TIDMBGUK

RNS Number : 9027U

Baillie Gifford UK Growth Fund PLC

28 November 2019

RNS Announcement

Baillie Gifford UK Growth Fund plc

Legal Entity Identifier: 549300XX386SYWX8XW22

Regulated Information Classification: Half Yearly Financial

Report

Results for the six months to 31 October 2019

3/4 Over the six month period to 31 October 2019, the Company's

net asset value per share total return decreased by 3.6% compared

to an increase in the FTSE All-Share Index total return of 0.4%.

The share price total return for the same period fell by 8.7%.

3/4 One new position was initiated in the period; Farfetch, an

online apparel retailer. There was one complete sale in the period;

Jupiter Fund Management.

3/4 The net revenue return per share was 2.51p compared to 3.14p

in the corresponding period last year. As highlighted previously,

no interim dividend will be declared as all future dividends will

be paid as a single final dividend.

3/4 The Managers remain satisfied with the operational

performance of the underlying holdings and are optimistic about the

scale of the long-term opportunities ahead for those companies.

Past performance is not a guide to future performance

Total return information is sourced from Refinitiv/Baillie

Gifford and relevant underlying index providers. See disclaimer at

end of this announcement.

Baillie Gifford UK Growth aims to achieve capital growth

predominantly from investment in UK equities with the aim of

providing a total return in excess of the FTSE All-Share Index. At

31 October 2019 the Company had total assets of GBP290.5

million.

Baillie Gifford UK Growth is managed by Baillie Gifford, an

Edinburgh based fund management group with approximately GBP207

billion under management and advice as at 27 November 2019.

Baillie Gifford UK Growth is a listed UK company. The value of

its shares and any income from them can fall as well as rise and

investors may not get back the amount invested. The Company is

listed on the London Stock Exchange and is not authorised or

regulated by the Financial Conduct Authority. You can find up to

date performance information about Baillie Gifford UK Growth at

www.bgukgrowthfund.com(++) .

Past performance is not a guide to future performance. See

disclaimer at end of this announcement.

++ Neither the contents of the Managers' website nor the

contents of any website accessible from hyperlinks on the Managers'

website (or any other website) is incorporated into, or forms part

of, this announcement.

27 November 2019

For further information please contact:

Anzelm Cydzik, Baillie Gifford & Co

Tel: 0131 275 2000

Mark Knight, Four Communications

Tel: 0203 697 4200 or 07803 758810

The following is the unaudited Interim Financial Report for the

six months to 31 October 2019.

Responsibility Statement

We confirm that to the best of our knowledge:

a) the condensed set of Financial Statements has been prepared

in accordance with FRS 104 'Interim Financial Reporting';

b) the Interim Management Report includes a fair review of the

information required by Disclosure Guidance and Transparency Rule

4.2.7R (indication of important events during the first six months,

their impact on the Financial Statements and a description of the

principal risks and uncertainties for the remaining six months of

the year); and

c) the Interim Financial Report includes a fair review of the

information required by Disclosure Guidance and Transparency Rule

4.2.8R (disclosure of related party transactions and changes

therein).

By order of the Board

Carolan Dobson

Chairman

27 November 2019

Chairman's Statement

Performance

Over the six month period to 31 October 2019, the Company's net

asset value ('NAV') per share total return (capital and income)

decreased by 3.6% compared to an increase in the FTSE All-Share

Index total return of 0.4%. The share price total return for the

same period fell by 8.7%.

While this is a somewhat disappointing short-term return, the

Board is confident in the long-term strategy being implemented on

its behalf by the managers. The Board recognises that market

conditions over this period have been particularly challenging for

the focused portfolio of good quality UK growth stocks held. The

Board maintains an active dialogue with the managers about the

composition of the portfolio and is confident that the longer-term

prospects for these portfolio companies look very exciting.

Continuation Vote

The Board is grateful for the expression of trust, in the

Company's strategy and the abilities of the managers, shown by

shareholders in voting overwhelmingly in favour of continuing the

life of the Company, for a further five-year period, at the

Company's Annual General Meeting that took place 1 August 2019.

Over 99.99% of votes cast were in favour of continuation.

Earnings and Dividends

The net revenue return per share for the six months to 31

October 2019 was 2.51p versus 3.14p for the equivalent period in

2018. No interim dividend is being declared. As highlighted in my

most recent annual Chairman's Statement, future dividends are to be

paid by way of a single final payment and will be the minimum

permissible to maintain investment trust status, reflecting our

priority which is capital growth.

Gearing

During the year, the Company replaced its Scotiabank GBP35

million revolving one-year credit facility with a GBP20 million

revolving credit facility with National Australia Bank. This new

facility contains the option to increase the amount borrowed to

GBP35 million. No borrowings were drawn in the period and this

continues to be the position.

The Board sets internal guidelines for the portfolio managers'

use of gearing which are altered from time to time but are subject

to net effective gearing not representing more than 20% of

shareholders' funds.

Discount Management

No shares were bought back in the six months to 31 October

2019.

The Company's share buy-back policy seeks to operate in the best

interests of shareholders by taking

into account the relative level of the Company's share price

discount to NAV when compared with peer group trusts, the absolute

level of discount, volatility in the level of discount and the

impact from share buy-back activity on the long-term liquidity of

the Company's issued shares.

Board Composition

As part of the Board's succession planning, Andrew Hutton

retired as a Director at the conclusion of the Company's Annual

General Meeting, held 1 August 2019, and shareholders approved the

appointment of Scott Cochrane and Ruary Neill to the Board.

Outlook

At the time of writing the macro backdrop continues to be

opaque. The UK has not left the European Union and the result of

December's General Election is far from obvious. The risks of a

disorderly Brexit remain high and continue to weigh over those

companies with material exposure to the domestic UK economy; the

portfolio does not have notable exposure to those companies most

sensitive to the UK economy and contains exceptional UK companies

which can grow over many years. Whilst the benefits of this

approach might not always be reflected in short-term shareholder

returns, the Board and Managers firmly believe it provides a

repeatable basis for adding value for long term investors.

Carolan Dobson

Chairman

27 November 2019

Past performance is not a guide to future performance.

For a definition of terms see Glossary of Terms and Alternative

Performance Measures (APM) at the end of this announcement.

Total return information is sourced from Refinitiv/Baillie

Gifford and relevant underlying index providers. See disclaimer at

the end of this announcement.

Interim Management Report

It has been a tumultuous six months in world politics and

economics, and UK investors continue to be chiefly preoccupied with

what the denouement of the drawn-out Brexit negotiation process

will look like. Depending on the noises coming from Westminster on

any given day, the FTSE All-share swings from one direction to

another - either favouring or eschewing domestically (or

internationally) exposed equities; investor behaviour is seemingly

more influenced by short-term moves in the value of Sterling than

fully considering the specifics of the underlying constituent

companies. Against this volatile backdrop, we made very few changes

to the portfolio. We recognise that, in turbulent times, it might

feel challenging to "just" do nothing. However, we are deeply

sceptical of our ability to trade our way around unpredictable

short-term events. Instead, we remain steadfast in our belief that

our mental energies are most usefully spent in building, as well as

maintaining, our conviction in the long-term opportunities and

competitive strengths of the individual businesses we are invested

in on your behalf.

It might be tempting to argue that our inactivity has not served

shareholders well since our performance during this period lagged

the benchmark. Nobody likes underperforming, but we fundamentally

believe that to generate attractive long-term returns in excess of

the benchmark, one has to accept short-term volatility against it.

We do not pretend that we have the ability to outperform every

period in a smooth manner and we would question the wisdom of even

trying to do so.

Although at times our growth style will not be in favour, we

believe that it will generate investment success over the long

term. Not owning some well-known UK blue chips impacted relative

performance in the period but we would rather own the companies we

do as we remain convinced they have superior, multi-decade, growth

opportunities. That is why we do not react to short term market

volatility by trading out of shares that have done poorly when the

long-term company fundamentals remain intact. We do not think this

is credible or indeed rational. Reacting in such a way and locking

in losses is the real risk that we, and fellow shareholders, should

be worried about. That is why we ask to be judged over a five-year

period as we think that this time frame allows a much greater

chance of the market appreciating the strengths of the businesses

we own. A fund manager that is too concerned or pressurised about

short term performance and volatility is likely to act in strange

ways that may not be in the long-term interests of shareholders.

Patience remains our watchword and our low level of portfolio

turnover is a sign of our confidence in the portfolio. Nonetheless,

we did sell Jupiter Fund Management, our only complete sale in the

period, due to concerns over its future growth prospects.

Rather than fear short-term volatility, we often seek to turn it

to our advantage. A good recent example was our decision to add to

our holding in Abcam, the online provider of antibodies and other

research tools to life scientists across the globe, a company we

have invested in for 15 years for other portfolios. In our meeting

in September, the CEO Alan Hirzel outlined various new projects

that would potentially double the size of the business over the

next five years. Abcam is a very profitable company, generating a

lot of cash and so it has money to invest. It has also demonstrated

a disciplined approach to allocating capital in the past, so this

was exactly what we wanted to hear. The market's reaction was

somewhat different to ours. It saw a cut to short term profits, so

marked the shares down. This provided us with the opportunity to

increase our exposure to this fantastic British growth company.

Similarly, our view is that, distracted by news flow around

Brexit, trade wars and the proposed de-merger of its UK business,

the market continues to underestimate Prudential's strengths. In

particular, its open-ended growth opportunity in Asia where

penetration rates of investment and life insurance products remain

low and are likely to grow significantly faster than the underlying

economies. Here, too, we decided to take advantage of the weakness

in the shares and added to the position.

Volatility also played a part in our new holding in Farfetch,

our only new purchase in the period. Although currently loss

making, this is the largest and fastest growing online platform for

luxury goods globally. It connects consumers in 190 countries with

3000 luxury brands and sellers (high end boutiques). Unlike other

online fashion companies, it is not a digital wholesaler. This

means it does not buy any inventory but connects in real time (and

to varying degrees) to the stock systems of its sellers. This

enables it to offer an unrivalled assortment of current luxury

fashion which is an important attraction for its global customer

base.

Shortly after we started buying the shares, the company released

interim results which were taken badly by the market. The main

disappointment was reduced growth guidance due to an unwillingness

to match the irrational promotional activities of competitors. We

think this slight sacrifice in the pace of rapid market share gains

is sensible in exchange for the fostering of good relationships

with luxury brands which are increasingly turning their backs on

traditional third-party distribution. The company also made an

acquisition which spooked the market as it likely sees it as

introducing a new layer of complexity to the business. We see it as

a bold, but potentially very rewarding, move over the

longer-term.

There are various risks to the Farfetch investment case and we

have only taken a small holding to reflect these. However, we like

the large, global, growth opportunity ahead of the company and

remain impressed with the scale of its ambition as well as the

calibre of its management team. Rather than kicking ourselves at

the seemingly unfortunate short-term timing of our initial

purchase, we took advantage of the share price weakness to continue

buying more.

Having flagged the merits, it would be wrong to argue that

volatility is always the friend of the long-term investor and that

share price weakness invariably presents an opportunity. The risk

we are preoccupied with above all else is that of the permanent

loss of capital. Whilst we will patiently tolerate the short-term

bumps along the road, provided we assess that the long-term

investment case still stacks up, we readily admit that such

assessments will sometimes be wrong. We will make mistakes. In that

context, we would acknowledge that our investment in Ted Baker has

proven disappointing. Shareholders might remember that we reduced

our holding meaningfully in the beginning of the year after the

company's founder left following a series of unproven allegations.

We were wary as to the longer-term impact his departure might have

on the development of the business. Unfortunately, trading has

deteriorated significantly since then. We have come to the view

that the combination of stiff industry headwinds and internal

disruption now make it unlikely that the business will adapt as

successfully as we had hoped over the next five years.

Even more than usual, it feels like we live in interesting and

uncertain times - times of technological, societal, political and

economic disruption. Rather than despair, however, we think this

presents an exciting backdrop for bottom-up growth investors such

as ourselves. The pace of change in many industries is quickening

and this will likely increase the divergence between those

companies which adapt and thrive and those which fall by the

wayside. In this volatile and news-driven environment, more than

ever, our chances of picking the winners will be greatly aided by

cultivating the resilience to remain patient and resolutely focused

on understanding long-term, structural changes. If we are

successful, superior investment returns will follow.

Baillie Gifford & Co

Managers & Secretaries

27 November 2019

List of Investments as at 31 October 2019 (unaudited)

=====================================================

Value % of

Name Business GBP'000 Total Assets

================================= ========================================================== ======== =============

Basic Materials

Rio Tinto Metals and mining company 7,369 2.5

Victrex Speciality high-performance chemicals manufacturer 5,097 1.8

======== =============

12,466 4.3

======== =============

Consumer Goods

Diageo International drinks company 9,002 3.1

Burberry Luxury goods retailer 8,167 2.8

Ted Baker Fashion retailer 1,231 0.4

======== =============

18,400 6.3

======== =============

Consumer Services

Auto Trader Group Advertising portal for second hand cars in the UK 11,385 3.9

Rightmove UK's leading online property portal 9,726 3.4

RELX Professional publications and information provider 8,867 3.1

Operator of online and mobile market place for takeaway

Just Eat food 8,143 2.8

Boohoo.com Online fashion retailer 7,929 2.7

Inchcape Car wholesaler and retailer 6,319 2.2

Carnival World's largest cruise ship operator 5,486 1.9

Mitchells & Butlers Pub and restaurant operator 5,057 1.7

Euromoney Institutional Investor Specialist publisher 4,475 1.5

Farfetch Online fashion retailer 1,344 0.5

68,731 23.7

======== =============

Financials

St. James's Place UK wealth manager 11,156 3.8

Hargreaves Lansdown UK retail investment platform 11,031 3.8

Prudential International life insurer 10,268 3.5

Legal & General Insurance and investment management company 8,553 3.0

Helical Property developer 7,105 2.5

Hiscox Property and casualty insurance 6,003 2.1

Just Group Provider of retirement income products and services 4,757 1.6

IntegraFin Provides platform services to financial clients 4,697 1.6

IG Group Spread betting website 2,733 0.9

Draper Esprit Technology focused venture capital firm 2,630 0.9

AJ Bell Investment platform 2,626 0.9

M&G Prudential Investment management company 1,627 0.6

73,186 25.2

======== =============

Name Business Value % of

GBP'000 Total Assets

==================== =============================================================== ======== =============

Health Care

Abcam Online platform selling antibodies to life science researchers 9,890 3.4

Genus World leading animal genetics company 9,238 3.2

======== =============

19,128 6.6

======== =============

Industrials

Renishaw World leading metrology company 9,855 3.4

HomeServe Domestic insurance 9,359 3.2

Halma Specialist engineer 8,743 3.0

Howden Joinery Manufacturer and distributor of kitchens to trade customers 8,305 2.9

Ultra Electronics Aerospace and defence company 7,489 2.6

Bunzl Distributor of consumable products 7,284 2.5

Volution Group Supplier of ventilation products 6,396 2.2

Ashtead Construction equipment rental company 6,355 2.2

Bodycote Heat treatment and materials testing 4,944 1.7

PageGroup Recruitment consultancy 4,860 1.7

Rolls-Royce Power systems manufacturer 4,632 1.6

Specialist service provider to the global marine and energy

James Fisher & Sons industries 3,264 1.1

======== =============

81,486 28.1

======== =============

Technology

First Derivatives IT consultant and software developer 5,769 2.0

Provider of professional services focusing on information

FDM Group technology 5,660 1.9

======== =============

11,429 3.9

======== =============

Total Equities 284,826 98.1

Net Liquid Assets 5,644 1.9

Total Assets 290,470 100.0

===================================================================================== ======== =============

Stocks highlighted in bold are the 20 largest holdings.

Income Statement (unaudited)

For the six months ended For the six months ended For the year ended

31 October 2019 31 October 2018 30 April 2019

(audited)

Revenue Capital Total Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

=========================== ======== ======== ======== ======== ======== ======== ======== ========= ========

Losses on investments - (14,054) (14,054) - (36,074) (36,074) - (6,850) (6,850)

Currency losses - (9) (9) - - - - - -

Income from investments and

interest receivable 4,243 - 4,243 5,291 - 5,291 8,658 - 8,658

Investment management fee

(note 3) (221) (515) (736) (94) (220) (314) (239) (556) (795)

Other administrative

expenses (239) - (239) (461) - (461) (689) - (689)

=========================== ======== ======== ======== ======== ======== ======== ======== ========= ========

Net return before finance

costs and taxation 3,783 (14,578) (10,795) 4,736 (36,294) (31,558) 7,730 (7,406) 324

Finance costs of borrowings (9) (21) (30) (11) (26) (37) (20) (47) (67)

=========================== ======== ======== ======== ======== ======== ======== ======== ========= ========

Net return on ordinary

activities before taxation 3,774 (14,599) (10,825) 4,725 (36,320) (31,595) 7,710 (7,453) 257

Tax on ordinary activities - - - - - - - - -

=========================== ======== ======== ======== ======== ======== ======== ======== ========= ========

Net return on ordinary

activities after taxation 3,774 (14,599) (10,825) 4,725 (36,320) (31,595) 7,710 (7,453) 257

=========================== ======== ======== ======== ======== ======== ======== ======== ========= ========

Net return per ordinary

share (note 4) 2.51p (9.70p) (7.19p) 3.14p (24.13p) (20.99p) 5.12p (4.95p) 0.17p

=========================== ======== ======== ======== ======== ======== ======== ======== ========= ========

Note:

Dividends paid and payable

per share (note 5) - 1.50p 4.45p

=========================== ======== ======== ======== ======== ======== ======== ======== ========= ========

The total column of this statement is the profit and loss

account of the Company. The supplementary revenue and capital

columns are prepared under guidance published by the Association of

Investment Companies.

All revenue and capital items in the above statement derive from

continuing operations.

A Statement of Comprehensive Income is not required as all gains

and losses of the Company have been reflected in the above

statement.

The accompanying notes at the end of this document are an

integral part of the Financial Statements.

Balance Sheet (unaudited)

At 31 October 2019 At 30 April 2019

(audited)

GBP'000 GBP'000

Fixed assets

Investments held at fair value through profit or loss

(note 6) 284,826 300,207

====================================================== ================== ================

Current assets

Debtors 225 1,487

Cash and deposits 5,842 4,488

====================================================== ================== ================

6,067 5,975

====================================================== ================== ================

Creditors

Amounts falling due within one year (423) (447)

Net current assets 5,644 5,528

====================================================== ================== ================

Net assets 290,470 305,735

====================================================== ================== ================

Capital and reserves

Share capital 40,229 40,229

Share premium account 9,875 9,875

Capital redemption reserve 19,759 19,759

Warrant exercise reserve 417 417

Share purchase reserve 60,433 60,433

Capital reserve 149,406 164,005

Revenue reserve 10,351 11,017

====================================================== ================== ================

Shareholders' funds 290,470 305,735

====================================================== ================== ================

Net asset value per ordinary share* 193.0p 203.1p

====================================================== ================== ================

Ordinary shares in issue (note 7) 150,520,484 150,520,484

====================================================== ================== ================

*See Glossary of Terms and Alternative Performance Measures at

the end of this announcement.

The accompanying notes at the end of this document are an

integral part of the Financial Statements.

Statement of Changes in Equity (unaudited)

For the six months ended 31 October 2019

Share Capital Warrant Share

Share premium redemption exercise purchase Capital Revenue Shareholders'

capital account reserve reserve reserve reserve* reserve funds

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

============== ========= ============ =========== =========== ============ ============ ======== =============

Shareholders'

funds at 1

May 2019 40,229 9,875 19,759 417 60,433 164,005 11,017 305,735

Net return on

ordinary

activities

after

taxation - - - - - (14,599) 3,774 (10,825)

Dividends paid

(note 5) - - - - - - (4,440) (4,440)

============== ========= ============ =========== =========== ============ ============ ======== =============

Shareholders'

funds at 31

October 2019 40,229 9,875 19,759 417 60,433 149,406 10,351 290,470

============== ========= ============ =========== =========== ============ ============ ======== =============

For the six months ended 31 October 2018

Share Capital Warrant Share

Share premium redemption exercise purchase Capital Revenue Shareholders'

capital account reserve reserve reserve reserve* reserve funds

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

============== ========= ============ =========== =========== ============ ============ ======== =============

Shareholders'

funds at 1

May 2018 40,229 9,875 19,759 417 60,433 171,458 10,081 312,252

Net return on

ordinary

activities

after

taxation - - - - - (36,320) 4,725 (31,595)

Dividends paid

(note 5) - - - - - - (4,516) (4,516)

============== ========= ============ =========== =========== ============ ============ ======== =============

Shareholders'

funds at 31

October 2018 40,229 9,875 19,759 417 60,433 135,138 10,290 276,141

============== ========= ============ =========== =========== ============ ============ ======== =============

*The Capital Reserve balance at 31 October 2019 includes

investment holding losses of GBP18,589,000 (31 October 2018 -

losses of GBP34,477,000)

The accompanying notes at the end of this document are an

integral part of the Financial Statements.

Condensed Cash Flow Statement (unaudited)

=========================================

Six months to Six months to

31 October 31 October

2019 2018

GBP'000 GBP'000

================================================== ============= =============

Cash flows from operating activities

Net return on ordinary activities before taxation (10,825) (31,595)

Net losses on investments 14,054 36,074

Currency losses 9 -

Finance costs of borrowings 30 37

Changes in debtors and creditors 1,237 1,101

================================================== ============= =============

Cash from operations 4,505 5,617

Interest paid (29) (41)

================================================== ============= =============

Net cash inflow from operating activities 4,476 5,576

-------------------------------------------------- ------------- -------------

Cash flows from investing activities

Acquisitions of investments (5,204) (295,251)

Disposals of investments 6,531 307,949

Net cash inflow from investing activities 1,327 12,698

================================================== ============= =============

Cash flows from financing activities

Bank loan repaid - (12,000)

Equity dividends paid (4,440) (4,516)

Net cash outflow from financing activities (4,440) (16,516)

================================================== ============= =============

Increase in cash and cash equivalents 1,363 1,758

Exchange movements (9) -

Cash and cash equivalents at start of year 4,488 3,642

================================================== ============= =============

Cash and cash equivalents at end of year* 5,842 5,400

================================================== ============= =============

* Cash and cash equivalents represent cash at bank and short

term money market deposits repayable on demand.

The accompanying notes at the end of this document are an

integral part of the Financial Statements.

Notes to the condensed financial statements (unaudited)

1. The condensed Financial Statements for the six months to 31 October 2019 comprise the statements

set out above together with the related notes below. They have been prepared in accordance

with FRS 104 'Interim Financial Reporting' and the AIC's Statement of Recommended Practice

issued in November 2014 and updated in October 2019 with consequential amendments and have

not been audited or reviewed by the Auditor pursuant to the Auditing Practices Board Guidance

'Review of Interim Financial Information'. The Financial Statements for the six months to

31 October 2019 have been prepared on the basis of the same accounting policies as set out

in the Company's Annual Report and Financial Statements at 30 April 2019.

Going Concern

Having considered the nature of the Company's principal risks and uncertainties, as set out

below, together with its current position, investment objective and policy, its assets and

liabilities and projected income and expenditure, together with the Company's dividend policy,

it is the Directors' opinion that the Company has adequate resources to continue in operational

existence for the foreseeable future. The Company's assets, the majority of which are investments

in quoted securities which are readily realisable, exceed its liabilities significantly. All

borrowings require the prior approval of the Board. Gearing levels and compliance with borrowing

covenants are reviewed by the Board on a regular basis. There are currently no drawings under

the National Australia Bank one year GBP20m revolver facility put in place in July 2019. In

accordance with the Company's Articles of Association, shareholders have a right to vote on

the continuation of the Company every 5 years, the next vote being in 2024. Accordingly, the

Directors consider it appropriate to adopt the going concern basis of accounting in preparing

these Financial Statements and confirm that they are not aware of any material uncertainties

which may affect the Company's ability to continue to do so over a period of at least twelve

months from the date of approval of these Financial Statements.

2. The financial information contained within this Interim Financial Report does not constitute

statutory accounts as defined in sections 434 to 436 of the Companies Act 2006. The financial

information for the year ended 30 April 2019 has been extracted from the statutory accounts

which have been filed with the Registrar of Companies. The Auditor's Report on those accounts

was not qualified, did not include a reference to any matters to which the Auditor drew attention

by way of emphasis without qualifying their report, and did not contain a statement under

sections 498(2) or (3) of the Companies Act 2006.

3. Baillie Gifford & Co Limited, a wholly owned subsidiary of Baillie Gifford & Co, has been

appointed by the Company as its Alternative Investment Fund Manager (AIFM) and Company Secretary.

The investment management function has been delegated to Baillie Gifford & Co. The management

agreement can be terminated on six months' notice. The annual fee is 0.5% of net asset value,

calculated on a quarterly basis. Baillie Gifford & Co Limited was appointed AIFM and Company

Secretary on 29 June 2018 and for the year to 30 April 2019 agreed to waive its management

fee to the extent of GBP732,000 (approximately equal to six months management fee payable

to Baillie Gifford).

=======================================================================================================

4. Net return per ordinary share Six months to Six months to

31 October 2019 31 October 2018

GBP'000 GBP'000

============================================================== =================== ==================

Revenue return on ordinary activities after taxation 3,774 4,725

Capital return on ordinary activities after taxation (14,599) (36,320)

================================================================== =================== ==================

Total net return (10,825) (31,595)

================================================================== =================== ==================

Weighted average number of ordinary shares in issue 150,520,484 150,520,484

================================================================== =================== ==================

Net return per ordinary share is based on the above totals of revenue and capital and the

weighted average number of ordinary shares in issue during each period.

There are no dilutive or potentially dilutive shares in issue.

===========================================================================================================

5. Dividends Six months to Six months to

31 October 2019 31 October 2018

GBP'000 GBP'000

========================================================================= ================= ================

Amounts recognised as distributions in the period:

Previous year's final dividend of 2.95p (2018 - 3.00p), paid 6 August 2019 4,440 4,516

4,440 4,516

============================================================================== ================= ================

Amounts paid and payable in respect of the period:

Interim dividend (2019 - 1.50p) - 2,258

============================================================================== ================= ================

- 2,258

------------------------------------------------------------------------------ ----------------- ----------------

No interim dividend has been declared in respect of the current period.

6. Fair Value Hierarchy

The fair value hierarchy used to analyse the basis on which the fair values of financial instruments

held at fair value through the profit or loss account are measured is described below. Fair

value measurements are categorised on the basis of the lowest level input that is significant

to the fair value measurement.

Level 1 - using unadjusted quoted prices for identical instruments in an active market;

Level 2 - using inputs, other than quoted prices included within Level 1, that are directly

or indirectly observable (based

on market data); and

Level 3 - using inputs that are unobservable (for which market data is unavailable).

The fair value of listed investments is bid price. The financial assets designated as valued

at fair value through profit or loss are all categorised as Level 1 in the above hierarchy.

All of the Company's investments fall into Level 1 for the periods reported.

7. At 31 October 2019, the Company had the authority to buy back 22,563,020 ordinary shares and

to issue/sell from treasury 15,052,048 ordinary shares without application of pre-emption

rights in accordance with the authorities granted at the AGM in August 2019. During the six

months to 31 October 2019, no shares were bought back into treasury

(30 April 2019 - nil) and no shares were issued/sold from treasury (30 April 2019 - nil).

8. During the period, transaction costs on equity purchases amounted to GBP3,000 (31 October

2018 - GBP1,430,000) and on equity sales GBP3,000 (31 October 2018 - GBP83,000).

9. Related Party Transactions

There have been no transactions with related parties during the first six months of the current

financial year that have materially affected the financial position or the performance of

the Company during that period and there have been no changes in the related party transactions

described in the last Annual Report and Financial Statements that could have had such an effect

on the Company during that period.

None of the views expressed in this document should be construed as advice to buy or sell

a particular investment.

----------------

10. Glossary of Terms and Alternative Performance Measures (APM)

Total Assets

Total assets less current liabilities, before deduction of all borrowings.

Net Asset Value

Net Asset Value (NAV) is the value of total assets less liabilities (including borrowings).

The NAV per share is

calculated by dividing this amount by the number of ordinary shares in issue (excluding treasury

shares).

Net Liquid Assets

Net liquid assets comprise current assets less current liabilities, excluding borrowings.

Discount/Premium (APM)

As stockmarkets and share prices vary, an investment trust's share price is rarely the same

as its NAV. When the share price is lower than the NAV per share it is said to be trading

at a discount. The size of the discount is calculated by subtracting the share price from

the NAV per share and is usually expressed as a percentage of the NAV per share. If the share

price is higher than the NAV per share, it is said to be trading at a premium.

Total Return (APM)

The total return is the return to shareholders after reinvesting the net dividend on the date

that the share price goes ex-dividend.

31 October 31 October 30 April 2019 30 April

2019 2019 NAV 2019 Share

NAV Share price

price

------------- -------------- ------------- ------------- ------------- ------------

Closing NAV

per

share/share

price (a) 193.0p 172.5p 203.1p 192.0p

Dividend

adjustment

factor* (b) 1.0145 1.0162 1.0236 1.0255

Adjusted

closing NAV

per

share/share

price (c = a x b) 195.8p 175.3p 207.9p 196.9p

Opening NAV

per

share/share

price (d) 203.1p 192.0p 207.5p 187.5p

------------- -------------- ------------- ------------- ------------- ------------

(c ÷ d) -

Total Return 1 (3.6%) (8.7%) 0.2% 5.0%

------------- -------------- ------------- ------------- ------------- ------------

* The dividend adjustment factor is calculated on the assumption that the dividends of 2.95p

(2019 - 4.50p) paid by the Company during the year were reinvested into shares of the Company

at the cum income NAV per share/share price, as appropriate, at the ex-dividend date.

Ongoing Charges (APM)

The total expenses (excluding borrowing costs) incurred by the Company as a percentage of

the average net asset value. The ongoing charges have been calculated on the basis prescribed

by The Association of Investment Companies.

Gearing (APM)

At its simplest, gearing is borrowing. Just like any other public company, an investment trust

can borrow money to invest in additional investments for its portfolio. The effect of the

borrowing on the shareholders' assets is called 'gearing'. If the Company's assets grow, the

shareholders' assets grow proportionately more because the debt remains the same. But if the

value of the Company's assets falls, the situation is reversed. Gearing can therefore enhance

performance in rising markets but can adversely impact performance in falling markets.

Equity gearing is the Company's borrowings adjusted for cash and cash equivalents expressed

as a percentage of shareholders' funds.

Potential gearing is the Company's borrowings expressed as a percentage of shareholders' funds.

The Company currently has no borrowings drawn down.

Leverage (APM)

For the purposes of the Alternative Investment Fund Managers (AIFM) Directive, leverage is

any method which increases the Company's exposure, including the borrowing of cash and the

use of derivatives. It is expressed as a ratio between the Company's exposure and its net

asset value and can be calculated on a gross and a commitment method. Under the gross method,

exposure represents the sum of the Company's positions after the deduction of sterling cash

balances, without taking into account any hedging and netting arrangements. Under the commitment

method, exposure is calculated without the deduction of sterling cash balances and after certain

hedging and netting positions are offset against each other.

Active Share (APM)

Active share, a measure of how actively a portfolio is managed, is the percentage of the portfolio

that differs from its comparative index. It is calculated by deducting from 100 the percentage

of the portfolio that overlaps with the comparative index. An active share of 100 indicates

no overlap with the index and an active share of zero indicates a portfolio that tracks the

index.

11. The Interim Financial Report will be available on the Company's page on the Managers' website

www.bgukgrowthfund.com++ on or around 13 December 2019.

Principal Risks and Uncertainties

The principal risks facing the Company are financial risk,

investment strategy risk, discount risk, regulatory risk, custody

and depositary risk, operational risk, leverage risk and political

risk. An explanation of these risks and how they are managed is set

out on pages 6 and 7 of the Company's Annual Report and Financial

Statements for the year to 30 April 2019 which is available on the

Company's website: www.bgukgrowthfund.com++. The principal risks

and uncertainties have not changed since the date of that

report.

++ Neither the contents of the Managers' website nor the

contents of any website accessible from hyperlinks on the Managers'

website (or any other website) is incorporated into, or forms part

of, this announcement.

None of the views expressed in this document should be construed

as advice to buy or sell a particular investment.

Automatic Exchange of Information

In order to fulfil its obligations under UK tax legislation

relating to the automatic exchange of information, the Company is

required to collect and report certain information about certain

shareholders.

The legislation requires investment trust companies to provide

personal information to HMRC on certain investors who purchase

shares in investment trusts. Accordingly, the Company will have to

provide information annually to the local tax authority on the tax

residencies of a number of non-UK based certificated shareholders

and corporate entities.

New shareholders, excluding those whose shares are held in

CREST, who come on to the share register will be sent a

certification form for the purposes of collecting this

information.

For further information, please see HMRC's Quick Guide:

Automatic Exchange of Information - information for account holders

http://www.gov.uk/government/publications/exchange-of-information-account-holders.

Third Party Data Provider Disclaimer

No third party data provider ('Provider') makes any warranty,

express or implied, as to the accuracy, completeness or timeliness

of the data contained herewith nor as to the results to be obtained

by recipients of the data. No Provider shall in any way be liable

to any recipient of the data for any inaccuracies, errors or

omissions in the index data included in this document, regardless

of cause, or for any damages (whether direct or indirect) resulting

therefrom.

No Provider has any obligation to update, modify or amend the

data or to otherwise notify a recipient thereof in the event that

any matter stated herein changes or subsequently becomes

inaccurate.

Without limiting the foregoing, no Provider shall have any

liability whatsoever to you, whether in contract (including under

an indemnity), in tort (including negligence), under a warranty,

under statute or otherwise, in respect of any loss or damage

suffered by you as a result of or in connection with any opinions,

recommendations, forecasts, judgments, or any other conclusions, or

any course of action determined, by you or any third party, whether

or not based on the content, information or materials contained

herein.

FTSE Index Data

FTSE International Limited ('FTSE') (c) FTSE 2019. 'FTSE(R)' is

a trade mark of the London Stock Exchange Group companies and is

used by FTSE International Limited under licence. All rights in the

FTSE indices and/or FTSE ratings vest in FTSE and/or its licensors.

Neither FTSE nor its licensors accept any liability for any errors

or omissions in the FTSE indices and/or FTSE ratings or underlying

data and no party may rely on any FTSE indices, ratings and/or data

underlying data contained in this communication. No further

distribution of FTSE Data is permitted without FTSE's express

written consent. FTSE does not promote, sponsor or endorse the

content of this communication.

- ends -

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR LLFVRLFLDFIA

(END) Dow Jones Newswires

November 28, 2019 02:00 ET (07:00 GMT)

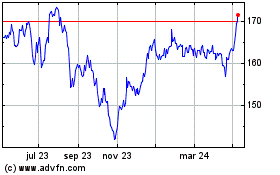

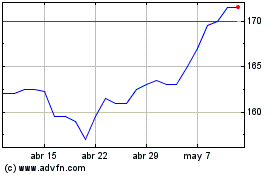

Baillie Gifford Uk Growth (LSE:BGUK)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Baillie Gifford Uk Growth (LSE:BGUK)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024