Mediobanca to Return Up to EUR2.5 Billion to Shareholders Through 2023

12 Noviembre 2019 - 7:40AM

Noticias Dow Jones

By Pietro Lombardi

Mediobanca is targeting higher earnings, revenue and

profitability through 2023, while planning to return up to 2.5

billion euros ($2.76 billion) to shareholders via dividends and

buybacks and continuing in its strategy of growing via targeted

acquisitions.

The new plan comes at a time of significant changes for the

investment bank. Last week, Italy's largest lender UniCredit SpA

(UCG.MI) sold its stake in the bank, ending a relationship spanning

over 70 years and leaving Italian billionaire and founder of

eyewear behemoth Luxottica, Leonardo Del Vecchio as the major

shareholder in Mediobanca, with a 9.9% stake. It also comes as the

banking industry faces a tough environment, with regulatory changes

compounding negative interest rates and low economic growth.

The bank targets revenue growth of 4% per year to EUR3 billion,

it said Tuesday, as it presented its new strategic plan through

2023. Earnings per share are seen rising 4% per year, while the

bank's return on tangible equity, a key measure of profitability,

is expected to reach 11% from the 10.2% it reported for fiscal

2019. These results should be reached thanks to growth across the

bank's business segments: Revenue should rise 8% yearly in the

wealth-management business, while the corporate and investment

banking business's top line is seen growing 6% per year. Revenue in

the consumer-banking unit is expected to grow 3% per year.

Mediobanca plans to increase shareholder remuneration by 50%,

compared with the previous plan, to up to EUR2.5 billion over the

plan's period. Of this, EUR1.9 billion will be in dividends, with

an additional EUR300 million to EUR600 million through buybacks.

Dividend per share is expected to grow by 10% in 2020 and 5% in

each of the following years, reaching EUR0.60 per share at the end

of the plan.

The bank will also continue with its M&A strategy.

"Companies which are able to accelerate the process of growing

the Mediobanca Group's core businesses will be considered as

potentially attractive targets, with a preference for

capital-light, high fee-generating businesses which are an

excellent fit for Mediobanca in terms of culture, ethics and

business approach," it said.

Mediobanca closed the previous plan achieving the targets it had

set and posting for fiscal 2019 its best yearly results in a decade

in terms of revenue, operating profit and net profit. The return on

tangible equity was 10.2% while the payout ratio was 50%.

In recent years Mediobanca has sold a number of stakes in other

companies using the proceeds to boost its corporate and

investment-banking business, as well as retail and

wealth-management operations. For example, it bought a 51% stake in

London-based credit manager Cairn Capital Group Ltd. from Royal

Bank of Scotland Group PLC (RBS.LN) and other institutional

investors and bought Barclays PLC's (BARC.LN) Italian retail

business.

The bank still has a 13% stake in Assicurazioni Generali SpA

(G.MI), Europe's third-largest insurer. Mr. Del Vecchio has

recently criticized the bank's management in Italian media, for its

reliance on Generali's stake and on its consumer-credit unit

Compass. He called for a stronger focus on its investment banking

business. Mr. Del Vecchio also has a stake just shy of 5% in the

insurer.

Write to Pietro Lombardi at pietro.lombardi@dowjones.com

(END) Dow Jones Newswires

November 12, 2019 08:25 ET (13:25 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

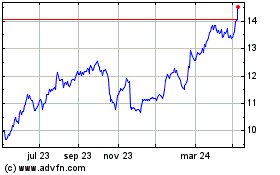

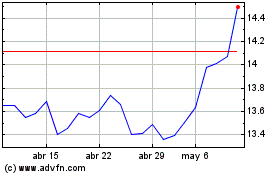

Mediobanca Banca di Cred... (BIT:MB)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Mediobanca Banca di Cred... (BIT:MB)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024