TIDMPAT

RNS Number : 7919X

Panthera Resources PLC

23 December 2019

23 December 2019

Panthera Resources PLC

("Panthera" or "the Company")

Interim Results - Six months ended 30 September 2019

Panthera Resources PLC (AIM: PAT), the gold exploration and

development company with key assets in India and West Africa, is

pleased to announce its unaudited interim results for the half year

ended 30 September 2019.

Highlights

-- Earnings for the reporting period was a loss of $659,348 or

$0.01 per share. This was an improvement on the previous

corresponding period loss of $1,106,883 or $0.02 per share. The

improvement resulted from efforts to reduce the company's overall

cost base and lower levels of expensed exploration

expenditures.

-- Government of Rajasthan (GoR) finally filed its response to

Metal Mining India Pvt Ltd's (MMI's) writ petition. The rejoinder

has now been filed on behalf of MMI and all documents therefore

lodged with the Hon'ble High Court of Rajasthan (Court) and the

case is now ready for a final hearing.

-- MMI was granted an interim stay order by the Court, which

fully protects our rights to the project area.

-- The Labola Project in Burkina Faso was acquired. Labola hosts

evidence of mineralisation over at least 7km of mineralised

structures known to extend for 9km strike and hosts a previously

identified resource which was estimated at approximately 600,000

ounces of contained gold averaging (approximately) 1.2g/t Au.

-- The final instalment of the first tranche of Galactic Gold

Pvt Ltd's (Galaxy) investment in Indo Gold Pty. Ltd (IGL) was

received and Galaxy now holds a 5% interest in IGL, resulting in

Panthera holding an effective 66.5% stake in the Bhukia Joint

Venture Project (Bhukia).

-- Tranche 3 of the Republic Investment Management (Republic)

financing agreement was restructured to bring forward GBP500,000 at

GBP0.10 per share and align pricing for the remainder of the

tranche with the market prevailing at the time.

-- Following up on the gold mineralised drill intercepts that

were returned from drilling at the Naton project in Burkina Faso,

further work (mostly soil geochemistry and mapping) has outlined

and better defined extensions to this mineralization and added

further high-quality drill targets.

-- The company's corporate restructuring has been completed and

subsidiaries formed in Mali and Burkina Faso now hold the

exploration assets in-country.

Activities during the Reporting Period

The key focus of Panthera's operating activities during the

reporting period was to:

(i) Progress the permitting of the Bhukia joint venture property

in Rajasthan, India through the Court and through parallel

negotiations with the GoR;

(ii) Continue to build a highly attractive portfolio of West

African gold exploration properties, some with clearly identified

drill targets;

(iii) Seek and successfully identify a strategic partner (or

partners) to advance the Company's West African gold exploration

initiatives; and

(iv) Optimise the Company's investment in Anglo Saxony Mining.

To this end the Company met with good success:

Bhukia Project (67%), India

-- Panthera is targeting a 6.0Moz+ AU resource at Bhukia, where

it currently has a JORC (2012) compliant inferred resource of

1.74Moz on a 100% basis (1.16Moz on a 67% attributable basis),

defined over only approximately 10% of an extensive gold in soil

geochemical anomaly.

-- During the previous reporting period, MMI's Bhukia PLA was

rejected. On 6 September 2018 a substantive writ petition was filed

with the Court on MMI's behalf. The GoR filed its reply 14 months

later in November of 2019. With the recent filing of MMI's

rejoinder to the reply, all pleadings are now lodged with the court

and the matter is ready for the Court to decide. Unfortunately,

given the overtaxed and generally inefficient nature of the Court,

we cannot predict with any certainty when our case will be

adjudicated.

-- The Company's operations in India have benefitted from input

and assistance from Galaxy and it's affiliates since the inception

of the investment and cooperation agreement. Even as events have

unfolded in the Court, communication with newly elected and

appointed politicians and bureaucrats have improved and, while at

an early stage, an increasingly constructive dialogue is

underway.

West African Gold Exploration Initiative

-- During the reporting period the West African assets were

restructured to be held in subsidiary companies in Mali and Burkina

Faso.

-- In an exciting addition to Panthera's West African gold

portfolio, a decision was made to move to a full Option to Purchase

agreement following its successful due diligence investigation of

the Labola Project in Burkina Faso.

-- Labola hosts drill defined mineralisation intermittently over

at least 7km of the known 9km strike and previously identified

resource estimates of approximately 600,000 ounces of contained

gold averaging (approximately) 1.2g/t Au.

-- The agreement allows for up to five years of exploration and

Panthera may obtain a 100% interest in the project by payment of

US$1,000,000 to the vendor at any time within this five-year

period. An additional payment of US$1,000,000 will become due if a

JORC compliant resource exceeding 1,000,000 ounces of contained

gold is defined and a 1% net smelter royalty capped at US$2M will

be payable from production.

-- This is the first time this package of properties has been

consolidated under one ownership and it represents an excellent

opportunity to integrate the significant amount of previous

drilling and optimise the resource potential of the project.

-- Significant potential for higher grade mineralisation can

also be seen based on previous drill results:

o 2m @ 130.6g/t Au from 66m

o 11m @ 8.2g/t Au from 147m

o 6.5m @ 7.26g/t Au from 318m.

Galaxy Partnership Tranche 1 Investment Concluded

-- During the reporting period Galaxy completed the first of its

two planned investment tranches in IGL. These two tranches,

totalling US$1.25m, will entitle Galaxy to a 10% holding in

IGL.

-- Galaxy has agreed to purchase two 5% stakes in IGL in two stages:

o Stage 1 (5%) - US$500,000 was completed in two investments of

$250,000 each, with the last $250,000 payment received in May

2019.

o Stage 2 (5%) - US$750,000 is scheduled to be made prior to the

re-commencement of exploration (now expected in the first half of

2020).

Republic Investment Management ("Republic") Tranche 3 Investment

Restructured

In a prudent move to provide near term liquidity in response to

delays to the permitting of the Company's Bhukia JV in India,

Panthera's binding investment agreement with Republic was

successfully restructured. The Tranche 3 payment previously

consisted of A$2.67m at A$0.65 per share and was due at the time

the Bhukia PL is granted and the necessary environmental and

forestry permits for drilling are obtained. The Tranche 3 capital

injection was restructured and split into two separate investment

tranches. Tranche 3A, provided proceeds of GBP500,000 at 10 pence

per share during the reporting period. The payment timing for

Tranche 3B will be made (as previously agreed) upon receipt of

approvals to recommence exploration at the Bhukia JV project in

India. Tranche 3B is now to be priced at a 15% discount to the 20

day VWAP at that time.

Management indicate that on current expenditure levels, all

current cash held will be used within the next 12 months. The

group's ability to continue as a going concern is dependent upon

raising additional capital. A key factor affecting this is the

granting of the PL and necessary environmental and forestry permits

which triggers an additional US$750,000 from Galaxy and GBP1m from

RIM. The Company will keep the market updated on progress with the

PL grant and its funding requirements.

Geoff Stanley, Chief Executive Officer of Panthera Resources,

commented:

"During this period Panthera has made excellent progress on

multiple fronts, including strengthening our legal case for grant

of the Bhukia PL, the acquisition of an excellent property package

with strong indications of gold mineralization in Burkina Faso and

completion of several financings that provide low dilution to

shareholders by leveraging the underlying value of the Company's

asset base.

With all legal pleadings now submitted with the Court in

Rajasthan, MMI's case is ready to be decided. The strength of the

joint venture's case is apparent, which we expect will allow a

fruitful negotiation to commence with the GoR regarding grant of

the long-awaited PL.

We are looking forward to reporting substantial additional

progress in 2020. Areas of focus will remain advancing the

permitting process in India to allow exploration to recommence at

Bhukia, adding to our already successful West African exploration

efforts and nurturing the ASM investment"

Enquiries

Panthera Resources PLC

Geoff Stanley (CEO) +1 (917) 941 7704

Nominated Advisor and Broker

RFC Ambrian +44 (0) 20 3440 6800

Rob Adamson

Bhavesh Patel

Charlie Cryer

Panthera Resources PLC

Unaudited Interim Financial Information for the period ended

30 September 2019

Set out below are the unaudited result of the group for the six

months to 30 September 2019.

Group Statement of comprehensive income

For the six months ended 30 September 2019

Six months Six months

to 30 September to 30 September

2019 2018

Unaudited Unaudited

$USD $USD

================================================= ========================== ==========================

Continuing operations

Revenue - 1,682

----------------------------------------------------- -------------------------- --------------------------

Gross profit - 1,682

Other Income 28,697 -

Exploration costs expensed (289,934) (534,903)

Administrative expenses (397,724) (260,054)

Share option expenses - -

Impairment expense -

AIM Listing and acquisition related costs - -

--------------------------------------------------- -------------------------- --------------------------

Loss from operations (658,961) (793,275)

Investment revenues 607 6,759

Loss on sale of assets - -

-------------------------------------------------- -------------------------- --------------------------

Loss before taxation (658,354) (786,516)

Taxation - -

Other comprehensive income

Items that may be reclassified to profit

or loss:

Changes in the fair value of available-for-sale

financial assets 1,316 -

Gain on sale to non controlling interest - -

Exchange differences (2,310) (320,367)

--------------------------

Loss and total comprehensive income for

the year (659,348) (1,106,883)

---------------------------------------------------- -------------------------- --------------------------

Total loss for the year attributable to:

- Owners of the Parent Company (637,744) (765,945)

- Non-controlling interest (20,610) (20,571)

(658,354) (786,516)

------------------------------------------------- -------------------------- --------------------------

Total comprehensive income for the year

attributable to:

- Owners of the Parent Company (638,738) (1,086,312)

- Non controlling interest (20,610) (20,571)

(659,348) (1,106,883)

------------------------------------------------- -------------------------- --------------------------

Earnings per share attributable to the owners

of the parent

Continuing operations (undiluted/diluted) (0.01) (0.02)

--------------------------------------------------- -------------------------- --------------------------

Group Statement of financial position

As at 30 September

2019

30 September 30 September

2019 2018

Unaudited Unaudited

$USD $USD

========================================= ========================== ==========================

Non-current assets

Property, plant

and equipment 4,275 1,941

Investments 6,747 -

Available for sale financial

asset 1,760,635 1,227,797

------------------------------------------- -------------------------- --------------------------

1,771,657 1,229,738

Current

assets

Trade and other

receivables 171,454 64,623

Cash and cash equivalents 381,847 500,883

------------------------------------------ -------------------------- --------------------------

553,301 565,506

----------------------------------------- -------------------------- --------------------------

Total assets 2,324,958 1,795,244

Non-current liabilities

Provisions 42,923 35,765

Deferred tax liabilities - -

42,923 35,765

Current liabilitites

Provisions 6,019 -

Trade and other

payables 185,883 72,120

Total liabilitites 234,825 107,885

------------------------------------------ -------------------------- --------------------------

Net assets 2,090,133 1,687,359

--------------------------------------------- -------------------------- --------------------------

Equity

Share capital 1,007,056 913,588

Share premium 18,010,161 17,373,601

Capital reorganisation

reserve 537,757 537,757

Other reserves (227,875) (819,211)

Retained earnings (16,991,030) (16,099,803)

------------------------------------------ -------------------------- --------------------------

Total equity attributable to owners

of the parent 2,336,069 1,905,932

Non-controlling

interest (245,936) (218,573)

Total equity 2,090,133 1,687,359

--------------------------------------------- -------------------------- --------------------------

Group Statement of changes

of equity

For the six months

ended 30 September

2019

Share Share premium Capital Other Retained Total Non-controlling Total

Capital account re-organisation reserves earnings equity interest

reserve

Unaudited Unaudited Unaudited Unaudited Unaudited Unaudited Unaudited Unaudited

$USD $USD $USD $USD $USD $USD $USD $USD

==================== ======================= ============================= ============================= ============================= ============================= ========================== ============================= ==========================

Balance at

1 April 2018 913,588 17,373,601 537,575 (497,524) (15,313,287) 3,014,135 (198,002) 2,816,133

Loss for the

year (786,516) (786,516) (20,571) (807,087)

Foreign exchange

differences

on translation

of currency (320,367) (320,367) (320,367)

Total comprehensive

income for

the year - - - (320,367) (786,516) (1,106,883) (20,571) (1,127,454)

-------------------- ----------------------- ----------------------------- ----------------------------- ----------------------------- ----------------------------- -------------------------- ----------------------------- --------------------------

Expiry of Options (1,320) (1,320) (1,320)

Total transactions

in the year

recognised

diectly in

equity - - - (1,320) - (1,320) - (1,320)

-------------------- ----------------------- ----------------------------- ----------------------------- ----------------------------- ----------------------------- -------------------------- ----------------------------- --------------------------

Balance at

30 September

2018 913,588 17,373,601 537,575 (819,211) (16,099,803) 1,905,932 (218,573) 1,687,359

-------------------- ----------------------- ----------------------------- ----------------------------- ----------------------------- ----------------------------- -------------------------- ----------------------------- --------------------------

Balance at

1 April 2019 913,588 17,373,601 537,757 (115,997) (16,352,292) 2,356,657 (225,326) 2,131,331

Loss for the

year (637,744) (637,744) (20,610) (658,354)

Changes in

the fair value

of

available-for-sale

financial assets 1,316 1,316 1,316

Foreign exchange

differences

realised during

the year (2,310) (2,310) (2,310)

Total comprehensive

income for

the year - - - - (638,738) (638,738) (20,610) (659,348)

-------------------- ----------------------- ----------------------------- ----------------------------- ----------------------------- ----------------------------- -------------------------- ----------------------------- --------------------------

Share application

moneys received 61,450 553,050 - 614,500 614,500

Shares issued

in lieu of

fees 32,018 83,510 115,528 115,528

Gain on fair

value of

investment

assets (81,943) (81,943) (81,943)

Foreign exchange

differences

on translation

of currency (29,935) (29,935) (29,935)

Total transactions

in the year

recognised

diectly in

equity 93,468 636,560 - (111,878) - 618,150 - 618,150

-------------------- ----------------------- ----------------------------- ----------------------------- ----------------------------- ----------------------------- -------------------------- ----------------------------- --------------------------

Balance at

30 September

2019 1,007,056 18,010,161 537,757 (227,875) (16,991,030) 2,336,069 (245,936) 2,090,133

-------------------- ----------------------- ----------------------------- ----------------------------- ----------------------------- ----------------------------- -------------------------- ----------------------------- --------------------------

Group Statement of cash flows

For the six months ended 30 September

2019

Six months Six months

to 30 September to 30 September

2019 2018

Unaudited Unaudited

$USD $USD

========================================== ========================== ==========================

Cash flows from operating

activities

Cash used in operations (606,593) (879,924)

Income taxes paid - -

------------------------------------------- -------------------------- --------------------------

Net cash outflow from operating

activities (606,593) (879,924)

Investing activities

Purchase of intangible

assets - -

Sale/(purchase) of property, plant

and equipment (1,308) -

Payments for available for sale

financial assets - -

Sale/(Purchase) of Investments - -

Net cash generated/(used) in investing

activities (1,308) -

Financing activities

Proceeds from issue of

shares 741,600 -

Share issue costs - -

Proceeds from share applications - -

Loans repaid from other

companies - -

Loans advanced to other

companies - -

Effect of exchange rate movement on cash

and investments 59,773 (190,771)

Net cash generaged from financing

activities 801,373 (190,771)

Net increase in cash and

cash equivalents 193,472 (1,070,695)

Cash and cash equivalents at beginning

of period 188,375 1,571,578

Cash and cash equivalents

at end of period 381,847 500,883

-------------------------------------------- -------------------------- --------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR LIFFDFELVFIA

(END) Dow Jones Newswires

December 23, 2019 02:32 ET (07:32 GMT)

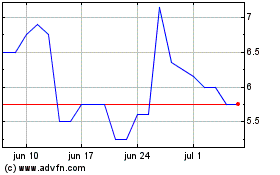

Panthera Resources (LSE:PAT)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Panthera Resources (LSE:PAT)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024