Fidelity, T. Rowe Win Preliminary OK on New Stock-Picking ETFs

14 Noviembre 2019 - 6:21PM

Noticias Dow Jones

By Justin Baer and Dawn Lim

Fidelity Investments and T. Rowe Price Group Inc. were among the

firms that won preliminary regulatory approval to offer a new

flavor of exchange-traded fund aimed at reviving investors'

interest in stock-picking managers.

The U.S. Securities and Exchange Commission on Thursday gave a

green light to the firms' plans, along with those submitted by

Natixis Investment Managers and Blue Tractor Group, to create ETFs

that choose securities without exposing the managers' trading

tactics.

The approvals granted Thursday were years in the making, and

come months after upstart Precidian Investments secured a go-ahead

for its own active ETF model.

The firms will still need to work through various details before

launching their funds, which also require further regulatory

approval. A priority is making sure the ETFs can trade

efficiently.

Thursday's approvals bring Fidelity, T. Rowe and the others a

step closer to launching funds they believe will help win back

investors who have moved money into low-cost ETFs that track

popular stock indexes.

Clients have been flocking to these cheaper, passively managed

products, which are less profitable for money-management firms, and

losing faith in more expensive managers that try to outperform the

market by handpicking investments. In a sign of the threat stock

pickers face, assets in actively managed U.S. equity funds were

surpassed by those in funds track broad U.S. stock indexes in

August, Morningstar data show.

Investors' interest in index funds surged in the past decade

with the emergence of the ETF, which trades on exchanges like

stocks but is cheaper, more transparent and more tax-advantageous

than mutual funds.

Active managers like to safeguard their stock-picking strategies

so they aren't mimicked by competitors, and have for years

hesitated to launch standard ETFs because they require more

disclosure than a typical mutual fund. The new ETF models are each

structured in a way that seeks to protect managers' trades.

"Given how money has moved away from traditional stock-picking

funds to ETFs, the ability to offer nontransparent, proven

strategies could be significant," said Todd Rosenbluth, head of

ETFs and mutual-fund research at research firm CFRA. It could

"alleviate some of the pressure traditional asset managers are

facing," he said.

"We are excited to receive notice of approval for our innovative

strategy, which we believe is the best approach to active equity

ETFs for our clients," Greg Friedman, Fidelity's head of ETF

management and strategy, said in a statement.

T. Rowe Price and Natixis aim to launch ETFs that will invest in

U.S. stocks.

"We believe this is a significant milestone that will lead to

opening a new avenue for our business," Tim Coyne, T. Rowe's head

of ETFs, said in a statement.

Precidian has licensed its ETF structure to industry

heavyweights such as Legg Mason Inc. and JPMorgan Chase & Co.,

and Precidian executives expect the first funds based on its model

to launch within the next several months.

Blue Tractor has a similar business plan and will now start

signing up its own licensees, said Simon Goulet, the firm's

co-founder.

(END) Dow Jones Newswires

November 14, 2019 19:06 ET (00:06 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

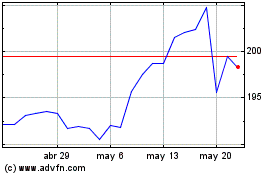

JP Morgan Chase (NYSE:JPM)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

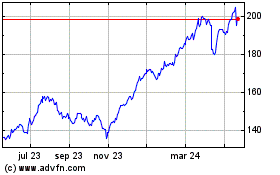

JP Morgan Chase (NYSE:JPM)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024