Banco Santander S.A. MREL Resolution Group Banco Santander (0690V)

28 Noviembre 2019 - 12:17PM

UK Regulatory

TIDMBNC

RNS Number : 0690V

Banco Santander S.A.

28 November 2019

Banco Santander, S.A. ("Santander"), pursuant to the Securities

Market Law, hereby announces the following:

INSIDE INFORMATION

The Bank of Spain has formally notified the binding minimum

requirement for eligible liabilities and own funds ("MREL"), both

total and subordinated, for the resolution group headed by

Santander[1] (the "Resolution Group"), as determined by the Single

Resolution Board ("SRB"). On 1 January 2020, this requirement will

replace the one that was applicable previously and that was

announced through a material fact on 24 May 2018 (CNMV registration

number 266090).

The MREL requirement has been set in terms of the Resolution

Group's total liabilities and own funds ("TLOF"). It consists of a

requirement for eligible liabilities as a percentage of TLOF

("Total MREL") and, within this, a requirement for eligible

liabilities with subordination as a percentage of TLOF

("Subordinated MREL").

For ease of understanding, the table below includes an

equivalent percentage in risk-weighted assets and an equivalent

amount using data as at 31 December 2017 (the date used by the SRB

for calibrating the MREL requirement). It also includes, for

comparison purposes, the Total MREL requirement announced in the

previous material fact, and the equivalent percentage and amount

for this requirement:

Requirement Equivalent percentage Equivalent amount

in terms of in risk-weighted (EUR million)

total liabilities assets at 31/12/17 at 31/12/17

and own funds

Total MREL

Communicated

on

28/11/19 16.81% 28.60% 108,631.80

------------------- ---------------------- ------------------

Subordinated

MREL[2]

Communicated

on

28/11/19 11.48% 19.53% 74,187.57

------------------- ---------------------- ------------------

Requirement Equivalent percentage Equivalent amount

in terms of in risk-weighted (EUR million)

total liabilities assets at 31/12/16 at 31/12/16

and own funds

MREL previously

announced

on 24/05/18 22.90% 24.35% 114,482.84

------------------- ---------------------- ------------------

The variation in the MREL requirement with respect to 2018 is

accounted for mainly by two factors: (i) a change in the scope of

consolidation of the Resolution Group, which now includes new

companies; and (ii) a modification in the calculation of capital

consumption due to equity risk; changes that have led to a

reduction in the risk-weighted assets of the Resolution Group.

According to our estimates, the Resolution Group complies with

the new MREL requirement and the subordination requirement. Future

requirements are subject to ongoing review by the resolution

authority.

Boadilla del Monte, Madrid, 28 November 2019

[1]The Resolution Group comprises Banco Santander, S.A. and the

entities that belong to the same European resolution group, mainly

the entities of the sub-group headed by Santander Consumer Finance.

S.A.

At 31 December 2017, the Resolution Group had risk-weighted

assets amounting to EUR 379,835 million and TLOF amounting to EUR

646,233 million.

[2]The SRB considers that the subordination requirement can be

covered by non-subordinated instruments in an amount equivalent to

2.5% of risk-weighted assets, 1.47% in terms of TLOF, having

considered the absence of material adverse impact on resolvability.

If this allowance were taken into account, the requirement that

would have to be covered by subordinated instruments would be

10.01% in terms of TLOF and 17.03% in terms of RWAs, using data as

of December 2017 as a reference.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCMMMZMRRDGLZM

(END) Dow Jones Newswires

November 28, 2019 13:17 ET (18:17 GMT)

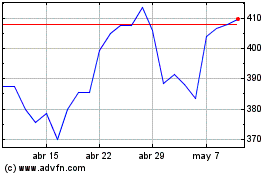

Banco Santander (LSE:BNC)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Banco Santander (LSE:BNC)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024