Salesforce Posts Quarterly Loss After Closing Its Biggest Acquisition -- Update

03 Diciembre 2019 - 7:44PM

Noticias Dow Jones

By Aaron Tilley

Salesforce.com Inc. posted a fiscal third-quarter net loss after

closing its biggest-ever acquisition even as its customer billings

remained on a growth track.

The provider of subscription-based business software said

Tuesday that it had a net loss of $109 million, compared with a

$105 million net profit a year earlier.

In August, Salesforce said it had completed the purchase of

Tableau Software, a data analytics platform, for more than $15

billion in stock. The addition, Salesforce has said, is expected to

help the company build out a new business in data analytics

software, though the deal's charges weighed on last quarter's

bottom line.

Shares fell 1.9% in after-hours trading as some projections for

billings growth in the current quarter disappointed investors. The

company said the figure reflected the Tableau acquisition and some

early renewal in the prior quarter.

Sales in the quarter ended Oct. 31 increased 33% to a record

$4.51 billion, compared with the $4.45 billion that analysts

surveyed by FactSet had expected. Salesforce's closely watched

anticipated billings for the coming months from its

subscription-based revenue model rose 28% year over year. It

previously promised growth of 24% to 25%.

Salesforce's co-chief executive officer, Marc Benioff, told

analysts that despite economic slowdowns in several important

markets, companies were continuing to invest in digital tools

underpinning growth prospects. In Europe, where tech spending is

slowing, sales rose 42% in the latest quarter on a

currency-adjusted basis, the company said.

The San Francisco company raised last month the top end of its

full-year sales guidance to $17 billion after boosting its outlook

over the summer. Salesforce also said it would increase sales to as

high as $35 billion in the fiscal year ended Jan. 31, 2024.

Salesforce's focus on rapidly boosting revenue has come with

acquisitions to maintain momentum. In addition to the Tableau deal,

Salesforce paid $6.5 billion last year for MuleSoft, a company that

makes software to help customers tap into data from legacy computer

systems as they migrate to the cloud. This year, Salesforce agreed

to buy ClickSoftware, a provider of field-service management

software, for $1.35 billion.

In keeping with the focus on growth, Salesforce said Tuesday

that revenue in the current quarter should reach $4.74 billion to

$4.75 billion. Analysts had forecast sales of $4.74 billion.

The company also said sales in the first quarter of the coming

fiscal year should rise as much as 29% to $4.84 billion compared

with the prior-year period.

Write to Aaron Tilley at Aaron.Tilley@wsj.com

(END) Dow Jones Newswires

December 03, 2019 20:29 ET (01:29 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

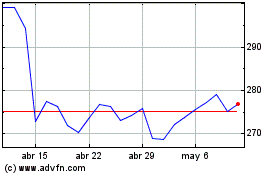

Salesforce (NYSE:CRM)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Salesforce (NYSE:CRM)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024