TIDMBHP

RNS Number : 7443X

BHP Group PLC

22 December 2019

NEWS RELEASE

Release Time IMMEDIATE

Date 23 December 2019

Release Number 24/19

Andrew Mackenzie retirement date 31 March 2020

The Board of BHP today announced that Andrew Mackenzie's

retirement date will be 31 March 2020, three months earlier than

previously announced on 14 November 2019. The Board, Mr Mackenzie

and Mr Henry are confident that the CEO transition is proceeding

well and ahead of schedule, with Mike Henry assuming the role of

Chief Executive Officer from 1 January 2020, as previously

announced.

Mr Mackenzie's retirement arrangements are summarised in the

attached schedule.

Further information on BHP can be found at: bhp.com

Summary of revised terms of retirement for Andrew Mackenzie

1. Fixed remuneration

Andrew Mackenzie will continue to be employed by the Company

until 31 March 2020 under the terms of the 2019 remuneration

policy. The Company will pay him a salary, make pension

contributions and provide usual other minor benefits until then.

His base salary is US$1,700,000 per annum and pension contributions

are 25 per cent of salary for FY2020. Upon retiring, Mr Mackenzie

will be entitled to receive the accumulated value of funds under

relevant pension plans, together with the value of any accrued

leave.

2. Severance payment

Mr Mackenzie will receive no severance payment, and no payment

in lieu of notice.

3. Incentive arrangements

Mr Mackenzie's entitlements under the Cash and Deferred Plan

(CDP), Short Term Incentive Plan (STIP) and Long Term Incentive

Plan (LTIP) are governed by the shareholder-approved remuneration

policy, applicable plan rules and the Group's leaving entitlements

policy as approved by shareholders at the 2017 Annual General

Meetings.

CDP

In relation to the FY2020 year, Mr Mackenzie will serve as CEO

for six months. He will be considered for a bonus under the CDP at

the end of the year (i.e. for the year ended 30 June 2020). Whether

any bonus will be paid, and the amount, will be determined by the

Remuneration Committee after an assessment of the Company's and his

personal performance after the year end. Accordingly, the awards

made under the CDP are "at-risk". Any amount assessed as payable

will be reported in the Remuneration Report that will be published

in September. This is consistent with the remuneration policy as

approved by shareholders, and the established practice of the

Company.

Even though Mr Mackenzie will be serving as an employee for nine

months of the FY2020 financial year, he will not receive any

payment under the CDP for the last three months of that period.

While the CDP does allow the Remuneration Committee the discretion

to make such a payment, in this case the Remuneration Committee

will not be using that discretion.

STIP

Under the rules of the STIP, unvested deferred shares are

transferred to a retiring executive on the originally scheduled

vesting date.

LTIP

Mr Mackenzie is a participant in the LTIP approved by

shareholders. The LTIP requires BHP to materially outperform the

comparator groups' Total Shareholder Return (TSR) for all the

awards to vest. The performance hurdles are stretching and ensure

alignment with shareholders. Accordingly, the awards made under the

LTIP are "at-risk", and the actual value of any LTIP awards may

ultimately be zero. The Remuneration Committee reviews performance

and takes advice from its independent adviser before making any

decisions about vesting. Importantly, even if the performance

hurdle is met the Committee conducts a holistic performance review

at vesting time and has an overriding discretion under the plan

rules to reduce the amount of shares that vest.

Under the terms of the LTIP, employees who retire are entitled

to hold awards granted previously. However, the number of awards is

reduced to reflect the period of service in relation to each grant.

They will vest only if the performance hurdle is met, and the

Remuneration Committee confirms vesting, at the expiration of the

term. The actual value of the LTIP awards may ultimately be

zero.

Mr Mackenzie's awards from 2015, 2016, 2017, 2018 and 2019 will

therefore be pro-rated according to the rules of the plan and in

each case must be held for the full five years from the date of

grant (see the table below).

4. Outstanding Share Awards

A. STIP awards

The table below provides details of the STIP awards which will

be unvested at the time of Mr Mackenzie's departure. These shares

represent half of the bonus paid under the STIP for FY2018 and

FY2019 as approved by shareholders. They must be held for two

years, which expire in 2020 and 2021, respectively.

Award Original Estimated Vesting Outcome Awards to

No of Awards Vesting Date Vest

STIP FY2018 52,061 Aug-20 100% 52,061

-------------- -------------- ---------------- ----------

STIP FY2019 25,845 Aug-21 100% 25,845

-------------- -------------- ---------------- ----------

Total 77,906 100% 77,906

-------------- -------------- ---------------- ----------

B. LTIP awards

The table below provides details of the LTIP awards that may

vest in the five years after Mr Mackenzie's departure.

As noted above, under the terms of the LTIP employees who retire

are entitled to hold awards granted prior to retirement. However,

the number of awards is reduced to reflect the period of elapsed

employment service in relation to each grant. The pro-rata rule of

the LTIP will thus impact the number of awards Mr Mackenzie retains

on departure. To determine the award Mr Mackenzie will retain on

departure, each individual award needs to be calculated on a

pro-rata basis according to the time worked over the five year

performance period (e.g. if Mr Mackenzie had been employed for half

of the five year performance period then he would retain half the

awards). The details of the awards Mr Mackenzie will retain are set

out below.

Whether the awards vest will depend on BHP's relative TSR

performance over the five-year periods to 30 June 2020, 2021, 2022,

2023 and 2024, respectively. In addition, even if the performance

hurdle is met the Committee conducts a holistic performance review

at vesting time and has an overriding discretion under the plan

rules to reduce the amount of awards that vest. Accordingly, the

vesting outcome and the number of LTIP awards that will vest is

unknown at this time.

Award Original Awards Pro-Rated Estimated Estimated Estimated

No of Awards to Lapse Awards Vesting Vesting Awards

on Retirement Retained Date Outcome to Vest

on Retirement

LTIP 2015 339,753 16,988 322,765 Aug-20 Unknown Unknown

LTIP 2016 339,753 84,938 254,815 Aug-21 Unknown Unknown

LTIP 2017 385,075 173,284 211,791 Aug-22 Unknown Unknown

LTIP 2018 304,523 197,940 106,583 Aug-23 Unknown Unknown

LTIP 2019 271,348 230,646 40,702 Aug-24 Unknown Unknown

-------------- --------------- --------------- ---------- ---------- ----------

Total 1,640,452 703,796 936,656

-------------- --------------- --------------- ----------

Authorised for lodgement by:

Rachel Agnew

Company Secretary

Media Relations Investor Relations

Email: media.relations@bhp.com Email: investor.relations@bhp.com

Australia and Asia Australia and Asia

Gabrielle Notley Tara Dines

Tel: +61 3 9609 3830 Mobile: Tel: +61 3 9609 2222 Mobile:

+61 411 071 715 + 61 499 249 005

Europe, Middle East and Africa Europe, Middle East and Africa

Neil Burrows Elisa Morniroli

Tel: +44 20 7802 7484 Mobile: Tel: +44 20 7802 7611 Mobile:

+44 7786 661 683 +44 7825 926 646

Americas Americas

Judy Dane Brian Massey

Tel: +1 713 961 8283 Mobile: Tel: +1 713 296 7919 Mobile:

+1 713 299 5342 +1 832 870 7677

BHP Group Limited ABN 49 004 BHP Group plc Registration

028 077 number 3196209

LEI WZE1WSENV6JSZFK0JC28 LEI 549300C116EOWV835768

Registered in Australia Registered in England and Wales

Registered Office: Level 18, Registered Office: Nova South,

171 Collins Street 160 Victoria Street

Melbourne Victoria 3000 Australia London SW1E 5LB United Kingdom

Tel +61 1300 55 4757 Fax +61 Tel +44 20 7802 4000 Fax +44

3 9609 3015 20 7802 4111

Members of the BHP Group which is

headquartered in Australia

Follow us on social media

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

BOAEAFAAAENNFAF

(END) Dow Jones Newswires

December 23, 2019 02:00 ET (07:00 GMT)

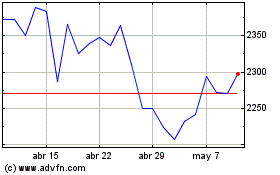

Bhp (LSE:BHP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

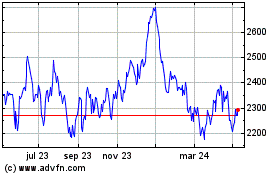

Bhp (LSE:BHP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024