JPMorgan Chase Reports Profit Rose 21%

14 Enero 2020 - 6:30AM

Noticias Dow Jones

By David Benoit

JPMorgan Chase & Co. said Tuesday that fourth-quarter profit

jumped 21%.

The nation's largest bank reported a profit of $8.52 billion, or

$2.57 a share. Analysts polled by FactSet had expected earnings of

$2.35 a share. A year earlier, the bank reported a profit of $7.07

billion, or $1.98 per share.

Revenue rose 9% to $28.33 billion from $26.11 billion a year

ago, topping analysts' expectations for $27.87 billion.

Banks are struggling with how to deal with continually low

rates. The Federal Reserve cut its benchmark rate again in October,

its third cut last year, and JPMorgan's lending margins fell. Lower

rates tend to reduce what banks can charge for loans, though they

can also fuel demand for loans and lower a bank's deposit

costs.

JPMorgan shares soared throughout 2019 to all-time highs, up

more than 40% for the year. Despite the increased cost, the bank

continued buying back stock in 2019, helping lift its per-share

earnings.

Shares rose about 1% to $138.70 in premarket trading

Tuesday.

-- To receive our Markets newsletter every morning in your

inbox, click here.

Write to David Benoit at david.benoit@wsj.com

(END) Dow Jones Newswires

January 14, 2020 07:15 ET (12:15 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

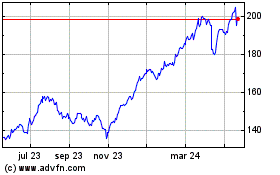

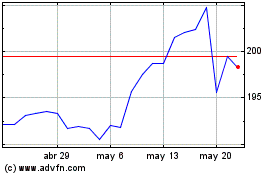

JP Morgan Chase (NYSE:JPM)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

JP Morgan Chase (NYSE:JPM)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024