Company returns to profit growth after slump in core iPhone

business

By Tripp Mickle

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (January 29, 2020).

Apple Inc. has shaken free of last year's iPhone slump, posting

record revenue and a return to profit growth in the latest quarter

behind strong sales of its flagship smartphone as well as apps and

AirPods wireless earbuds.

The tech giant reported revenue rose 9% in the December quarter

to $91.82 billion, driven by blossoming sales of devices and

services connected to the iPhone such as smartwatches and

streaming-TV subscriptions. Sales of iPhones, which account for

more than half of its revenue, rose 8% to $55.96 billion.

Shares of Apple, which have more than doubled over the past

year, rose 1.5% in after-hours trading.

Apple executives said they expect the robust sales growth to

continue in the current quarter, though they acknowledged the

coronavirus outbreak had introduced some uncertainty in China, its

second most-important market and the country where most of its

products are manufactured.

Chief Executive Tim Cook said Apple is limiting travel to China

because of the health crisis and has reduced store operating hours

in the country. He said Apple has alternatives to its suppliers in

Wuhan, the region at the center of the outbreak. Factories outside

the region have pushed back plans to reopen after the Lunar New

Year to Feb. 10 from the end of January, he said.

Mr. Cook said the company's guidance for record fiscal

second-quarter revenue of $63 billion to $67 billion represents a

wider-than-normal range due to the uncertainty. Apple counts on

China for nearly a fifth of its sales and relies on its workforce

to assemble most of the iPhones, iPads and Macs it sells around the

world.

The results for its fiscal first quarter marked a return to form

for Apple, which last year failed to report a quarterly revenue

record for the first time since the iPhone's 2007 release. A year

ago, it slashed its guidance for the first time in more than 15

years. An iPhone sales slump and an economic downturn in China led

to the company's first decline in fiscal-year revenue since

2016.

Apple snapped out of a slowdown in its smartphone business by

introducing new services and accessories that would appeal to

owners of the 900 million iPhones world-wide. The addition of a

credit card and video-subscription service helped increase sales of

services 17% in the latest quarter, the company said. Meanwhile,

the introduction of the $250 AirPods Pro with noise cancellation

helped fuel a 37% surge in the company's wearables business, which

also includes smartwatches and iPods.

"Demand for AirPods continues to be phenomenal, particularly for

our new addition AirPods Pro," Mr. Cook said during a call with

analysts.

The growth in both those businesses has energized investors and

helped the company's stock record one of the biggest one-year

rallies in history. Apple's share price has more than doubled from

last year's low, adding more than $725 billion to its value, well

above the total value of Facebook Inc.

"This is continued evidence that services can transform the

company," said Mark Stoeckle, chief executive of Adams Funds, a

Baltimore-based investment firm with $2.5 billion under management

that counts Apple among its largest holdings. " Tim Cook has

brought out products that have not only added to revenue and

earnings but done so within an ecosystem where that cash cow -- the

iPhone business -- has been the beneficiary."

Net income for the latest period rose 11% to $22.24 billion,

marking Apple's first quarterly profit increase in more than a year

and a new company record. Per-share earnings for the quarter were

$4.99; analysts surveyed by FactSet had expected $4.54.

Additional cameras on the three phone models released in

September and a $50 price cut on the base model helped the iPhone

business return to growth. Still, iPhone sales were below the

company's December-quarter peak of $61.1 billion two years ago.

To give a jolt to its smartphone business, Apple plans to

release a low-price iPhone this year that is expected to be an

update to the $399 SE model it first released in 2016. It also is

expected to release its first 5G iPhones in the fall, offering a

new generation of wireless speed that has Wall Street analysts

forecasting a return to iPhone shipment growth in 2021.

Sales in Greater China, which includes Hong Kong and Taiwan,

rebounded in the December quarter, rising 3% after a yearlong

decline. Apple's sales in the region of apps, as well as

smartwatches and iPads, continue to grow, even as the iPhone

business is challenged by Chinese rivals and a broad slowdown in

smartphone sales.

Apple blunted the challenge to its iPhone business and gained

market share by reducing iPhone 11 prices, Canalys said. The firm

predicted unit sales will improve with the release of a 5G iPhone

in China.

"Tim Cook has made a huge bet on China, so Apple is more

vulnerable than most companies on the sale and supply-chain side,"

said Steve Milunovich, technology strategist at Wolfe Research. He

said that Apple could manage any loss in sales from people shopping

less over the Lunar New Year because of the viral outbreak but

would face a "worst-case scenario" if production was disrupted at

factories.

In the Americas, Apple's largest geographic segment, services

helped deliver a 12% increase in sales. The company launched its

credit card and Apple TV+ streaming service in the U.S. in the

second half of last year.

The company didn't provide subscription numbers for its Apple

TV+ video service. Launched in November with a price of $4.99 a

month, its marquee drama, "The Morning Show," starring Jennifer

Aniston, Reese Witherspoon and Steve Carell, was nominated for a

Golden Globe, but other planned releases such as a film and

documentary have been challenged by controversy over their subject

matter.

Mr. Cook said in a statement that the number of active Apple

devices world-wide rose to 1.5 billion from 1.4 billion a year ago.

The 7% increase represents a deceleration in growth from prior

years, but shows that Apple is continuing to increase its customer

base as it aims to sell more services.

Write to Tripp Mickle at Tripp.Mickle@wsj.com

(END) Dow Jones Newswires

January 29, 2020 02:47 ET (07:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

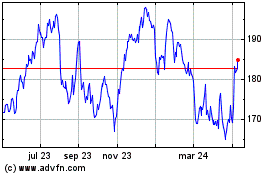

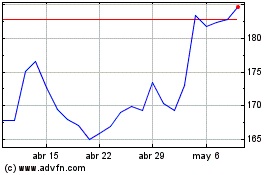

Apple (NASDAQ:AAPL)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Apple (NASDAQ:AAPL)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024