Woodbois Limited 2020 cash flow enhancement and additional funds (9516Z)

16 Enero 2020 - 1:00AM

UK Regulatory

TIDMWBI

RNS Number : 9516Z

Woodbois Limited

16 January 2020

16 January 2020

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF THE MARKET ABUSE REGULATION (EU) 596/2014.

Woodbois Limited

("Woodbois", the "Group" or the "Company")

(AIM: WBI)

2020 cash flow enhancement and additional funds to assist

trading growth

Woodbois, the African focused forestry and timber trading

company, is pleased to provide an update regarding certain cash

enhancement measures for 2020, set out below, that have been agreed

upon with various stakeholders in order to accelerate the Company's

growth as it moves toward a cashflow positive position during

2020.

Paul Dolan (CEO) commented, "Following our statement of record

quarterly and annual revenues for 2019 on 7 January, I am now

pleased to be able to detail important cash-management measures

which will allow the Company to enter the new decade in a stronger

position as we move towards generating sustainable positive

cash-flow. The deferral by a year of the 2020 acquisition purchase

payments by our senior management team is an important statement of

support for, and confidence in, the fundamental strength of our

business. I am grateful to the team, and also to our largest

stakeholders for demonstrating their commitment to strengthening

the Company's working capital position. This will assist our

ability to continue to pursue growth opportunities and maintain our

proven trajectory of rapid growth."

Deferred Consideration re Acquisition of Woodbois in 2017

On 24 May 2017 the Company (previously known as Obtala Limited)

announced the acquisition of Woodbois International ApS (and

subsequently changed the Company name to Woodbois Limited). The

terms of the acquisition provided for deferred cash consideration

of US$5.0m, payable in equal quarterly payments over 5 years,

commencing 30 September 2017. The Company has agreed with the

vendors, Zahid Abbas, Jacob Hansen and Hadi Ghossein or companies

wholly owned and controlled by them, each a Director of the

Company, to defer payments totalling $1.25m by a year, being the

quarterly payments for the period from 1 January 2020 to 31

December 2020, following which quarterly payments will resume on 31

March 2021.

Internal Trading Fund ("ITF")

1798 Volantis Fund Limited ("Volantis"), a fund managed on a

discretionary basis by Lombard Odier Asset Management group

("Lombard"), will provide an additional US$1.0m through investment

into the Group's ITF ("Additional Loan") by way of an additional

loan agreement with Woodbois Trading Limited, a wholly owned

subsidiary of the Group. The Additional Loan funds may also be

utilised for general working capital purposes.

The Additional Loan is on similar terms as the US$5.0m already

invested in the ITF by Volantis, announced on 10 January 2019, with

an interest coupon of 11.5% per annum to be paid semi-annually. The

Additional Loan may be recalled by Volantis at any time and is

repayable on 20 January 2021.

Furthermore, Africa Resource Investment Limited ("ARI") has

agreed that, in respect of its existing $5.0m ITF loan, it will not

request any withdrawal prior to 31 December 2020.

In addition, each of Volantis and Paul Dolan, Chief Executive,

have indicated their intention to receive Woodbois ordinary shares

("Shares") in lieu of interest (at 11.5% pa) for the period from 1

July 2019 to 31 December 2020 in respect of their ITF loans. A

further announcement will be made in this regard.

Convertible Bond interest

In connection with the Company's 4% convertible bonds 2024

("Bonds"), issued on 21 October 2019, Pelham Limited (a company

controlled by Miles Pelham) and Paul Dolan have agreed to roll up

interest payments due for the period from issue until 31 December

2020 on an aggregate $20.4m of Bonds. These agreements (the "Bond

Interest Agreements") are for $20.0m of Bonds held by Miles Pelham

and $0.40m of Bonds held by Paul Dolan. In the event such Bonds

remain unconverted as at 31 December 2020, the rolled-up interest

would result in the issue of approximately $0.98m additional Bonds

at that time.

As detailed in the Company's announcement of 20 September 2019,

the Bondholders are deemed to be a concert party for the purposes

of the Takeover Code. In order to avoid an inadvertent breach of

Rule 9 of the Takeover Code, Pelham Limited has undertaken to the

Company that its aggregate interest (as defined in the Takeover

Code) in Shares, when aggregated with all Shares which have been

issued to (and are still held by) any other Bondholders; and all

other Shares in which the other Bondholders are interested (as

defined in the Takeover Code) and in respect of which the Company

is aware (having made all reasonable enquiries), will not at any

time exceed 28.0% of the enlarged issued Share capital of the

Company. This undertaking remains in force.

Related Party Transactions

Volantis is a substantial shareholder of the Company.

Accordingly, the Additional Loan is classified as a related party

transaction under the AIM Rules for Companies. The independent

directors (being all the directors other than Henry Turcan, who is

an employee of Lombard and so is precluded from taking part in

deliberations), having consulted with Arden Partners, nominated

adviser, consider that the terms of the Additional Loan are fair

and reasonable insofar as shareholders are concerned.

Miles Pelham is a substantial shareholder of the Company and

Paul Dolan is CEO and a director of the Company. Accordingly, the

Bond Interest Agreements are deemed to be related party

transactions for the purposes of the AIM Rules for Companies. The

independent directors (being all the directors other than Paul

Dolan), having consulted with Arden Partners as its nominated

adviser, consider the terms of those transactions are fair and

reasonable insofar as shareholders are concerned.

Enquiries:

Woodbois Limited

Paul Dolan - CEO

www.woodbois.com

+44 (0)20 7099 1940

Arden Partners Plc (Nominated adviser and broker)

Richard Johnson

+44 (0)20 7614 5900

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

UPDFLFITLDIELII

(END) Dow Jones Newswires

January 16, 2020 02:00 ET (07:00 GMT)

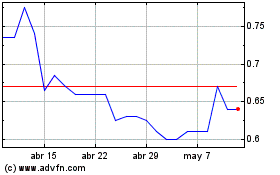

Woodbois (LSE:WBI)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Woodbois (LSE:WBI)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024