Canadian Dollar Falls As Trump Approves Hong Kong Legislation

27 Noviembre 2019 - 8:56PM

RTTF2

The Canadian dollar declined against its most major counterparts

in the Asian session on Thursday, as most Asian shares fell amid

worries that tensions between the U.S. and China over Hong Kong may

dampen the prospects for an interim trade deal.

Overnight, U.S. President Donald Trump signed into law

congressional legislation backing pro-democracy protesters in Hong

Kong, despite strong objections by China.

China reiterated its retaliation threat and said the Hong Kong

Human Rights Democracy Act seriously interferes in the internal

affairs of China violating international laws and basic principles

of foreign relations.

We urge the U.S. to not continue going down the wrong path, or

China will take countermeasures, and the U.S. must bear all

consequences," the Chinese Foreign Ministry said in a

statement.

Oil extended losses after a report showed U.S. crude inventories

grew unexpectedly last week.

The loonie edged down to 82.29 against the yen and held steady

thereafter. At Wednesday's close, the pair was quoted at 82.45.

Data from the Ministry of Economy, Trade and Industry showed

that retail sales in Japan plunged a seasonally adjusted 14.4

percent on month in October.

That missed expectations for a decline of 10.4 percent following

the 7.2 percent increase in September.

The loonie slipped to a 2-day low of 1.3293 against the

greenback from Wednesday's closing value of 1.3281. The currency is

likely to find support around the 1.35 level.

The loonie that ended Wednesday's trading at 1.4608 against the

euro weakened to a 2-day low of 1.4633. If the currency falls

further, 1.49 is possibly seen as its next support level.

In contrast, the loonie held steady against the aussie, after

having climbed to a 9-day high of 0.8981 at 6:15 pm ET. The pair

had closed Wednesday's deals at 0.8999.

Data from the Australian Bureau of Statistics showed that

private capital expenditure in Australia fell a seasonally adjusted

0.2 percent on quarter in the third quarter of 2019 - worth

A$29.413 billion.

That missed expectations for a flat reading following the 0.6

percent drop in the three months prior.

Looking ahead, Eurozone economic sentiment index for November is

due out in the European session.

At 8:00 am ET, German preliminary inflation data for November

will be released.

U.S. stock markets are closed for Thanksgiving holiday.

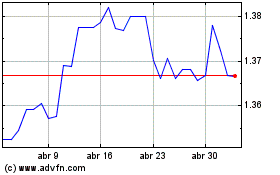

US Dollar vs CAD (FX:USDCAD)

Gráfica de Divisa

De Mar 2024 a Abr 2024

US Dollar vs CAD (FX:USDCAD)

Gráfica de Divisa

De Abr 2023 a Abr 2024