TIDMAGT

RNS Number : 4867T

AVI Global Trust PLC

14 November 2019

AVI GLOBAL TRUST PLC

Monthly Update

AVI Global Trust plc (the "Company") presents its Update,

reporting performance figures for the month ended 31 October

2019.

This Monthly Newsletter is available on the Company's website

at:

https://www.aviglobal.co.uk/content/uploads/2019/11/AVI-Global-Trust-2019-OCT.pdf

Performance Total Return

This investment management report relates to performance figures

to 31 October 2019.

Month Financial Calendar

Yr * Yr

to date to date

AGT NAV(1) -1.6% -1.6% 12.4%

MSCI ACWI Ex US(2) -1.4% -1.4% 13.6%

MSCI ACWI Ex US Value(1) -1.6% -1.6% 8.8%

MSCI ACWI(1) -2.2% -2.2% 17.5%

Morningstar Global Growth(1) -1.9% -1.9% 15.8%

* AVI Global Trust financial year commences on the 1(st)

October. All figures published before the fiscal results

announcement are AVI estimates and subject to change.

(1) Source: Morningstar. All NAV figures are cum-fair

values.

(2) From 1(st) October 2013 the lead benchmark was changed to

the MSCI ACWI ex US (GBP) Index. The investment management fee was

changed to 0.7% of net assets and the performance related fee

eliminated.

Manager's Comment

AVI Global Trust (AGT)'s NAV fell by -1.6% in October, with

underlying NAV declines more than offsetting the positive impact

from a tightening portfolio discount (in from 33.0% to 32.5%).

Currencies were a powerful headwind over the month, with GBP

strengthening against all major currencies on the back of the UK's

Withdrawal Agreement reached with the EU. Contributors for the

month include EXOR, the Japan Special Situations basket, and Cosan

Ltd. Detractors include Riverstone Energy, Pershing Square

Holdings, and Third Point Offshore Investors (all three of which

suffered from a weaker USD, the most pronounced of the major

currency moves against GBP).

EXOR was your Company's largest contributor, adding 43 basis

points (bps) to returns as the NAV rose by +6%. The discount

tightened from 31% to 28%, resulting in total share price returns

of +12%. Fiat Chrysler Automobiles (FCA), 28% of EXOR's NAV, was

the star performer with a share price rise of +17% following the

announcement of its merger with Peugeot. A large part of our thesis

for EXOR has been the consolidation of FCA with a large competitor.

Under the terms of the deal, FCA shareholders will receive c. 30%

of the pre-announcement share price in the form of a special

dividend as well as a distribution of Comau shares (a company

specialising in industrial automation in which FCA holds a stake),

and will own 50% of the combined entity post-merger. Taking just

50% of the expected annual synergies adds 31% to FCA's earnings,

highlighting the accretive nature of the deal.

The deal will create the fourth largest autos manufacturer

globally, with annual sales of 9m vehicles. We view the combination

as eminently sensible, given the complementary nature of each

company's geographic operations (e.g. PSA has a large, profitable

business in Europe, but low exposure to the Americas; FCA is much

stronger in the US than it is in Europe), and the ability to

generate cost savings through scale and increased purchasing power.

The Agnelli family behind EXOR - particularly John Elkann - has a

history of savvy capital allocation at FCA, such as the spin-out of

Ferrari and CNH Industrial to unveil hidden value, the sale of

parts manufacturer Magneti Marelli to KKR/Calsonic Kansei, and now

the planned merger with Peugeot. By aligning AGT's capital with the

Agnelli's holding company, EXOR, we benefit from this long-term

view and disciplined, value-creating approach to capital

allocation. At the current 28% discount, we continue to see

considerable value in the shares with multiple levers of value

creation available, including a spin-out of Maserati & Alfa

Romeo from FCA, the planned split of CNH Industrial (16% of EXOR's

NAV) into two specialised companies, and the use of special

dividends to conduct NAV-accretive buybacks at the EXOR level.

The Japan Special Situations basket was October's second-largest

contributor, adding 32bps to NAV. The 17 stocks in the basket

returned an average of +7% (in JPY terms), outperforming both the

TOPIX and TOPIX Small (+5% and +6% respectively) along the way.

Notable performers in the basket include Fujitec (+14%), with

strong upward revision in profit forecasts, and Sekisui Jushi (+5%)

which announced a buyback of 7% of outstanding shares. The level of

total buybacks in Japan has been increasing strongly, with JPY12

trillion of announced buybacks in 2019 (year to date), which

compares to JPY6 trillion in 2018.

There was a negative note during the month, when the Japanese

government published proposals that altered the ownership level at

which foreign investors in protected industries need to seek

regulatory approval. The proposals appeared, prima facie, designed

to thwart foreign activism in the country; however, the Ministry of

Finance later clarified that foreign investors will be exempted,

provided that they do not seek a director's seat or the sale of key

assets.

Post month end, our thesis that parent-child listed subsidiary

arrangements would come under pressure was confirmed as Toshiba

Corp offered to buy in three of its listed subsidiaries, of which

two are held in the Japan Special Situations basket: Toshiba Plant

& Systems (52% owned by Toshiba Corp) and Nuflare Technologies

(57%). Toshiba Corp offered JPY2,670 and JPY11,900 for Toshiba

Plant and Nuflare respectively, representing increases of +27% and

+45% from the undisturbed share price. Since the end of September,

the tender offer from Toshiba Corp represents a rise of +48% and

+55% for Toshiba Corp and Nuflare respectively.

We consider all these developments to be highly encouraging and

interpret them as being confirmatory evidence of the changing

regime in Japan, with corporations improving their capital

allocation and governance policies to the benefit of all

stakeholders. Furthermore, the government remains supportive of

foreign activism to propel changes in corporate Japan.

Riverstone Energy (RSE) was this month's largest detractor,

reducing returns by 65bps as its share price declined by -26%. We

wrote extensively about RSE in the recently published annual

report.

In summary, RSE has been negatively impacted by the decline in

oil prices over the past year, with West Texas Intermediate falling

-23% since the October 2018 peak, and multiples for listed US

E&P companies falling much more dramatically. RSE's third

quarter statement reveals the extent of the downfall, with the

portfolio currently held at 0.7x cost, compared to 1.4x just one

year ago. Particular pain has been felt at Hammerhead Resources

(11% of NAV), with infrastructure bottlenecks depressing local oil

prices, and listed Centennial Resource Development (CDEV) (7% of

NAV - down -25% in October and -85% over one year). In the case of

CDEV, the current share price - combined with a conservative

valuation placed on each flowing barrel - implies a negative value

being assigned to its undeveloped acreage.

Our investment in RSE has clearly been a difficult one over the

last year. While we are encouraged by the Board's recent

announcement that it was evaluating options to manage the discount,

we believe that structural solutions will be required to

sustainably narrow the discount.

Pershing Square Holdings (PSH) was the second-largest detractor,

reducing returns by 56bps (over half of this due to currency,

however). The NAV fell by -5%, although the discount tightened by

1% to 26%, resulting in share price returns of -4%. Performance at

the portfolio level was mixed, with key holding Chipotle Mexican

Grill (19% of PSH's NAV) falling -7% despite a strong quarterly

earnings report with beats on sales, profits and margins. Concerns

have grown about the company's ability to maintain high same-store

sales growth next year versus more challenging comps, but we

believe the runway from menu innovation and further growth in

digital orders is very long. Restaurant Brands (18% of PSH's NAV)

declined -8% on worries about slowing growth at Burger King and Tim

Hortons. Howard Hughes (8%)'s share price fell -14% as the results

of its strategic review made clear that a quick sale of the

business is unlikely. That said, sales of non-core assets with the

proceeds used for an aggressive buyback programme should prove

supportive.

Trading activity was limited over the month. AGT received a

distribution of GBP8m from Vietnam Phoenix (1.8% of NAV) following

the sale of key asset Greenfeed.

Contributors / Detractors (in GBP)

Largest Contributors 1 month contribution Percent of

bps NAV

EXOR 43 5.1

JAPAN SPECIAL SITUATIONS** 32 18.9

Largest Detractors 1 month contribution Percent of

bps NAV

RIVERSTONE ENERGY -65 1.9

PERSHING SQUARE HOLDINGS -56 7.3

** A basket of 17 stocks: Daiwa Industries, Fujitec Co, Kanaden

Corp, Kato Sangyo Co, Konishi Co, Mitsuboshi Belting, Nakano Corp,

Nishimatsuya Chain Co, NuFlare Technology, Pasona Group, Sekisui

Jushi Corp, SK Kaken, Tachi-S Co, Teikoku Sen-I Co, Toagosei Co,

Toshiba Plant Systems & Services, Digital Garage

Link Company Matters Limited

Corporate Secretary

14 November 2019

LEI: 213800QUODCLWWRVI968

The content of the Company's web-pages and the content of any

website or pages which may be accessed through hyperlinks on the

Company's web-pages, other than the content of the Newsletter

referred to above, is neither incorporated into nor forms part of

the above announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

DOCBLBDBDXBBGCS

(END) Dow Jones Newswires

November 14, 2019 11:37 ET (16:37 GMT)

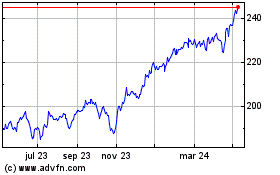

Avi Global (LSE:AGT)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

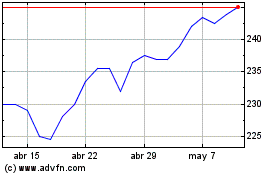

Avi Global (LSE:AGT)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024