TIDMTHS

RNS Number : 3813Z

Tharisa PLC

10 January 2020

Tharisa plc

(Incorporated in the Republic of Cyprus with limited

liability)

(Registration number HE223412)

JSE share code: THA

LSE share code: THS

A2X share code: THA

ISIN: CY0103562118

LEI: 213800WW4YWMVVZIJM90

('Tharisa' or the 'Company')

First quarter production report for the quarter ended 31

December 2019

Stable production sets a steady foundation despite external

disruptions

Salient features for the quarter ended 31 December 2019

-- Reef tonnes mined 1 143.0 kt and tonnes milled 1 247.1 kt

-- Platinum Group Metals ('PGMs') recovery at 82.2% with production of 34.4 koz on a 6E basis

-- Chrome recovery at 63.1% with concentrate production of 342.5 kt

-- Record PGM metal basket price for the quarter at US$1 406/oz,

and increase of 16.1% over the quarter

-- Average chrome price received for the quarter was US$145/t

-- Stripping ratio of 10.9 m(3) :m(3)

-- Unprecedented inclement weather and electricity load shedding by Eskom impacted production

Commenting on the production results, Tharisa CEO Phoevos

Pouroulis, said:

"A solid operational performance from mining and processing lead

to a stable quarter despite the adverse impact of weather, and the

well-publicised Eskom power shortages. Whilst Tharisa benefits from

our overall low usage and stand-by capacity, the unprecedented

moves to "Stage 6" load-shedding and consequent power reductions,

did provide disruption to the processing plants' stability.

Overall, plant performance was commendable. Mining, accounting for

the weather-related impact, was in line with expectations and we

should see a build up towards the latter half of the year. Our

co-product model remains robust as record PGM prices were received.

However, we remain concerned about the prevailing low chrome and

ferrochrome prices, which has had a negative effect on the chrome

industry. Our progress in Zimbabwe is continuing as planned."

Safety

Safety is a core value and Tharisa continues to strive for zero

harm at its operations. A LTIFR of 0.21 per 200 000 man hours

worked was recorded at the end of the quarter.

Production update

The production update for the quarter ended 31 December 2019 is

as follows:

Quarter Quarter Quarter Quarter Year

ended ended on quarter ended ended

31 Dec 30 Sept movement 31 Dec 30 Sept

2019 2019 % 2018 2019

------------ -------- --------- ------------ --------

Reef mined kt 1 143.0 1 248.2 (8.4) 1 090.6 4 627.1

m(3)

Stripping ratio : m(3) 10.9 10.3 5.8 6.7 8.3

Reef milled kt 1 247.1 1 291.2 (3.4) 1 192.5 4 836.0

PGM flotation feed kt 921.0 965.2 (4.6) 901.3 3 605.9

PGM rougher feed

grade g/t 1.41 1.44 (2.1) 1.59 1.47

PGM recovery % 82.2 84.7 (3.0) 76.5 82.1

6E PGMs produced koz 34.4 38.0 (9.5) 33.6 139.7

Average PGM contained

metal basket price US$/oz 1 406 1 211 16.1 983 1 081

Average PGM contained

metal basket price ZAR/oz 20 745 17 792 16.6 14 050 15 531

Cr(2) O(3) ROM grade % 18.3 18.3 - 18.5 18.1

Chrome recovery % 63.1 61.0 3.4 58.9 62.0

Chrome yield % 27.5 26.5 3.8 25.6 26.7

Chrome concentrates

produced (excluding

third party) kt 342.5 341.9 0.2 305.4 1 290.0

Metallurgical grade kt 261.0 252.4 3.4 233.4 977.9

Specialty grades kt 81.5 89.5 (8.9) 72.0 312.1

Third party chrome

production kt 62.3 69.4 (10.2) 52.2 241.1

Metallurgical grade

chrome concentrate US$/t

contract price CIF China 145 148 (2.0) 164 162

Metallurgical grade

chrome concentrate ZAR/t

contract price CIF China 2 120 2 203 (3.8) 2 311 2 322

Average exchange

rate ZAR:US$ 14.7 14.7 - 14.3 14.4

----------------------- ------------ -------- --------- ------------ -------- ---------

Mining

Reef tonnes mined totalled 1 143.0 kt, which when compared to

the previous comparable quarter in December 2018 was up 4.8% but

lower than the previous quarter ended September 2019, as inclement

weather impacted the open pit operation, resulting in a ROM

'opportunity loss ' of over 230 kt. Rainfall during December was

137% higher than the previously recorded highest rainfall in the

five prior years.

The lower reef tonnage had a direct impact on reef milled but

was up when compared to December 2018 at 1 247.1 kt.

The stripping ratio improved against all measurements at 10.9

m(3) :m(3) .

Processing

Stand by power generating capacity mitigated the impact of Eskom

loadshedding on the processing plants although the increase to

"Stage 6" and the resultant electricity curtailment did result in

an overall reduction in tonnes milled of 11.2 kt which had a

further impact on overall chrome production.

PGM production was 34.4 koz (6E basis) from a rougher feed grade

of 1.41 g/t and recoveries at 82.2%.

Chrome concentrate production was 342.5 kt, comprising 261.0 kt

of metallurgical grade and 81.5 kt of specialty grade. Third party

chrome production was 62.3 kt, as the K3 plant was closed during

December.

Market update

Our co-product business model has benefitted from record PGM

prices, with the average PGM contained metal basket price for the

quarter at US$1 406/oz (ZAR20 745/oz), with palladium and rhodium

continuing to be the main driver of the increased basket price.

The average chrome price received for the quarter was US$145/t

with current spot trading at US$133/t, levels the Company believes

are unsustainable in the long-term, but expectations are for chrome

concentrate prices to remain at these levels during the current

quarter, with some potential for improvement into the third

quarter.

Outlook

Tharisa's FY2020 production guidance remains at 155 koz to 165

koz PGMs (6E basis) and 1.45 Mt to 1.55 Mt of chrome

concentrates.

The co-product model remains robust and we continue to enjoy the

benefits of record PGM basket prices as we ramp up production in

both PGM and chrome concentrates.

The above information has not been reported on or reviewed by

Tharisa's auditors.

Paphos, Cyprus

10 January 2020

JSE Sponsor

Investec Bank Limited

Investor relations contacts:

Ilja Graulich (Head of Investor Relations and

Communications)

+27 11 996 3500

+27 83 604 0820

igraulich@tharisa.com

Financial PR contacts:

Bobby Morse / James Husband

+44 020 7466 5000

tharisa@buchanan.uk.com

Broker contacts:

Peel Hunt LLP (UK Joint Broker)

Ross Allister / David McKeown

+44 207 7418 8900

BMO Capital Markets Limited (UK Joint Broker)

Thomas Rider / Neil Elliot / Michael Rechsteiner

+44 020 7236 1010

Berenberg (UK Joint Broker)

Matthew Armitt / Detlir Elezi

+44 20 3207 7800

Nedbank Limited (acting through its Corporate and Investment

Banking division) (RSA Broker)

Shabbir Norath

+27 11 295 6575

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

DRLURRVRRWUAARR

(END) Dow Jones Newswires

January 10, 2020 02:00 ET (07:00 GMT)

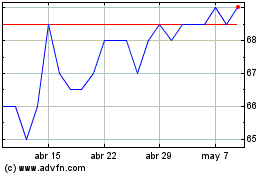

Tharisa (LSE:THS)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Tharisa (LSE:THS)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024