Unilever to Miss Sales Target, Putting Pressure on CEO -- 2nd Update

17 Diciembre 2019 - 7:11AM

Noticias Dow Jones

By Saabira Chaudhuri

LONDON -- Unilever PLC warned it would miss its sales target for

the year, blaming difficulties in the U.S. and other key markets

and setting up an early challenge for Chief Executive Alan Jope,

less than a year in the top job.

The owner of Dove body wash and Ben & Jerry's ice cream said

sales growth on an underlying basis -- which strips out currency

and acquisition impacts -- would be slightly below its guidance of

growth at the lower end of 3% to 5%. Earnings, margin and cash

aren't expected to be impacted, it said.

The surprise announcement prompted Unilever shares to fall more

than 5% in recent trading in London.

The company has been battling intense competition in the U.S.

from Procter & Gamble Co. in categories like shampoo. P&G,

which makes Tide detergent and Bounty paper towels, has invested in

product quality, packaging, marketing and retail execution.

RBC analyst James Edwardes Jones estimated the figures imply the

company's lowest quarterly sales growth for over a decade and said

Unilever must increase investment. "This is what happens when a

company cuts marketing, while its competitors are increasing

theirs," he said.

Mr. Jope, on a call with reporters, said Unilever was

accelerating its cost-savings plan to fund greater investment in

its business, and that it would also consider selling slow-growing

units.

While he didn't specify, analysts have long suggested the

company might look to sell some of its food brands. Rival Nestlé

SA, after missing sales targets for several quarters, has sharpened

its focus on high-growth categories like coffee and petfood, while

exiting slower-growth units like U.S. confectionery, a strategy

that is paying off.

Mr. Jope also said the company was working to attract new

consumers to its brands and come up with new products. He said

investments in U.S. ice cream, hair care and dressings -- lately

problem categories in America -- had already started to pay

off.

"We are far from crisis conditions," he said. "This is just a

little bit more turbulent than normal."

Unilever has also shuffled top management as part of its efforts

to jumpstart sales.

Earlier this month, Unilever said it was replacing its North

America head with the former chief executive of Revlon Inc. That

followed the naming of a new chairman and new beauty and personal

care head this year.

However, having new faces "leaves some uncertainty over the

approach and plans at the group," wrote analysts at Société

Générale in a recent note. "Investors we speak to are increasingly

uneasy about an opaqueness of what Unilever thinks it can achieve

in the medium term and what is changing to get that delivered."

Some analysts have also expressed concern that Mr. Jope, a

marketeer by training who took over in January, would be less

focused on financials than his predecessor Paul Polman.

"CEO Alan Jope is more enthusiastic talking about

sustainability, digital and the talent agenda than the nuts and

bolts of growth drivers, cost savings and portfolio choices," wrote

Jefferies analyst Martin Deboo in a recent note. A Unilever

spokesman declined to comment on recent analyst remarks.

At the same time, others have welcomed Mr. Jope's indication

that Unilever will pull back on acquisitions. Under Mr. Polman,

Unilever made a string of small buys to boost exposure to

high-growth categories, but growing those has proved difficult.

Aside from challenges in North America, the company is also

grappling with an economic slowdown in India -- its largest market

by volume. Cash shortages in rural areas along with a combination

of flooding and droughts over the monsoon season has hindered

demand. Growth is currently trending at less than 5%, down from

about 10% last year, Mr. Jope said Tuesday.

The company also flagged West Africa as a problem area. In

Nigeria and Ghana -- Unilever's two largest markets in the region

-- Mr. Jope said the company is facing "a double whammy" of slowing

demand and disruptions to distribution.

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com

(END) Dow Jones Newswires

December 17, 2019 07:56 ET (12:56 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

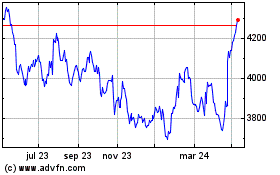

Unilever (LSE:ULVR)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

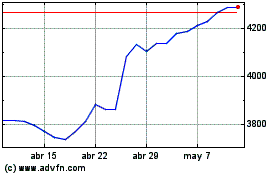

Unilever (LSE:ULVR)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024