IBM Sales Expected to Dip Despite Red Hat Purchase: What to Watch

21 Enero 2020 - 4:59AM

Noticias Dow Jones

By Asa Fitch

International Business Machines Corp. is expected to report

fourth-quarter earnings after the market closes Tuesday. The

technology giant may be heading for its sixth successive quarter of

year-over-year revenue decline -- but has been trying to reverse

that slide, in part, through the $33 billion purchase of open

source software giant Red Hat Inc.

Here's what to look for in the results:

EARNINGS FORECAST: IBM is expected to report adjusted earnings

per share of $4.69 for the quarter ended Dec. 31, down from $4.87

for the same period last year, according to analysts surveyed by

FactSet. Adjusted net income should be around $4.19 billion, down

from $4.42 billion in the year-prior quarter, the analysts

expect.

REVENUE FORECAST: IBM is set to report $21.64 billion in sales,

the analyst survey shows, down about half a percent from the

year-prior.

WHAT TO WATCH:

RED HAT IMPACT: IBM's earnings growth largely hinges on the

success of the addition of Red Hat, the Raleigh, N.C.-based company

that sells support and training for open-source software. The deal

closed in July, but the full impact of the acquisition hasn't yet

shown up in IBM's results, partly because of deal-related financial

adjustments. Investors will be looking for signs of whether the

combination is working or not.

IT SPENDING: Corporate IT spending slowed last year after a U.S.

tax cut drove investments the year prior. That could hit IBM's

fourth-quarter results and weigh on the outlook for the current

year. IBM may also be losing market share in its core business,

Morgan Stanley said last week, as it downgraded the stock. "While

acceleration in Red Hat remains a bright spot, weakening trends at

core IBM make sustainable revenue growth less likely," the analysts

said.

MAINFRAME SALES: The fourth quarter was the first full

three-month period in which IBM's latest generation of mainframe

computers were on sale. New mainframes -- large, powerful computers

that companies use to process and store data -- have traditionally

meant a reliable revenue boost for IBM, as customers rush to

upgrade hardware. The last spell of revenue growth for the company,

in 2017 and 2018, was attributable in part to strong sales of the

previous generation of mainframes. Investors are hoping the old

playbook yields the same result.

Write to Asa Fitch at asa.fitch@wsj.com

(END) Dow Jones Newswires

January 21, 2020 05:44 ET (10:44 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

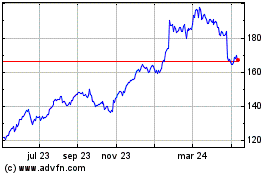

International Business M... (NYSE:IBM)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

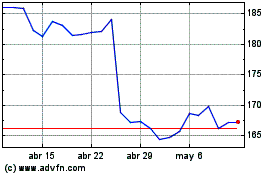

International Business M... (NYSE:IBM)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024