expected to

open up new revenue opportunities for sports leagues, gambling

companies and telecommunications firms alike, executives say.

Enhancing today's popular fantasy sports leagues with online

betting, for example, could prompt consumers to spend more time and

money in those apps.

Among the companies making new inroads in this area is New

York-based Verizon Communications Inc., which owns Yahoo Sports, a

provider of sports news, scores and fantasy sports leagues. In

October, Verizon's media unit formed a partnership with casino

giant MGM Resorts International, linking the Yahoo Sports app with

the casino giant's BetMGM platform to allow sports betting.

Scott Butera, president of interactive gaming at MGM, says

fantasy and live-sports content are complementary. "If Tom Brady is

your quarterback this week in fantasy, maybe you will also be

inclined to bet on whether he'll throw two or more touchdown passes

in a game," he says. (The geolocation feature in phones helps

betting apps determine whether consumers are located in states that

allow mobile wagers.)

Faster 5G service will help connect more sensors within stadiums

and bring much lower latency, which translates into more in-game

betting opportunities, says Guru Gowrappan, chief executive officer

of Verizon Media Group.

AT&T Inc. also has taken an interest in the sports-betting

space. Earlier this year the sports-news website Bleacher Report,

part of AT&T's WarnerMedia unit, formed a partnership with

Caesars Entertainment Corp. to produce sports-betting related

content, including videos.

"We don't want to be, you know, running books. That's not our

gig," Randall Stephenson, chief executive of AT&T, said on a

Recode podcast earlier this year. But gambling is critical to the

business AT&T is in, he said.

"There's nothing that changes the fan engagement more than

having something on the line on a game," he said.

Gambling is also slowly making its way into sports venues. Last

month, Monumental Sports & Entertainment, the owner of the

Washington Wizards basketball team, Washington Capitals hockey

team, and Washington Mystics women's basketball team, signed an

agreement with U.K.-based betting company William Hill to open a

sports-betting complex inside the District of Columbia's Capital

One Arena. Monumental said the agreement is the first of its kind

for a professional sports venue in the U.S.

In the U.K., more than 70% of all mobile sports bets are in-play

or after the game has started, while sports betting in the U.S. has

focused primarily on which team will win or lose, says Stephen

Master, president of sports-business advisory firm Master

Consulting.

U.S. sports are well positioned for in-game betting, he says,

because games like baseball and football are less free-flowing than

soccer. Every at-bat, drive or kickoff has an outcome on which to

bet.

But "if in-play betting is really going to take off like it has

overseas, you really need the low-latency, high-speed connectivity"

of 5G, he says.

Challenges remain

Professional sports leagues already are affixing sensors to

players and sports equipment to collect biometric, performance,

speed and velocity measurements.

Zebra Technologies Corp., based in Lincolnshire, Ill., partners

with the NFL to put chips on player uniforms and balls that track

statistics such as player speed and proximity to each other.

To date, that information has been used to help coaches and

players improve performance, but sports-betting executives expect

that data to eventually be piped into fan-wagering platforms. Such

data, for example, would allow consumers to bet on the speed of a

player as he scores a touchdown or how fast a quarterback's pass

was.

Still, fusing 5G service with mobile sports betting may take

some time. U.S. consumers are holding on to their smartphones

longer -- often more than three years -- so the adoption of devices

compatible with 5G service could be slow.

And although carriers began rolling out 5G networks this year in

select cities and some sports arenas, it could take years before

the service is widely available nationwide.

Meanwhile, constant interaction with devices during games could

drain phone batteries, reducing some fans' incentive to engage in

mobile sports betting. And those who want to simultaneously stream

games and bet on them via their phones may need larger screens to

have the best user experience, sports-betting consultants say.

Nevertheless, some states expect the broader adoption of mobile

sports betting to fuel new and existing industries. Behind the fan

placing bets on the Jets or Giants on a Sunday afternoon is

sophisticated wireless-payments and financial-services technology

and regulatory infrastructure, says New Jersey's Mr. Sullivan.

Betting on in-game action requires even faster connectivity and

further investment by the companies that provide those

services.

Ms. Krouse is a reporter for The Wall Street Journal in New

York. Email her at sarah.krouse@wsj.com.

(END) Dow Jones Newswires

November 11, 2019 22:15 ET (03:15 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

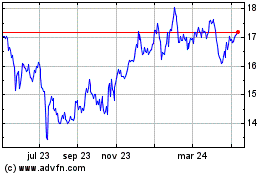

AT&T (NYSE:T)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

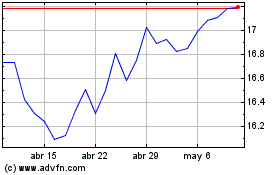

AT&T (NYSE:T)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024