Oracle Will Stay With Sole CEO -- WSJ

13 Diciembre 2019 - 2:02AM

Noticias Dow Jones

Software company reports higher profit but disappointing revenue

for quarter

By Maria Armental

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (December 13, 2019).

Oracle Corp. said it won't replace its late co-CEO, Mark Hurd,

leaving Safra Catz as the sole top executive leading the software

giant after years of operating with an unusual, two-chief

structure.

In the company's first earnings report since Mr. Hurd's death in

October, Oracle founder and Chairman Larry Ellison said it is

working to strengthen its management team, to build develop a group

of executives who are "potential CEOs when both Safra and I retire,

which is not anytime soon." But he described the two-CEO setup as

unusual and not something Oracle is looking to repeat.

Ms. Catz now leads Oracle as sole CEO. Company co-founder Larry

Ellison, who ceded the CEO post to Mr. Hurd and Ms. Catz in 2014,

remains active as chairman and chief technology officer.

The twin-CEO structure has had a mixed record at the small

number of companies that have tried it. But two of Oracle's rivals,

Salesforce.com Inc. and SAP SE have also adopted it over the past

two years.

The Silicon Valley company, best known for its corporate

database software, reported $9.61 billion in revenue for the

quarter ended Nov. 30, missing analysts' projected $9.65 billion,

according to FactSet.

Profit for the second quarter rose to $2.31 billion, or 69 cents

a share. Excluding stock-based compensation and other items, profit

rose to 90 cents a year, from 80 cents a share a year earlier.

Analysts surveyed by FactSet expected a profit of 68 cents a

share, or 89 cents a share as adjusted.

For the current quarter, Oracle gave a somewhat muted outlook.

It projected adjusted profit of 95 cents to 97 cents a share

compared with analysts' projected 97 cents. Sales, Oracle said,

would rise roughly 2%, broadly in line with analysts'

projections.

The company said it is seeing strong demand and higher

conversion rates and expects strong momentum in the second half of

this fiscal year to carry through 2021.

Oracle deftly navigated constant technological changes since it

was founded in 1977; but in the era of cloud computing, it has been

playing catch-up to the likes of Amazon.com Inc., Microsoft Corp.

and Alphabet Inc.'s Google.

In the most recent quarter, Oracle reported a combined $7.94

billion cloud and license revenue, just shy of analysts'

projections of roughly $8 billion.

Oracle has been trying to introduce new features to its cloud,

including greater automation, to help lure customers away from

other vendors, in particular market leader Amazon.

This month, the company added to its board Vishal Sikka, founder

and chief executive of artificial-intelligence company Vianai

Systems and a SAP and Infosys Ltd. veteran, highlighting Mr.

Sikka's experience in AI and machine learning.

Shares, which have been trading near record levels in recent

months, closed Thursday at $56.47 and fell 2.6% in after-hours

trading.

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

December 13, 2019 02:47 ET (07:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

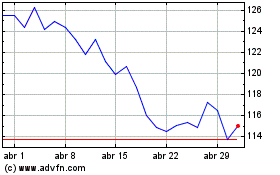

Oracle (NYSE:ORCL)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Oracle (NYSE:ORCL)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024