GE's New CFO Has an $8 Million Incentive to Stay

27 Noviembre 2019 - 5:58PM

Noticias Dow Jones

By Nina Trentmann

General Electric Co.'s incoming finance chief will earn an

annual base pay of $1.5 million but will have to stay with the

troubled conglomerate for four years before she can take home an $8

million stock bonus that is part of her compensation package.

The pending payout is aimed at tying the executive to her new

employer -- an increasingly common practice in an era of stiff

competition for high-profile finance chiefs.

Boston-based GE on Monday named Carolina Dybeck Happe as its

next chief financial officer, and is expected to start her new role

next year.

Ms. Dybeck Happe's wage, which is slightly more than what

outgoing CFO Jamie Miller earned, comes with an annual bonus

opportunity of 125% of the base salary and a 2020 equity award

worth $5 million, according to a filing with U.S. regulators.

Her sign-on bonus -- a one-time, new-hire stock option with a

grant fair value of $8 million to be paid in one lump sum if she

stays for four years -- is particularly indicative of how companies

are using such payments and bonuses as retention tools, according

to corporate recruiters.

"The competition for CFOs has never been more fierce," said

Jenna Fisher, a managing director at Russell Reynolds, who heads

the recruitment firm's corporate officers practice. "It is becoming

more challenging for companies to hire executives out of their

existing contracts."

These so-called golden handcuffs -- a lump sum in cash, an

equity award or stock options -- reward executives for staying put

for a certain number of years. They also are meant to deter

competitors from poaching.

"Carolina is a proven, sought-after global CFO with a superior

track record, and her compensation package is strongly tied to

producing results for investors," a GE spokeswoman said

Wednesday.

GE hired Ms. Dybeck Happe away from Danish shipping giant A.P.

Moller-Maersk A/S, where she took on the role of CFO in

January.

Ms. Dybeck Happe's compensation at GE will be higher than that

of the average CFO at the 500 largest public companies in the U.S.,

where finance chiefs in 2018 earned an average base salary of

$661,264, received average annual bonuses of $665,000 and earned

total equity of $1.96 million, according to compensation-data firm

Equilar Inc. For its calculation, Equilar ranked the biggest listed

U.S. companies by revenue that filed compensation data before April

30.

A large part of Ms. Dybeck Happe's compensation at GE will be

performance-based to ensure alignment with shareholder interests,

the company said. GE had to make a lucrative offer because of the

complexity of the new role and the overall transformation process

at the company, analysts said.

Companies are finding that CFOs are having shorter stints at

each job. Finance chiefs at Fortune 500 and S&P 500 companies

currently stay for slightly less than five years with an employer,

according to data by Crist|Kolder Associates, an average that has

been inching down in part because of enticing offers from companies

in need of quality finance executives.

This trend is incentivizing companies to offer more attractive

packages to incoming finance chiefs, said Mickey Matthews,

international chairman of recruitment firm Stanton Chase.

Public companies also are competing with private companies and

high-growth startups for executives, according to Scott Atkinson,

head of the venture capital practice at Heidrick &

Struggles.

Maersk didn't publicly disclose Ms. Dybeck Happe's compensation

package when it announced her appointment in 2018, according to a

spokeswoman.

But it is possible that GE also had to compensate her for

forfeiting cash bonuses or an equity portion that would have vested

at a later stage in her role at the shipping company, recruiters

said.

A person familiar with the matter said she received an offer

from GE that "she couldn't resist both in terms of salary and other

benefits."

Costas Paris contributed to this article.

Write to Nina Trentmann at Nina.Trentmann@wsj.com

(END) Dow Jones Newswires

November 27, 2019 18:43 ET (23:43 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

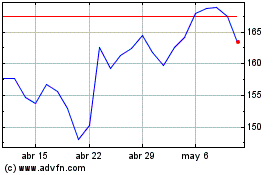

GE Aerospace (NYSE:GE)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

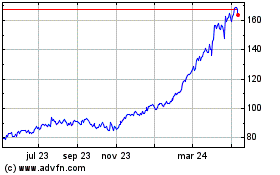

GE Aerospace (NYSE:GE)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024