TIDMTSCO

RNS Number : 2165Z

Tesco PLC

09 January 2020

3Q and Christmas Trading Statement 19/20

STRONG PERFORMANCE in a subdued uk MARKET

19 weeks 3Q + Christmas Trading = 19 week period

Sales Total LFL sales Total LFL sales Total LFL sales

GBPm sales change sales change sales change

change change change

(constant (constant (constant

rates) rates) rates)

---------------- --------- ---------- ---------- ----------

UK & ROI 16,807 0.2% 0.4% 0.2% 0.4% 0.2% 0.4%

--------- ---------- --------- ---------- --------- ---------- ---------

UK 13,709 (0.5)% (0.4)% 0.0% 0.1% (0.3)% (0.2)%

ROI 873 0.7% 2.0% 0.6% 1.9% 0.7% 2.0%

Booker 2,225 4.3% 5.0% 1.4% 2.3% 3.4% 4.1%

--------- ---------- --------- ---------- --------- ---------- ---------

Central Europe 1,928 (14.2)% (11.0)% (12.8)% (9.1)% (13.7)% (10.3)%

--------- ---------- --------- ---------- --------- ---------- ---------

Asia 1,933 (0.1)% (1.6)% 0.1% (1.4)% (0.0)% (1.6)%

--------- ---------- --------- ---------- --------- ---------- ---------

Tesco Bank 361 (5.2)% n/a (18.8)% n/a (9.6)% n/a

--------- ---------- --------- ---------- --------- ---------- ---------

Group 21,029 (1.4)% (0.9)% (1.7)% (0.8)% (1.5)% (0.9)%

--------- ---------- --------- ---------- --------- ---------- ---------

All sales shown on exc. VAT, exc. fuel basis. Sales change shown

at constant rates, unless otherwise stated.

Sales change at actual rates for 19-week period: Group (1.1)%,

UK & ROI 0.1%, C. Europe (16.1)% and Asia 8.0%. Further detail

in Note 1.

Dave Lewis, Chief Executive:

"In a subdued UK market we performed well, delivering our fifth

consecutive Christmas of growth.

In our Centenary year, our customer proposition was compelling,

our product offering very competitive and thanks to the outstanding

contribution of our colleagues, our operational performance was the

best of the last six years. As a result, this Christmas we had the

biggest ever day of UK food sales in our history."

Trading update (3Q: 13 weeks to 23 November 2019; Christmas

Trading: 6 weeks to 4 January 2020)

Whilst the UK environment has clearly been challenging, the

combination of our attractive customer offer and strong operational

delivery enabled us to outperform the market once again, following

on from our strong performance last year. Customers benefited from

lower prices - with a typical basket of 21 festive products in the

weeks before Christmas being GBP2.28 cheaper year-on-year - and

strong, relevant promotions, including our first ever Christmas

Clubcard Prices offer.

Over the Christmas period we outperformed the market in both

volume and value terms(2) , with a strong performance in fresh

food. Further improvements in price and quality were complemented

by our 'Festive 5' vegetable offer and an enthusiastic customer

response to our significantly expanded range of plant-based foods.

Customer satisfaction with our shopping trip further improved and

we saw our highest level of availability in six years. Our online

grocery business delivered over 14 million orders across the 19

weeks, with an increase in both average basket size and customer

satisfaction scores for the Christmas period. Our headline sales

performance for the UK as a whole included a c.(0.4)% impact from

reduced general merchandise sales as we continue to refine the mix

of our offer.

The customer reaction to the launch of Clubcard Plus in November

has been very positive. For a GBP7.99 monthly subscription,

customers can benefit from 10% off 2 big shops in-store as well as

savings on popular Tesco brands and double data on Tesco Mobile.

Later this month, subscribers will also be able to apply for a

Clubcard Plus credit card from Tesco Bank with no foreign exchange

fees abroad(3) .

In ROI, our 'You Won't Pay More' campaign supported positive

sales growth. Our online grocery business also made a strong

contribution, with nearly 15% growth in orders.

Booker's continued focus on customer service was recognised as

we were named 'Best National Wholesaler' for overall customer

satisfaction(4) in November. Whilst the market was subdued, sales

grew strongly across the 19-week period, by 3.8% excluding tobacco

(3.4% including tobacco). The acquisition of the assets of Best

Food Logistics is proceeding as planned and we anticipate

completion in early March.

Our overall sales performance in Central Europe reflects the

ongoing significant transformation of our business, fundamentally

changing our approach in Poland and re-sizing, simplifying and

improving the relevance of our businesses in the Czech Republic,

Hungary and Slovakia. Whilst the changes in Poland have had the

most significant impact, our sales performance excluding Poland

across the 19-week period of (3.7)% also reflects an impact of

c.(3)% from the combination of closures, the right-sizing of large

stores and improvements to product mix. We have continued to

strengthen our offer for customers, including improved availability

and a more compelling seasonal product offer.

In Asia, total sales were level at constant rates, as we

continue to optimise the mix of our product ranges. Our focus on

sustainable, profitable ranges resulted in a (13)% reduction in

general merchandise sales year-on-year - an impact of c.(1.4)% on

overall sales performance. We saw strong growth in fresh food

(approaching +5%) supported by a highly competitive offer for

customers in our meat and seafood ranges. New formats, such as our

new Express propositions that have now rolled out to 117 stores and

our 'ultra-convenient' E-Pop stores, performed well.

On 8 December 2019 we confirmed that, following inbound

interest, we have commenced a review of the strategic options for

our businesses in Thailand and Malaysia, including an evaluation of

a possible sale of these businesses. No decisions concerning the

future of Tesco Thailand or Malaysia have been taken, and there can

be no assurance that any transaction will be concluded. A further

announcement will be made if and when appropriate.

On an underlying basis and taking account of the impact of our

decision to exit the mortgage market in September, Tesco Bank sales

grew by 0.1% in 3Q, 1.6% over Christmas and 0.5% in the 19-week

period(5) .

Contacts

Investor Relations: Chris Griffith 01707 912 900

Media: Christine Heffernan 01707 918 701

Robert Morgan, Teneo 0207 420 3143

A call for investors and analysts will be held today at

8.00am.

Dial in number: 0800 358 9473 (toll free) / +44 (0) 333 300 0804

Access Code: 67589067#

A recording will be available on +44 (0) 333 300 0819 and access

code 301307723# until 8 February 2020.

We will report our full year results on Wednesday 8 April

2020.

Notes

1. Sales change at actual rates:

3Q Christmas 19 week period

period

UK & ROI 0.2% 0.0% 0.1%

-------- --------- --------------

Central

Europe (15.8)% (16.6)% (16.1)%

-------- --------- --------------

Asia 9.7% 5.1% 8.0%

-------- --------- --------------

Group (0.8)% (1.8)% (1.1)%

-------- --------- --------------

2. Sales outperformance relates to 5-weeks ending 28 December

2019 and is sourced from IRI Retail Advantage(TM) , global insight

providers to the retail industry. Aldi and Lidl do not submit data

to IRI and are therefore excluded from their market definition.

3. Subject to status.

4. HIM annual Wholesale Tracking Programme, which consists of

over 2,000 face-to-face interviews with retailers and foodservice

operators at cash and carry depots, and over 2,400 telephone

interviews conducted with delivered wholesale users.

5. Tesco Bank's reported sales change of (9.6)% for the 19-week

period includes an impact of c.(6)% from our decision to stop

selling mortgages. Performance for the six-week Christmas period

also includes the effect of annualising the one-off benefit of

+15.7% in the prior year relating to upfront recognition of

insurance renewals as required by IFRS 15, following a contract

renewal with our pet insurance provider. The underlying performance

quoted above of 0.1% for 3Q, 1.6% for the Christmas period and 0.5%

for the 19-week period excludes both these effects.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

QRTEANFPEAEEEFA

(END) Dow Jones Newswires

January 09, 2020 02:00 ET (07:00 GMT)

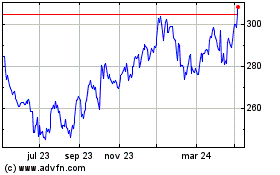

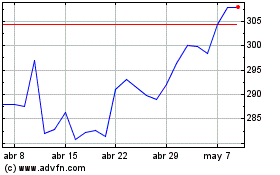

Tesco (LSE:TSCO)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Tesco (LSE:TSCO)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024