BlackRock Energy and Resources Income Trust Plc - Portfolio Update

22 Enero 2020 - 4:05AM

PR Newswire (US)

| BLACKROCK ENERGY AND

RESOURCES INCOME TRUST plc (LEI:54930040ALEAVPMMDC31) |

|

| All information is at

31 December 2019 and unaudited. |

|

|

|

|

| Performance at month

end with net income reinvested |

|

|

|

|

|

One |

Three |

Six |

One |

Three |

Five |

|

|

Month |

Months |

Months |

Year |

Years |

Years |

|

| Net asset value |

4.5% |

0.2% |

-4.0% |

12.4% |

6.2% |

20.8% |

|

| Share price |

8.5% |

0.3% |

-1.6% |

5.3% |

-5.4% |

8.9% |

|

|

|

|

|

|

|

|

|

| Sources: Datastream,

BlackRock |

|

|

|

|

| At month end |

|

|

|

|

|

| Net asset value –

capital only: |

77.31p |

|

| Net asset value cum

income*: |

77.71p |

|

| Share price: |

70.60p |

|

| Discount to NAV (cum

income): |

9.2% |

|

| Net yield: |

5.7% |

|

| Gearing - cum

income: |

8.5% |

|

| Total assets: |

£93.7m |

|

| Ordinary shares in

issue: |

113,870,349 |

|

| Gearing range (as a % of

net assets): |

0-20% |

|

| Ongoing charges**: |

1.5% |

|

|

|

|

* Includes

net revenue of 0.40p.

** Calculated as a percentage of average net assets and using

expenses, excluding any interest costs and excluding taxation for

the year ended 30 November 2019. |

|

|

|

|

| Sector

Analysis |

% Total

Assets^ |

|

Country

Analysis |

% Total

Assets^ |

|

|

|

|

|

| Integrated Oil |

31.0 |

|

Global |

65.9 |

| Diversified Mining |

23.5 |

|

USA |

12.7 |

| Gold |

16.3 |

|

Canada |

11.2 |

| Copper |

10.0 |

|

Latin America |

4.6 |

| Exploration &

Production |

5.9 |

|

Australia |

3.6 |

| Industrial Minerals |

5.1 |

|

Asia |

2.3 |

| Silver |

3.5 |

|

South Africa |

1.8 |

|

Distribution |

3.1 |

|

Africa |

0.4 |

| Diamonds |

2.1 |

|

Net Current

Liabilities^ |

-2.5 |

| Electricity |

2.0 |

|

|

----- |

| Net Current

Liabilities^ |

-2.5 |

|

|

100.0 |

|

-----

100.0

===== |

|

|

===== |

| ^ Total

Liabilities for the purposes of these calculations exclude bank

overdrafts, and the Net Current Liabilities figure shown in

the tables above therefore exclude bank overdrafts equivalent to

5.9% of the Company’s net asset value. |

|

|

|

|

|

| Ten Largest

Investments |

|

|

|

|

|

|

|

|

|

| Company |

|

|

|

|

|

Region

of Risk |

% Total

Assets |

|

|

|

|

|

| BHP |

Global |

8.5 |

|

| First Quantum

Minerals* |

Global |

7.4 |

|

| Royal Dutch Shell

‘B’ |

Global |

6.2 |

|

| Barrick Gold |

Global |

5.7 |

|

| BP Group |

Global |

5.0 |

|

| Exxon Mobil |

Global |

4.0 |

|

| Rio Tinto |

Global |

3.9 |

|

| Total |

Global |

3.7 |

|

| ConocoPhillips |

USA |

3.6 |

|

| Chevron |

Global |

3.5 |

|

|

|

|

|

| Commenting on the

markets, Olivia Markham and Tom Holl, representing the Investment

Manager noted: |

|

|

|

The

Company’s NAV increased by 4.5% during the month of December (in

Sterling terms).

Global equity markets continued to rise in December with the MSCI

World Index returning 3.0%. Geopolitical risk moderated somewhat as

the US and China tentatively reached a phase one trade deal, which

continued to support equity markets into year end. In terms of

economic data, consumer confidence indicators and services

Purchasing Managers’ Index (PMI) data remained supportive, whilst

manufacturing PMI data in December was broadly weaker across the

major economic blocs.

It was a strong end to the year for the mining sector on the back

of the improved equity market sentiment as well as rising mined

commodity prices. Mined commodity prices were up almost across the

board, with copper, gold and iron ore prices up 5.2%, 4.0% and 4.5%

respectively (figures in US Dollars).

Within the energy sector, The Organisation of the Petroleum

Exporting Countries (OPEC+) agreed to remove 500,000 barrels per

day from the oil market in their December meeting, which is in

addition to the previously agreed reduction of 1.2 million barrels

per day announced in December 2018. Voluntary cuts in addition to

these by Saudi Arabia will also continue. Against this backdrop,

oil prices increased over the month, with the Brent and West Texas

Intermediate indices returning +5.1% and +10.7%, to end the period

at prices of $67/bbl and $61/bbl respectively. This positive return

reflected the improving macroeconomic sentiment, the OPEC+

commitment to constraining production combined with a lower oil rig

count suggesting US shale growth continues to decline. Natural Gas

and Natural Gas Liquids (NGL) prices also continued to weaken

during the month, due to an oversupplied market.

All data points in US Dollar terms unless otherwise specified.

Commodity price moves sourced from Thomson Reuters Datastream. |

|

|

|

Source:

BlackRock. Data as at 31 December 2019.

22 January 2020 |

|

|

|

| ENDS |

|

|

|

| Latest information is

available by typing www.blackrock.co.uk/brci on the internet,

"BLRKINDEX" on Reuters, "BLRK" on Bloomberg or "8800" on Topic 3

(ICV terminal). Neither the contents of the Manager’s website

nor the contents of any website accessible from hyperlinks on the

Manager’s website (or any other website) is incorporated into, or

forms part of, this announcement. |

|

*The holding in First Quantum Minerals includes both an equity

holding and a holding in several bonds. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Copyright y 21 PR Newswire

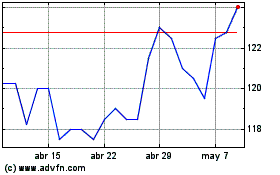

Blackrock Energy And Res... (LSE:BERI)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

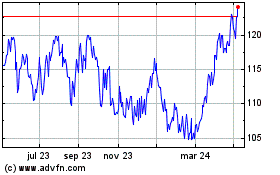

Blackrock Energy And Res... (LSE:BERI)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024