Tissue Regenix Group PLC Updated loan facility agreement with MidCap (3497T)

14 Noviembre 2019 - 1:01AM

UK Regulatory

TIDMTRX

RNS Number : 3497T

Tissue Regenix Group PLC

14 November 2019

This announcement contains inside information

Tissue Regenix Group plc

Updated loan facility agreement with MidCap

Leeds, 14 November 2019 - Tissue Regenix Group (AIM:TRX)

("Tissue Regenix" or the "Company") the regenerative medical

devices company, announces the terms of a revised agreement

("Agreement") that it has entered into with MidCap Financial Trust

("MidCap") with regard to the term loan credit facility (the "Term

Loan") and revolving credit facility (the "RCF") (together, the

"Facilities"). This follows the Company's announcement on 11

November 2019. Further details of the Facilities are contained in

the Company's announcement on 4 June 2019.

Following engagement with MidCap the Company has successfully

renegotiated the Term Loan, agreeing an immediate repayment of $5.5

million of the outstanding Term Loan ("Repayment"). Under the terms

of the Agreement, MidCap has agreed to waive the prepayment fee and

defer a portion of the exit fee due thereunder until the earlier of

the date upon which the Term Loan is repaid or the maturity date.

The remaining balance of $2.0 million of the Term Loan currently

drawn down by the Company will remain in place ("Tranche One"). The

Company will also continue to have access to draw down the

remainder of the RCF, which is calculated based on the underlying

inventory and receivables on the balance sheet and eligibility

thereof. In addition, MidCap has agreed to suspend its testing of

the financial banking covenants until 30 June 2020, when it will

recommence with reduced revenue targets.

MidCap has agreed to add the repaid $5.5 million of Tranche One

to its commitment amount under tranche two of the Term Loan, which

consisted of $5.0 million and now consists of $10.5 million

("Tranche Two"). Access to Tranche Two and the final tranche of

$2.5 million ("Tranche Three") of the Term Loan remain in place,

however the drawdown of these tranches is now subject to MidCap's

discretion and satisfactory recapitalisation of the Company at that

time.

The repayment of the outstanding principal of the Term Loan will

begin on 1 July 2020 and will amortise on a straight-line basis

across 48 months.

The Company's cash balance as at 31 October 2019 was $9.3

million including $0.6 million of drawn RCF. Following the

Repayment, the Company will have cash of approximately $3.7 million

including $0.7 million of the drawn revolver and as at 31 October

2019 the business had access to a further $1.1 million of the RCF

based on the available inventory and receivables at that time.

The Company estimates that, following the Repayment, it

currently has sufficient working capital until at least the end of

March 2020. The Board is currently considering the funding

requirements, and further announcements will be made at the

appropriate time.

John Samuel, Executive Chairman Tissue Regenix Group plc,

commented: "I am very pleased that Midcap have shown their support

for the Company by entering this revised agreement. There is still

much to do to bring on stream new capacity but with strong demand

for our products and the hard work and dedication of our employees

we will continue to review our funding options."

For more Information:

Tissue Regenix Group plc Tel: 0330 430 3073 /

Caitlin Pearson Head of Communications 07920272 441

--------------------------------------------- ---------------------

Stifel Nicolaus Europe Limited (Nominated Tel: 0207 710 7600

Adviser, Broker and Financial Advisor)

Jonathan Senior / Alex Price / Ben Maddison

--------------------------------------------- ---------------------

FTI Consulting Tel: 0203 727 1000

Brett Pollard / Victoria Foster Mitchell

/ Mary Whittow

============================================= =====================

The person responsible for this announcement is John Samuel,

Executive Chairman

About Tissue Regenix

Tissue Regenix is a leading medical devices company in the field

of regenerative medicine. Tissue Regenix was formed in 2006 when it

was spun-out from the University of Leeds, UK. The company's

patented decellularisation ('dCELL(R) ') technology removes DNA and

other cellular material from animal and human soft tissue leaving

an acellular tissue scaffold which is not rejected by the patient's

body and can then be used to repair diseased or worn out body

parts. Current applications address many critical clinical needs

such as sports medicine, heart valve replacement and wound

care.

In November 2012 Tissue Regenix Group plc set up a subsidiary

company in the United States - 'Tissue Regenix Wound Care Inc.',

January 2016 saw the establishment of joint venture GBM-V, a multi-

tissue bank based in Rostock, Germany.

In August 2017 Tissue Regenix acquired CellRight Technologies(R)

, a biotech company that specializes in regenerative medicine and

is dedicated to the development of innovative osteoinductive and

wound care scaffolds that enhance healing opportunities of defects

created by trauma and disease. CellRight's human osteobiologics may

be used in spine, trauma, general orthopedic, foot & ankle,

dental, and sports medicine surgical procedures.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

UPDLXLLFKFFXFBL

(END) Dow Jones Newswires

November 14, 2019 02:01 ET (07:01 GMT)

Tissue Regenix (LSE:TRX)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

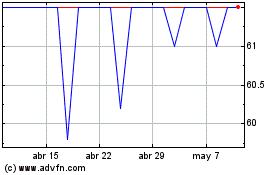

Tissue Regenix (LSE:TRX)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024