TIDMFEVR

RNS Number : 2405A

Fevertree Drinks PLC

20 January 2020

20 January 2020

Fevertree Drinks plc

("Fever-Tree" or the "Group")

Year End Trading Update

Fever-Tree, the world's leading supplier of premium carbonated

mixers, announces its trading update for the year ended 31(st)

December 2019, ahead of reporting its Preliminary Results on 24(th)

March 2020.

Revenue Revenue % change

FY2019 FY2018

GBPm GBPm

United Kingdom 132.6 134.1 -1%

United States of America 47.6 35.8 +33%

Europe 64.4 55.5 +16%

Rest of the World 15.8 12.0 +32%

260.5 237.4 +9.7%

======== ======== =========

Group revenue is expected to be GBP260.5 million representing

growth of c.10%, reflecting the significant progress made during

2019 across many of our regions. However, this performance is below

the Board's expectations, primarily reflecting subdued Christmas

trading in the UK.

Our key growth markets delivered a strong performance with sales

accelerating in the second half in the US and Europe as well as a

notable end to the year in Australia and Canada. As we enter 2020,

the Group is seeing this good momentum continue across multiple

regions. While the UK has performed below expectations, it has been

a year when we have lapped exceptional comparators and despite that

we have retained our clear category leadership position and are

very well placed to return to growth as we proceed through

2020.

UK

As reported, the wider retail environment in the UK experienced

a challenging Christmas with the mixer category not immune from the

weak consumer confidence and corresponding slowdown in spending.

Whilst Fever-Tree remained the clear market leader, the expected

improvement in trading during this important period did not

materialise with the macroeconomic uncertainty leading to a subdued

end to the year across both the On and Off-Trade.

Whilst we expect conditions for the category to remain

challenging in the first half of 2020 reflecting the current level

of consumer confidence, our brand strength, operational

improvements, distribution opportunities, and our innovation

pipeline, alongside softer comparatives in the second half,

provides us with confidence in returning to growth during the

year.

US

The US delivered a particularly encouraging performance in 2019.

We saw significant progress in widening and deepening our

distribution footprint and the Group continued to drive category

growth. We have established a very strong platform over the last 18

months which provides us with increasing confidence in the

opportunity ahead.

Given this progress, we will be investing further in the brand

over the course of 2020. The Group has already conducted a number

of successful trials with key customers, providing both parties

with compelling evidence of our ability to unlock the wider

potential of this very significant market over the medium and

longer term. However, implementing these initiatives is expected to

result in a one-off impact on net revenue growth in 2020 and as a

result, we are revising our growth forecasts for the US business to

low double digit for the year ahead before returning to previously

expected growth rates thereafter.

We are confident that this investment will drive significant

long-term volume and profit growth in what is expected, over time,

to become a very significant region. We look forward to providing

further details of these initiatives at the Full Year Results in

March.

Europe

While the end to the year was slightly behind expectations,

sales in Europe accelerated in the second half with a good

performance across our key territories. The premiumisation trend is

gaining momentum in many countries across the region and Fever-Tree

is outperforming its premium competitors and driving the growth of

the category.

Europe remains a key region for the Group with multiple growth

drivers. There remain opportunities to drive further distribution

through current customers as well as gaining new accounts in both

the On and Off-Trade and expectations for the year ahead remain

unchanged.

ROW

The progress and momentum in territories such as Australia and

Canada continues to be exciting, with our outperformance against

the mainstream incumbent in both markets especially notable. We are

continuing to explore opportunities to invest for further growth in

these markets and expectations for the year ahead remain

unchanged.

Financials

Despite the softer trading than expected in the final months of

the year, we have continued to invest behind the brand for the

longer term, most notably in our growth regions. As a result,

margins have ended the year behind our expectations and we expect

earnings to decline by c.5% when compared to 2018.

As outlined above we plan to continue to invest in our growth

regions in the year ahead and resulting in gross and EBITDA margins

adjusting to c.49% and c.28% for 2020 respectively.

The Group's balance sheet remains strong with the year-end cash

position anticipated to be GBP128m.

Conference Call

A conference call for analysts and investors will be held at

8.00am today.

Participants wishing to dial into the conference call can do so

using the following details:

International Dial

In number: +44 (0) 2071 928000

Confirmation code: 9879766

A 7 day replay facility will be available afterwards on:

International Dial

In number: +44 (0) 3333009785

Replay Conference: ID: 9879766

Tim Warrillow, CEO, commented:

"Despite the subdued end to the year in the UK, we have

delivered a strong performance across many of our regions in 2019

and begin 2020 with real momentum in a number of key growth

markets. Whilst the UK mixer category has clearly not been immune

from the consumer belt tightening seen in recent months, we remain

the clear category leader and have a strong platform to return to

growth during 2020 and beyond.

However this is a global opportunity which remains in its

relative infancy in many markets. The trend towards premium spirits

and premium long mixed drinks continues to gather momentum around

the world. Fever-Tree is the no1 premium mixer globally and our

performance in 2019 across US, Europe and as far afield as

Australia and Canada highlights the fast-growing international

strength of the business.

Our decision to increase our investment in these regions and in

particular in the US reflects our belief and excitement in the

long-term opportunity ahead for the Group."

This announcement contains inside information for the purposes

of article 7 of the Market Abuse Regulation EU No. 596/2014.

For further information:

Fevertree Drinks plc +44 (0)20 7349 4922

Tim Warrillow, Co-founder and CEO

Andy Branchflower, Finance Director

Oliver Winters, Communications & IR Director

Numis Securities - Nominated Adviser and Joint Broker +44 (0)20 7260 1000

Garry Levin

Matt Lewis

Hugo Rubinstein

Investec Bank plc - Joint Broker +44 (0)20 7597 5970

David Flin

Alex Wright

David Anderson

Brunswick Group +44 (0) 20 7404 5959

Jonathan Glass

Fiona Micallef-Eynaud

Notes to Editors:

Fever-Tree is the world's leading supplier of premium carbonated

mixers for alcoholic spirits by retail sales value, with

distribution to over 75 countries worldwide. Based in the UK, the

brand was launched in 2005 to provide high quality mixers which

could cater to the growing demand for premium spirits, in

particular gin, but also increasingly for vodka, rum and whisky.

The Company now sells a range of carbonated mixers to hotels,

restaurants, bars and cafes ("On-Trade") as well as selected retail

outlets ("Off-Trade").

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTSFEESUESSEDF

(END) Dow Jones Newswires

January 20, 2020 02:00 ET (07:00 GMT)

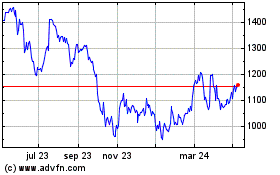

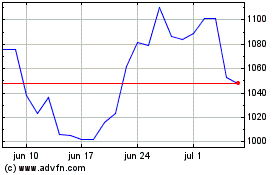

Fevertree Drinks (LSE:FEVR)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Fevertree Drinks (LSE:FEVR)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024