TIDMNTBR

RNS Number : 4383U

Northern Bear Plc

25 November 2019

25 November 2019

Northern Bear plc

("Northern Bear" or the "Company")

Interim results for the six month period ended 30 September

2019

The board of directors of Northern Bear (the "Board") is pleased

to announce the unaudited interim results for the Company and its

subsidiaries (together the "Group") for the six months to 30

September 2019.

Financial Summary

-- Revenue of GBP27.8m (2018: GBP28.6m)

-- Operating profit of GBP1.3m (2018: GBP1.7m)

-- Adjusted operating profit* of GBP1.4m (2018: GBP1.7m)

-- Basic earnings per share of 5.4p (2018: 6.9p)

-- Adjusted basic earnings per share* of 5.6p (2018: 7.4p)

-- Net bank debt of GBP0.7m at 30 September 2019 (31 March 2019:

net cash GBP2.0m; 30 September 2018: net bank debt GBP0.3m)

* stated prior to the impact of amortisation and other

acquisition related adjustments

Steve Roberts, Executive Chairman of Northern Bear,

commented:

"Following a frustratingly slow first financial quarter to 30

June, resulting from contract delays, we have experienced a much

stronger second quarter to 30 September, with excellent results

across the Group having been achieved since July.

"The Group continues to hold a significant order book, and we

consider the outlook for the second half of the current financial

year to be positive. Accordingly, I am hopeful of reporting another

strong set of full year results."

For further information please contact:

+44 (0) 166

Northern Bear plc 182 0369

Steve Roberts - Executive Chairman +44 (0) 166

Tom Hayes - Finance Director 182 0369

Strand Hanson Limited (Nominated Adviser

and Broker)

James Harris

James Spinney +44 (0) 20 7409

James Bellman 3494

Chairman's statement

Introduction

I am pleased to report the unaudited interim results for the six

months ended 30 September 2019 (the "Period") for Northern Bear plc

(the "Company" and, together with its subsidiaries, the

"Group").

In our preliminary results for the year to 31 March 2019

("FY19"), announced in July 2019, we stated that the Group had

experienced a slow first financial quarter ended 30 June 2019

("Q1"), due to a number of contract delays arising from matters

which were beyond our control. We also stated that, with such

contracts having commenced, trading was expected to be stronger in

the second quarter.

We subsequently issued a trading update in October 2019 to

confirm that trading in the second quarter ended 30 September 2019

("Q2") was much stronger than Q1, and ahead of the corresponding

period last year, with excellent results across the Group since

July.

Further to the October trading update, I am pleased to confirm

the Group's results for the Period with adjusted operating profit

(stated prior to the impact of amortisation and other acquisition

related adjustments) of GBP1.4m (2018: GBP1.7m) and adjusted basic

earnings per share of 5.6p (2019: 7.4p).

Whilst we are greatly encouraged by performance in Q2, the

slower trading in Q1 means that reported results for the Period are

not as strong as those for the six months to 30 September 2018 (the

"Prior Period"). However, when we reported the interim results for

the Prior Period, we stated that these results were considered

exceptional and this should be taken into account when comparing

the results for the Period.

Trading

There were some excellent results for our Group companies over

the Period. Our Roofing division produced some outstanding results,

despite the impact of the contract delays in Q1 referred to above,

after very strong trading in Q2.

Revenue for the Period was GBP27.8m (2018: GBP28.6m) and,

through continued careful contract selection and execution, gross

margins were in line with Prior Period at 19.5% (2018: 19.7%).

Administrative expenses increased to GBP4.1m (2018: GBP3.9m) due

primarily to non-payroll costs including fleet expenses (which vary

depending on contract locations) and investment in training and

compliance costs.

Overall profit before income tax for the Period was GBP1.2m

(2018: GBP1.6m) and basic earnings per share was 5.4p (2018:

6.9p).

Cash flow

Net bank debt at 30 September 2019 was GBP0.7m (30 September

2018: GBP0.3m, 31 March 2019: GBP2.0m net cash).

We had stated in the March 2019 results that the cash position

at 31 March 2019 reflected some favourable working capital swings

which to an extent would be expected to reverse post year end. This

was the case, and the current customer and contract mix has an

increased working capital requirement which reduced operating cash

flow in the Period. The cash position was also impacted by the

payment of the FY19 final ordinary and special dividends totalling

GBP0.7m (2018: GBP0.7m), and annual bonus payments related to FY19

but settled in the Period which contributed to the movement in

trade and other payables.

As we have emphasised previously, the net bank debt position

represents a snapshot at a particular point in time and our net

cash/bank debt position can move by up to GBP1.5m in a matter of

days given the nature, size and variety of contracts that we work

on and the related working capital balances. The highest bank

position in the Period was GBP2.0m net cash, the lowest net bank

debt position during the period was GBP2.6m, and the average was

GBP1.1m net bank debt.

Our revolving credit facility and overdraft with Yorkshire Bank

are committed to 31 May 2020. We have already commenced renewal

discussions and are confident that facilities will be renewed in

the New Year. Pending this renewal, we have presented the amount

drawn on the revolving facility at 30 September 2019 of GBP2.0m (30

September 2018: GBP2.0m, 31 March 2019: GBP1.0m) in loans and

borrowings in current liabilities, as it falls due within one

year.

Balance sheet

Details of new accounting standards which are being applied for

the Group's current financial year are set out in Note 2 to this

document. The principal change in the Period is the adoption of

IFRS 16 "Leases", which requires all leases to be included on the

balance sheet with recognition of right of use assets and

corresponding liabilities for future lease payment obligations.

The Group's leases previously reported as operating leases

relate to land and buildings and motor vehicles. The related

balances have been presented separately on the face of the

consolidated balance sheet in order to show the impact of IFRS 16

adoption. We have not restated comparative information for prior

periods.

Dividend

Our stated policy is to pay only a final dividend, at the

Board's discretion, and to assess future dividend levels in line

with the Group's relative performance, after taking into account

the Group's available cash, working capital requirements, corporate

opportunities, debt obligations, and the macro economic environment

at the relevant time.

Provided that the strong trading performance and operating

environment continues for the remainder of the financial year, it

is the current intention of the Board to continue with our dividend

policy. However, we do not intend to pay further special dividends

unless profitability increases from FY19 levels.

Strategy

We continue to seek acquisitions of established specialist

building services businesses, either in the same or complementary

sectors to our current operations. Our main criteria are that a

business is well-established in its sector, has a consistent track

record of profitability and cash generation and has a strong

management team who are committed to remaining with the business.

Any potential acquisition would, in addition, need to be earnings

accretive and provide an acceptable return on investment.

Outlook

The Group continues to hold a high level of committed orders

although, as experienced in Q1, we have limited short term

visibility as to when these orders will be realised. The strong

momentum in Q2 has, to date, continued into the second half of the

financial year and we consider the outlook for the current

financial year to remain positive, despite continued uncertainty in

the macro-economic environment, and are hopeful of reporting

another strong set of full year results.

Conclusion

I am pleased to be reporting what we consider to be a strong set

of results for the Period. As always, our loyal, dedicated and

skilled workforce is a key part of our success and we make every

effort to support them through continued training and health and

safety compliance. I would once more like to thank all of our

employees for their hard work and contribution.

Steve Roberts

Executive Chairman

25 November 2019

Consolidated statement of comprehensive income

for the six month period ended 30 September 2019

6 months ended 6 months ended Year ended

30 September 30 September

2019 2018 31 March 2019

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Revenue 27,849 28,576 56,575

Cost of sales (22,431) (22,942) (44,659)

--------------- --------------- --------------

Gross profit 5,418 5,634 11,916

Other operating income 12 12 24

Administrative expenses (4,059) (3,903) (8,725)

--------------- --------------- --------------

Operating profit (before

amortisation and other

adjustments) 1,371 1,743 3,215

Deferred consideration

adjustments 36 23 265

Amortisation of intangible

assets arising on acquisitions (77) (76) (152)

Operating profit 1,330 1,690 3,328

Finance costs (97) (103) (197)

--------------- --------------

Profit before income tax 1,233 1,587 3,131

Income tax expense (235) (302) (540)

--------------- --------------- --------------

Profit for the period 998 1,285 2,591

--------------- --------------- --------------

Total comprehensive income

attributable to equity

holders of the parent 998 1,285 2,591

=============== =============== ==============

Earnings per share from

continuing operations

Basic earnings per share 5.4p 6.9p 14.0p

Diluted earnings per share 5.4p 6.9p 13.9p

Consolidated statement of changes in equity

for the six month period ended 30 September 2019

Capital

Share redemption Share Merger Retained Total

capital reserve premium reserve earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 April 2018 189 6 5,169 9,605 6,409 21,378

Total comprehensive income

for the period

Profit for the period - - - - 1,285 1,285

Transactions with owners, recorded

directly in equity

Exercise of share options - - - - 14 14

Equity dividends paid - - - - (740) (740)

At 30 September 2018 189 6 5,169 9,605 6,968 21,937

========= ============ ========= ========= ========== ========

At 1 April 2018 189 6 5,159 9,605 6,409 21,378

Total comprehensive income

for the year

Profit for the year - - - - 2,591 2,591

Transactions with owners, recorded

directly in equity

Exercise of share options - - - - 17 17

Equity dividends paid - - - - (740) (740)

At 31 March 2019 189 6 5,169 9,605 8,277 23,246

========= ============ ========= ========= ========== ========

At 1 April 2019 189 6 5,169 9,605 8,277 23,246

Total comprehensive income

for the period

Profit for the period - - - - 998 998

Transactions with owners, recorded

directly in equity

Equity dividends paid - - - - (741) (741)

Other items

Cumulative effect of IFRS16

initial application - - - - (18) (18)

--------- ------------ --------- --------- ---------- --------

At 30 September 2019 189 6 5,169 9,605 8,516 23,485

========= ============ ========= ========= ========== ========

Consolidated balance sheet

at 30 September 2019

30 September 30 September 31 March

2019 2018 2019

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Assets

Property, plant and equipment 3,145 3,122 3,033

Right of use asset 1,084 - -

Intangible assets 20,399 20,552 20,476

Trade and other receivables 1,025 1,420 1,057

Total non-current assets 25,653 25,094 24,566

Inventories 805 724 652

Trade and other receivables 9,906 9,224 8,450

Prepayments 606 536 259

Cash and cash equivalents 1,300 1,746 3,038

Total current assets 12,617 12,230 12,399

------------- ------------- ---------

Total assets 38,270 37,324 36,965

============= ============= =========

Equity

Share capital 189 189 189

Capital redemption reserve 6 6 6

Share premium 5,169 5,169 5,169

Merger reserve 9,605 9,605 9,605

Retained earnings 8,516 6,968 8,277

Total equity attributable to

equity holders of the Company 23,485 21,937 23,246

============= ============= =========

Liabilities

Loans and borrowings 230 2,173 1,236

Deferred consideration - 206 217

Lease liabilities 814 - -

Deferred tax liabilities 295 316 295

Total non-current liabilities 1,339 2,695 1,748

------------- ------------- ---------

Loans and borrowings 2,236 194 232

Deferred consideration 229 417 97

Trade and other payables 10,075 11,181 11,152

Lease liabilities 292 - -

Current tax payable 614 900 490

Total current liabilities 13,446 12,692 11,971

------------- ------------- ---------

Total liabilities 14,785 15,387 13,719

============= ============= =========

Total equity and liabilities 38,270 37,324 36,965

============= ============= =========

Consolidated statement of cash flows

for the six month period ended 30 September 2019

6 months ended 6 months ended Year ended

30 September 30 September 31 March

2019 2018 2019

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Cash flows from operating

activities

Operating profit for the period 1,330 1,690 3,328

Adjustments for:

Depreciation of property,

plant and equipment 265 264 538

Depreciation of lease asset 152 - -

Amortisation 77 76 152

Loss/(profit) on sale of property,

plant and equipment 5 14 17

Deferred consideration adjustments (36) (23) (265)

1,793 2,021 3,770

Change in inventories (153) 228 163

Change in trade and other

receivables (1,424) (811) 326

Change in prepayments (347) (271) 6

Change in trade and other

payables (1,077) 846 819

--------------- --------------- -----------

Cash generated from operations (1,208) 2,013 5,084

Interest paid (82) (65) (127)

Tax paid (111) - (669)

--------------- --------------- -----------

Net cash flow from operating

activities (1,401) 1,948 4,288

--------------- --------------- -----------

Cash flows from investing

activities

Proceeds from sale of property,

plant and equipment 141 119 518

Acquisition of property, plant

and equipment (405) (333) (581)

Acquisition of subsidiary

(net of cash acquired) (64) (327) (426)

--------------- --------------- -----------

Net cash from investing activities (328) (541) (489)

--------------- --------------- -----------

Cash flows from financing

activities

Issue / (repayment) of borrowings 1,007 (498) (1,498)

Repayment of finance lease

liabilities (127) (168) (271)

Repayment of lease liabilities (148) - -

Proceeds from the exercise

of share options - 14 17

Equity dividends paid (741) (740) (740)

Net cash from financing activities (9) (1,392) (2,492)

--------------- --------------- -----------

Net (decrease)/increase in

cash and cash equivalents (1,738) 15 1,307

Cash and cash equivalents

at start of period 3,038 1,731 1,731

Cash and cash equivalents

at end of period 1,300 1,746 3,038

=============== =============== ===========

Notes

1. Basis of preparation

These interim consolidated financial statements have been

prepared using accounting policies based on International Financial

Reporting Standards (IFRS and IFRIC Interpretations) issued by the

International Accounting Standards Board ("IASB") as adopted for

use in the EU. They do not include all disclosures that would

otherwise be required in a complete set of financial statements and

should be read in conjunction with the 31 March 2019 Annual Report

and Financial Statements. The financial information for the half

years ended 30 September 2019 and 30 September 2018 does not

constitute statutory accounts within the meaning of Section 434 (3)

of the Companies Act 2006 and both periods are unaudited. The

financial information has not been prepared (and is not required to

be prepared) in accordance with IAS 34 Interim Financial

Reporting.

The annual consolidated financial statements of Northern Bear

plc (the "Company", or, together with its subsidiaries, the

"Group") are prepared in accordance with IFRS as adopted by the

European Union. The comparative financial information for the year

ended 31 March 2019 included within this report does not constitute

the full statutory Annual Report for that period. The statutory

Annual Report and Financial Statements for the year ended 31 March

2019 have been filed with the Registrar of Companies. The

Independent Auditors' Report on the Annual Report and Financial

Statements for the year ended 31 March 2019 was i) unqualified, ii)

did not draw attention to any matters by way of emphasis, and iii)

did not contain a statement under 498(2) - (3) of the Companies Act

2006.

2. Accounting policies

The Group has applied the same accounting policies and methods

of computation in its interim consolidated financial statements as

in its 2019 annual financial statements, as set out in Notes 2 and

3 of that document, except for those that relate to new standards

and interpretations effective for the first time for periods

beginning on (or after) 1 April 2019, and will be adopted in the

2020 financial statements. The accounting policies applied are

based on the recognition and measurement principles of IFRS in

issue as adopted by the European Union (EU) and are effective at 31

March 2020 or are expected to be adopted and effective at 31 March

2020.

The Group has adopted IFRS 16 'Leases' from 1 April 2019. IFRS

16 requires lessees to record all leases on the balance sheet by

recognising right of use assets relating to leased assets, and

lease liabilities representing future lease payment obligations.

The Group's leases previously recognised as operating leases under

IAS 17 'Leases' include land and buildings and motor vehicles.

Right of use assets and lease liabilities in relation to these

leases have both been presented separately on the face of the

consolidated balance sheet in these interim financial

statements.

The Group has adopted IFRS 16 using the modified retrospective

approach under which the cumulative effect of initial application

is recognised as an opening reserves adjustment of GBP18,000 at 1

April 2019. The Group's comparative information for prior periods

has not been restated under this approach.

Under IFRS 16 the Group now recognises a right of use asset and

a lease liability at the lease commencement date.

The lease liability is measured initially at the present value

of future lease payments from the commencement date, discounted

using the interest rate implicit in the lease or, if that rate

cannot be readily determined, the Group's incremental borrowing

rate under its current bank facilities, with appropriate

adjustments if required for residual value guarantees, the exercise

price of purchase options, and termination penalties. The Group has

predominantly used the incremental borrowing rate as the discount

rate for this purpose.

The right of use asset is measured based on the initial lease

liability with adjustments as required for initial direct costs,

the costs of removal and restoring, payments made at or prior to

commencement, and lease incentives received.

Following initial adoption of IFRS 16 the Group recognised

GBP902,000 of right of use assets and GBP920,000 of lease

liabilities, both in relation to leases formerly classed as

operating leases under IAS 17, on the consolidated balance sheet at

1 April 2019. The Group recognised GBP152,000 depreciation of right

of use assets and GBP20,000 of interest payments in finance costs

in the consolidated statement of comprehensive income during the

period.

Other new and amended standards and interpretations issued by

the IASB that will apply for the first time in the next annual

financial statements are not expected to have a material impact on

the Group's financial statements.

3. Taxation

The taxation charge for the six months ended 30 September 2019

is calculated by applying the Directors' best estimate of the

annual effective tax rate to the profit for the period.

4. Earnings per share

Basic earnings per share is the profit or loss for the period

divided by the weighted average number of ordinary shares

outstanding, excluding those held in treasury, calculated as

follows:

6 months 6 months

ended ended Year ended

30 September 30 September 31 March

2019 2018 2019

Unaudited Unaudited Audited

Profit for the period (GBP'000) 998 1,285 2,591

------------- ------------- -----------

Weighted average number of ordinary

shares excluding shares held

in treasury for the proportion

of the year held in treasury

('000) 18,519 18,510 18,515

Basic earnings per share 5.4p 6.9p 14.0p

------------- ------------- -----------

The calculation of diluted earnings per share is the profit or

loss for the period divided by the weighted average number of

ordinary shares outstanding, after adjustment for the effects of

all potential dilutive ordinary shares, excluding those in

treasury, calculated as follows:

6 months 6 months

ended ended Year ended

30 September 30 September 31 March

2019 2018 2019

Unaudited Unaudited Audited

Profit for the period (GBP'000) 998 1,285 2,591

------------- ------------- -----------

Weighted average number of

ordinary shares excluding shares

held in treasury for the proportion

of the year held in treasury

('000) 18,519 18,510 18,515

Effect of potential dilutive

ordinary shares ('000) 55 64 63

Diluted weighted average number

of ordinary shares excluding

shares held in treasury for

the proportion of the year

held in treasury ('000) 18,574 18,574 18,578

============= ============= ===========

Diluted earnings per share 5.4p 6.9p 13.9p

------------- ------------- -----------

The following additional earnings per share figures are

presented as the directors believe they provide a better

understanding of the trading performance of the Group.

Adjusted basic and diluted earnings per share is the profit for

the period, adjusted for acquisition related costs, divided by the

weighted average number of ordinary shares outstanding as presented

above.

Adjusted earnings per share is calculated as follows:

6 months 6 months

ended ended Year ended

30 September 30 September 31 March

2019 2018 2019

Unaudited Unaudited Audited

Profit for the period (GBP'000) 998 1,285 2,591

Deferred consideration adjustments (36) (23) (265)

Amortisation of intangible assets

arising on acquisitions 77 76 152

Unwinding of discount on deferred

consideration liabilities 21 38 70

Corporation tax effect of above

items (18) - (43)

------------- ------------- -----------

Adjusted profit for the period

(GBP'000) 1,042 1,376 2,505

------------- ------------- -----------

Weighted average number of ordinary

shares excluding shares held in

treasury for the proportion of

the year held in treasury ('000) 18,519 18,510 18,515

Adjusted basic earnings per

share 5.6p 7.4p 13.5p

------------- ------------- -----------

Adjusted diluted earnings per

share 5.6p 7.4p 13.5p

------------- ------------- -----------

4. Earnings per share (continued)

On 25 July 2017 the Group acquired the entire issued share

capital of H Peel & Sons (Holdings) Limited and its subsidiary

H. Peel & Sons Limited.

The consideration was satisfied through a combination of cash,

equity instruments, and deferred and contingent consideration. The

amount recognised on the Group's balance sheet for deferred and

contingent consideration at the date of acquisition was based on

the discounted present value of estimated future payments to be

made.

Deferred consideration adjustments for the above periods relate

to the difference between the amount provided for deferred and

contingent consideration due in the period and the actual amount

paid.

As deferred and contingent consideration is presented at

discounted present value the unwinding of this discount is recorded

in finance costs in the income statement.

5. Finance costs

6 months 6 months

ended ended Year ended

30 September 30 September 31 March

2019 2018 2019

Unaudited Unaudited Audited

On bank loans and overdrafts 44 60 106

Finance charges payable in respect

of hire purchase contracts 12 5 21

Finance charges on lease liabilities 20 - -

Unwinding of discount on deferred

consideration liabilities 21 38 70

------------- ------------- -----------

Total finance costs 97 103 197

------------- ------------- -----------

6. Principal risks and uncertainties

The directors consider that the principal risks and

uncertainties which could have a material impact on the Group's

performance in the remaining six months of the financial year

remain the same as those stated on page 9 to 12, and 64 to 67 of

our Annual Report and Financial Statements for the year ended 31

March 2019, which are available on the Company's website,

www.northernbearplc.com.

7. Half year report

The condensed financial statements were approved by the Board of

Directors on 25 November 2019 and are available on the Company's

website, www.northernbearplc.com. Copies will be sent to

shareholders and are available on application to the Company's

registered office.

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR CKBDQOBDDNDB

(END) Dow Jones Newswires

November 25, 2019 02:00 ET (07:00 GMT)

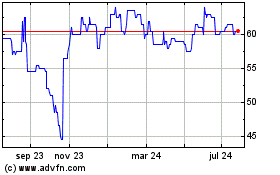

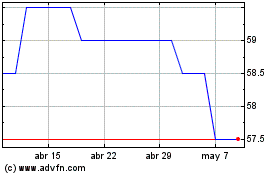

Northern Bear (LSE:NTBR)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Northern Bear (LSE:NTBR)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024