BlackRock Shakes Up Sustainable Investing Business Following Criticism

14 Enero 2020 - 5:51AM

Noticias Dow Jones

By Julie Steinberg

Investment giant BlackRock Inc. announced a series of moves

Tuesday to address risks related to climate change, following

criticism from investors and advocacy groups for investing in

fossil fuels and allegedly being slow to act on green issues.

The world's largest money manager, with around $7 trillion in

assets under management, will expand its range of sustainable

investment products and disclose more details of its climate-change

conversations with the companies in which it invests.

The firm said it would assess environmental, social and

governance, or ESG, factors with the same rigor as liquidity and

credit risk. It said it was exiting investments in companies that

generate more than 25% of their revenues from thermal coal

production, and doubling its ESG exchange-traded funds to 150.

"Climate change has become a defining factor in companies'

long-term prospects," BlackRock Chief Executive Laurence Fink said

in this year's annual letter to the CEOs of companies in which the

firm invests.

The moves follow BlackRock's announcement last week that it had

joined Climate Action 100+, the world's largest group of investors

by assets pressuring companies to act on climate change.

Write to Julie Steinberg at julie.steinberg@wsj.com

(END) Dow Jones Newswires

January 14, 2020 06:36 ET (11:36 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

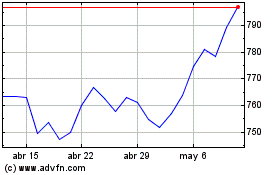

BlackRock (NYSE:BLK)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

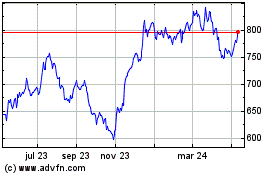

BlackRock (NYSE:BLK)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024