Dow Jones Industrial Average Tops 28000 for the First Time

15 Noviembre 2019 - 3:42PM

Noticias Dow Jones

By Paul J. Davies and Gunjan Banerji

The Dow Jones Industrial Average surged above 28000 for the

first time Friday, a furious rally in the final minutes of the

trading session.

The blue-chip index opened modestly higher and climbed

throughout the session as investors cheered good news on trade

talks and the economy. Friday's biggest gainers were UnitedHealth

Group, Johnson & Johnson and Pfizer.

The index closed at 28004.89, a gain of 223 points, or 0.8%.

White House economic adviser Lawrence Kudlow indicated progress

toward a potential trade deal with China this week, while Federal

Reserve Chairman Jerome Powell expressed optimism over the economy.

A better-than-expected corporate earnings season has also helped

fend off fears of a recession.

The S&P 500 notched its longest winning streak since 2017,

coming off a historically calm stretch for the stock market.

Investors drove the broad stock market index up about 0.9%

Friday for a 0.9% weekly gain.

The S&P 500's six-week winning streak is its longest since

November 2017 when the index rose for eight consecutive weeks.

However, it comes in the midst of lull -- the index hadn't moved up

or down more than 0.5% for nine consecutive trading days through

Thursday, the longest streak since October 2018, according to Dow

Jones Market Data.

The mixed signals of progress between the U.S. and China have

left investors in a lurch. Although the market sees a resolution as

more likely, global stock indexes have hardly budged this week --

reflecting the continued concern for regression in talks.

"I think the uncertainty is still elevated," said Justin

Onuekwusi, head of retail multiasset funds at Legal & General

Investment Management. "Just because you see an improvement doesn't

mean it's gone away," he said.

The Nasdaq Composite added 0.7%. Those indexes are set slight

weekly gains.

Fresh data early Friday showed U.S. retail sales rebounded in

October, rising 0.3% and beating the estimates of economists

surveyed by The Wall Street Journal.

The latest retail sales figures, along with some strong

corporate earnings reports, have bolstered confidence in the U.S.

consumer, a key engine of domestic growth. Walmart on Thursday

reported another increase in sales, extending its winning streak to

five years.

"Ever so slowly...you get increasing confirmation that this

slowdown has stabilized," said Joseph Amato, chief investment

officer at Neuberger Berman. "All these things have come together

to build a little bit more confidence in risk assets."

On Friday, shares of J.C. Penney rose 8.2% after the retailer

boosted its financial outlook for this year and reported

better-than-expected third-quarter results. Some strong retailer

earnings have spurred optimism that a strong holiday season could

be ahead for these companies.

Investors have also been encouraged by a rebound in

government-bond yields, particularly in the U.S., and the growing

positive gap between 10-year yields and two-year yields, which is a

move away from the recessionary signals of earlier this year.

U.S. 10-year Treasury yields rose to 1.827% on Friday, according

to Tradeweb, from 1.815% on Thursday. The lurch higher in

government bond yields and strong economic data has led some

investors to boost their outlooks for the rest of the year.

"Much of this rally over the past 30 days is the reassessment of

the recession risk that was increasingly priced into the market,"

said Bob Browne, chief investment officer of Northern Trust Corp.

"We would expect this momentum to continue going into the end of

the year."

Elsewhere, the Nikkei 225 in Tokyo finished the day 0.7% higher,

although it was marginally down for the week, while in Europe the

Stoxx 600 was up 0.6% on the day.

In Hong Kong, the Hang Seng Index was flat Friday but ended the

week down 4.8%, its worst week since early August, after

antigovernment protests in the Chinese territory turned more

violent with some of the worst clashes in six months of unrest. The

Shanghai Composite Index ended the week down 2.5%.

There were conflicting signals for the oil markets: The

International Energy Agency raised its 2020 oil-production growth

forecast for producers outside the Organization of the Petroleum

Exporting Countries. However, that came just hours after OPEC had

cut its forecast for oil production output for non-cartel countries

next year.

Caitlin Ostroff contributed to this article.

Write to Paul J. Davies at paul.davies@wsj.com and Gunjan

Banerji at Gunjan.Banerji@wsj.com

(END) Dow Jones Newswires

November 15, 2019 16:27 ET (21:27 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

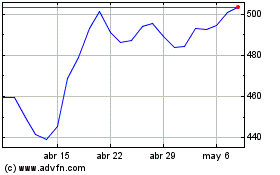

UnitedHealth (NYSE:UNH)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

UnitedHealth (NYSE:UNH)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024