TIDMNTBR

RNS Number : 9542Z

Northern Bear Plc

16 January 2020

16 January 2020

Northern Bear PLC

("Northern Bear" or the "Company")

Acquisition of J Lister

Northern Bear, the AIM listed group of companies (together, the

"Group") providing specialist building and support services to

customers in Northern England and across the UK, is delighted to

announce the acquisition of Lister Holdings (York) Limited and its

wholly owned subsidiary J Lister Electrical Limited (together "J

Lister") (the "Acquisition").

Key highlights

-- J Lister is an electrical contracting business based in York, established in 1973.

-- J Lister has an established customer base and offers

significant growth potential, via both organic expansion of the

existing business and cross selling with other Northern Bear Group

companies.

-- For the year ended 31 March 2019, J Lister achieved revenue

of GBP2.5m and profit before tax of GBP0.28m.

-- The Acquisition is expected to be earnings enhancing for Northern Bear.

-- Initial and deferred consideration of GBP0.95m, including the

issue of GBP0.1m in ordinary shares in Northern Bear, with a

further earn-out payment of up to GBP0.3m in cash, dependent on

profits in excess of historical levels (see below).

-- J Lister will be part of Northern Bear's Specialist Building Services reporting segment.

Steve Roberts, Executive Chairman of Northern Bear,

commented:

"I am delighted to announce the acquisition of J Lister. We have

looked at a large number of opportunities since our last

acquisition, being that of H Peel & Sons (Holdings) Limited and

its subsidiary, in July 2017. We have now acquired a

well-established, consistently profitable and cash generative

business with a strong management team committed to remaining with

the business. In addition, J Lister has a number of opportunities

for expansion and to cross-sell with our existing Group companies.

I would like to welcome all of the J Lister employees to our Group

and we look forward to working with them."

For further information please contact:

+44 (0) 166

Northern Bear plc 182 0369

Steve Roberts - Executive Chairman +44 (0) 166

Tom Hayes - Finance Director 182 0369

Strand Hanson Limited (Nominated Adviser

and Broker)

James Harris +44 (0) 20 7409

James Bellman 3494

Further information on the Acquisition

Further information on J Lister

J Lister was established in 1973, is based in the City of York

and operates across the North of England. It has a strong

reputation in the Yorkshire market, based on operating in both the

commercial and domestic sectors, with several long standing,

blue-chip customers providing a high volume of recurring orders.

Key services provided include electrical repairs, installation,

maintenance and testing, fire alarms, emergency lighting, and door

access systems.

J Lister demonstrates a consistent track record of profitability

and cash generation, including during the last major recession. The

business has grown in recent years through an expanded service

offering, including CAD and technical drawings, design and

consultancy, and project management, as well as working on larger

projects.

J Lister has a very strong order book, including a major new

contract recently secured and commenced which should underpin short

term profitability. There are future growth opportunities for J

Lister via larger contracts for the existing customer base, new

customer opportunities and geographic expansion. We also expect a

number of cross-selling opportunities for J Lister via the Group's

existing customer base.

Consideration for the Acquisition

The purchase consideration (the "Consideration"), payable to the

shareholders of Lister Holdings (York) Limited ("Sellers"), is as

follows:

-- Cash consideration of GBP0.75m payable on completion;

-- Deferred cash consideration of GBP0.1m, due in two annual

instalments on the first and second anniversaries of the completion

date (15 January 2020) ("Completion");

-- 136,054 ordinary shares of 1p each in Northern Bear (the

"Consideration Shares") due on Completion, valued at approximately

GBP0.1m, based on the average closing mid-market price of the

Company's ordinary shares for the five working days ended on 15

January 2020, being 73.5p; and

-- Up to GBP0.3m payable in cash under an earn-out over a

three-year period. This amount would only be payable if the

business generates profits over that period in excess of historical

levels (see below).

The maximum aggregate amount of the Consideration will be

GBP1.25m, should all future earn out targets be met in full. To

achieve the full earn-out of GBP0.3m, cumulative profit before tax

for the three years to 30 September 2022 must exceed GBP1.422m.

The Consideration Shares are subject to a lock in and orderly

market arrangement pursuant to which the sellers have undertaken

that, subject to certain limited exceptions, they will not dispose

of any interest in the Consideration Shares for a period of 12

months from the date of admission to trading on AIM of the

Consideration Shares and, for the 12 months following that initial

period, that they will only dispose of their holdings with the

consent of the Company and Strand Hanson, the Company's Nominated

Adviser and Broker.

The acquisition is expected to be earnings enhancing for

Northern Bear in the financial year to 31 March 2020, and it is

anticipated that all future earn-out and deferred consideration

payments will be met through cash generated by J Lister. The

initial cash element of the Consideration due on completion will be

met from the Group's existing bank facilities.

Consideration Shares

The Company has agreed to issue the Consideration Shares, which

will rank pari passu with the Company's existing ordinary shares,

to the Sellers, conditional upon their admission to trading on AIM

("Admission"). Application will be made for Admission and it is

expected that Admission will become effective and trading will

commence at 8.00 a.m. on 24 January 2020.

Following Admission, the Company's total issued share capital

will consist of 18,655,276 ordinary shares of 1p each with voting

rights, plus a further 362,040 non-voting ordinary shares which the

Company holds in treasury.

On Admission, the abovementioned figure of 18,655,276 may be

used by shareholders as the denominator for the calculations by

which they will determine if they are required to notify their

interest in, or a change to their interest in, the share capital of

the Company under the Financial Conduct Authority's Disclosure and

Transparency Rules.

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

ACQUVVWRRSUAAAR

(END) Dow Jones Newswires

January 16, 2020 02:00 ET (07:00 GMT)

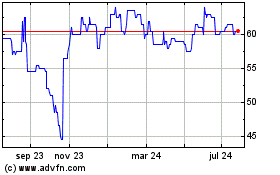

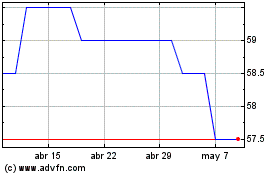

Northern Bear (LSE:NTBR)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Northern Bear (LSE:NTBR)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024