MGM Resorts Nears Deal to Sell MGM Grand, Mandalay Bay to Joint Venture --Update

14 Enero 2020 - 7:36AM

Noticias Dow Jones

By Katherine Sayre, Miriam Gottfried and Cara Lombardo

MGM Resorts International is nearing an agreement to sell the

MGM Grand and Mandalay Bay resorts and casinos on the Las Vegas

Strip to a joint venture that includes private-equity and

real-estate giant Blackstone Group Inc., according to people

familiar with the matter.

Blackstone would own slightly less than half of the properties

through its private real-estate investment trust, while MGM Growth

Properties LLC, a public REIT, would own the remainder, the people

said. The total purchase price couldn't be learned, but the deal

values MGM Grand, the company's largest property by square footage

as of its most recent annual financial filing, at roughly $2.5

billion, the people said.

The deal is expected to be similar to MGM Resorts' sale of its

flagship Bellagio casino in Las Vegas to Blackstone last year.

In October, Blackstone said its private real-estate investment

trust, known as BREIT, would take control of the Bellagio through a

$4.25 billion joint venture with MGM. MGM, which retained a 5%

stake in the venture, continues to operate the casino and is

renting the property from the venture for $245 million a year.

MGM Chief Executive Jim Murren said on a conference call in

October that the company planned to also sell the MGM Grand, using

the Bellagio transaction as a blueprint for future real-estate

deals.

The MGM Grand Las Vegas includes a hotel and resort as well as

three condominium towers.

MGM sold another Las Vegas Strip casino, Circus Circus, to Phil

Ruffin, who also owns the Treasure Island casino, for $825 million

last year.

The MGM Grand sale would be another step in MGM's "asset light"

strategy intended to pull cash out of its real estate and focus on

new business areas including sports betting, entertainment and a

casino development in Japan. The company, which has a market value

of about $17 billion, began evaluating real-estate deals to help

pay off debt after its board of directors formed a real-estate

committee in January 2019.

Write to Katherine Sayre at katherine.sayre@wsj.com, Miriam

Gottfried at Miriam.Gottfried@wsj.com and Cara Lombardo at

cara.lombardo@wsj.com

(END) Dow Jones Newswires

January 14, 2020 08:21 ET (13:21 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

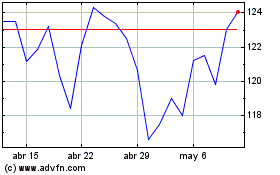

Blackstone (NYSE:BX)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Blackstone (NYSE:BX)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024