Australian Dollar Spikes Up As RBA Keeps Cash Rate On Hold

02 Diciembre 2019 - 8:27PM

RTTF2

The Australian dollar firmed against its key counterparts in the

Asian session on Tuesday, as the Reserve Bank of Australia held its

cash rate steady in its final meeting this year, saying that recent

rate cuts are supporting employment and income growth and

achievement of the inflation goal.

The board of the Reserve Bank of Australia, governed by Philip

Lowe, decided to leave the cash rate unchanged at a record 0.75

percent.

"Given these effects of lower interest rates and the long and

variable lags in the transmission of monetary policy, the Board

decided to hold the cash rate steady at this meeting," the bank

said in a statement.

The bank maintained that it was reasonable to expect that an

extended period of low interest rates will be required in Australia

to reach full employment and achieve the inflation target. The bank

said it is prepared to ease monetary policy further, if needed.

The bank observed that the lower cash rate has put downward

pressure on the exchange rate, which is supporting activity across

a range of industries.

Data from the Australian Bureau of Statistics showed that

Australia logged current account surplus for the second consecutive

quarter in the three months to September. The current account

surplus rose A$3.18 billion to A$7.85 billion in the September

quarter.

The currency outperformed against its most major counterparts on

Monday, as upbeat Chinese data helped ease investor concerns about

slowing global growth. It rose 0.9 percent against the greenback,

0.4 percent against the yen and 0.3 percent against the euro for

the day.

The aussie appreciated 0.4 percent to near a 3-week high of

0.6844 against the greenback, from a low of 0.6815 it recorded at

6:30 pm ET. The pair had finished Monday's deals at 0.6818. Should

the aussie extends its rally, 0.71 is likely seen as its next

resistance level.

After a brief decline to 74.27 against the yen at 6:30 pm ET,

the aussie turned higher, rising 0.6 percent to a 3-week high of

74.73. The aussie had finished yesterday's trading session at 74.30

against the yen. The currency is seen locating resistance around

the 78.00 mark.

The aussie advanced to 1.6185 against the euro, its biggest

since November 14, and marked a 0.4 percent gain from a low of

1.6253 seen at 5:30 pm ET. The euro-aussie pair was valued at

1.6247 at Monday's close. The aussie may face resistance around the

1.60 mark, if it appreciates again.

The aussie was 0.3 percent higher at 1.0510 against the kiwi,

following a decline to 1.0480 at 10:15 pm ET. At Monday's close,

the pair was worth 1.0485. Extension of the aussie's uptrend may

take it to a resistance around the 1.08 region.

The aussie gained 0.5 percent against the loonie, approaching

near a 4-week high of 0.9107. The rally came after a drop to 0.9064

at 5:00 pm ET. The pair was quoted at 0.9074 when it ended trading

on Monday. Next immediate resistance for the aussie is likely seen

around the 0.92 level.

Looking ahead, at 2:30 am ET, Swiss consumer inflation for

November is slated for release.

U.K. construction PMI for November and Eurozone PPI for October

are due out in the European session.

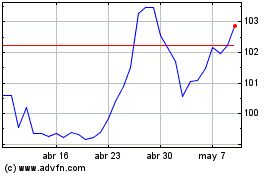

AUD vs Yen (FX:AUDJPY)

Gráfica de Divisa

De Mar 2024 a Abr 2024

AUD vs Yen (FX:AUDJPY)

Gráfica de Divisa

De Abr 2023 a Abr 2024