Picton Prop Inc Ltd Net Asset Value as at 31 December 2019

03 Febrero 2020 - 1:00AM

UK Regulatory

TIDMPCTN

3 February 2020

PICTON PROPERTY INCOME LIMITED

("Picton", the "Company" or the "Group")

LEI: 213800RYE59K9CKR4497

Net Asset Value as at 31 December 2019

Picton announces its Net Asset Value for the quarter ended 31 December 2019.

Highlights during the quarter included:

NAV growth and strengthened balance sheet through debt reduction

* Net assets increased to GBP519.1 million (30 September 2019: GBP510.7 million).

* NAV/EPRA NAV per share rose 1.7% to 95.2 pence (30 September 2019: 93.6

pence).

* Total return for the quarter of 2.6% (30 September 2019: 1.6%).

* LTV reduced to 22.4% (30 September 2019: 24.5%).

Dividend declared

* Dividend of 0.875 pence per share declared and to be paid on 28 February

2020 (30 September 2019: 0.875 pence per share).

* Annualised dividend equivalent to 3.5 pence per share, delivering a

dividend yield of 3.5%, based on 30 January 2020 share price.

* Dividend cover for the quarter of 114% (30 September 2019: 114%).

Further valuation uplift driven by asset management

* Like-for-like increase in property portfolio valuation for the quarter of

1.4% (30 September 2019: 0.7%) driven primarily by industrial and regional

office sector gains.

* GBP3.3 million invested in over 10 refurbishment and repositioning projects.

* Secured an average increase of 11% against the September ERV from nine

lease events (renewals, regears and one rent review), with a combined

annual rent of GBP3.0 million.

* Completed nine lettings on average 3% ahead of the September ERV, with a

combined annual rent of GBP0.5 million.

* Agreed to pre-lease Shipton Way, Rushden, to Whistl UK Limited at an annual

rent of GBP1.6 million who will become the Company's largest single occupier

from October 2020, when the existing occupier vacates.

* Completed the disposal of an office building in Croydon for GBP18.2 million.

* Stable occupancy of 88% (30 September 2019: 88%).

Nick Thompson, Chairman of Picton, commented:

"We have delivered another positive uplift in net assets, whilst at the same

time reducing borrowings and increasing the amount available under our

revolving credit facilities to capitalise on any emerging opportunities."

Michael Morris, Chief Executive of Picton, commented:

"The asset management activity over the quarter, driven by a number of key

leasing and regear transactions, has delivered further growth. Our primary

focus is our refurbishment programme and corresponding leasing activity to

drive both income and value."

This announcement contains inside information.

For further information:

Tavistock

Jeremy Carey/James Verstringhe, 020 7920 3150,

james.verstringhe@tavistock.co.uk

Picton

Michael Morris, 020 7011 9980, michael.morris@picton.co.uk

Note to Editors

Picton, established in 2005, is a UK REIT. It owns and actively manages a GBP685

million diversified UK commercial property portfolio, invested across 48 assets

and with around 350 occupiers (as at 31 December 2019). Through an occupier

focused, opportunity led approach to asset management, Picton aims to be one of

the consistently best performing diversified UK focused property companies

listed on the main market of the London Stock Exchange.

For more information please visit: www.picton.co.uk

NET ASSET VALUE

The unaudited Net Asset Value ('NAV') of Picton, as at 31 December 2019, was GBP

519.1 million, reflecting 95.2 pence per share, an increase of 1.7% over the

quarter, or 2.6% on a total return basis.

The NAV attributable to the ordinary shares is calculated under IFRS and

incorporates the independent market valuation as at 31 December 2019, including

income for the quarter, but does not include a provision for the dividend this

quarter, which will be paid in February 2020.

31 Dec 2019 30 Sept 2019 30 Jun 2019 31 Mar 2019

GBPmillion GBPmillion GBPmillion GBPmillion

Investment properties* 675.3 683.2 679.0 676.1

Other assets 16.4 19.5 17.0 15.8

Cash 21.9 17.1 21.6 25.2

Other liabilities (19.2) (22.0) (21.8) (23.0)

Borrowings (175.3) (187.1) (187.4) (194.7)

Net Assets 519.1 510.7 508.4 499.4

Net Asset Value per share 95.2p 93.6p 93.0p 92.7p

*The investment property valuation is stated net of lease incentives.

The movement in Net Asset Value can be summarised as follows:

Total Movement Per share

GBPmillion % Pence

NAV at 30 September 2019 510.7 93.6

Movement in property values 7.7 1.5 1.4

Net income after tax for 5.5 1.1 1.0

the period

Dividends paid (4.8) (0.9) (0.8)

NAV at 31 December 2019 519.1 1.7 95.2

DIVID DECLARATION

A separate announcement has been released today declaring a dividend of 0.875

pence per share in respect of the period 1 October 2019 to 31 December 2019 (1

July 2019 to 30 September 2019: 0.875 pence).

Post-tax dividend cover over the quarter was 114% (30 September 2019: 114%).

DEBT

In the period the Company repaid GBP11.8 million of debt. Its total borrowings at

31 December 2019 were GBP175.3 million, 96% of which is fixed under long-term

facilities, with the remainder at variable rates. The net gearing ratio,

calculated as total debt less cash, as a proportion of gross property value, is

22.4% (30 September 2019: 24.5%).

The weighted average debt maturity profile of the Group is approximately 9.8

years and the weighted average interest rate is 4.2%.

The Company has GBP41.5 million available under its revolving credit facilities.

PORTFOLIO UPDATE

Like-for-like, the portfolio valuation increased by 1.4% or GBP9.6 million,

including GBP3.3 million of capital expenditure across the portfolio during the

period. The industrial and regional office sectors delivered the strongest

growth, on the back of active management and proven rental growth. The London

office sector saw a slight increase and the retail and leisure sector valuation

declined over the quarter, principally impacted by continued weak sentiment in

the regional retail and retail warehouse sectors.

The sector weightings at 31 December 2019 and valuation movements over the

quarter are shown below:

Sector Portfolio Like-for-like

Weightings Valuation change

Industrial 48.9% 3.2%

South East 34.4%

Rest of UK 14.5%

Offices 32.8% 1.4%

London City and West End 4.2%

Inner and Outer London 5.7%

South East 11.5%

Rest of UK 11.4%

Retail and Leisure 18.3% (3.0)%

Retail Warehouse 7.3%

High Street - Rest of UK 4.3%

High Street - South East 4.9%

Leisure 1.8%

Total 100% 1.4%

As at 31 December 2019, the portfolio had a net initial yield of 4.6% (allowing

for void holding costs) or 4.8% (based on contracted net income) and a net

reversionary yield of 6.3%. The weighted average unexpired lease term, based on

headline rent, was 5.4 years.

Occupancy was maintained at 88%.

The top ten assets, which represent 52% of the portfolio by capital value, are

detailed below.

Asset Sector Location

Parkbury Industrial Estate, Radlett Industrial South East

River Way Industrial Estate, Harlow Industrial South East

Angel Gate, City Road, EC1 Office London

Stanford Building, Long Acre, WC2 Retail London

50 Farringdon Road, EC1 Office London

Tower Wharf, Cheese Lane, Bristol Office South West

Shipton Way, Rushden, Northants Industrial East

Midlands

Lyon Business Park, Barking Industrial Outer

London

30 & 50 Pembroke Court, Chatham Office South East

Colchester Business Park, Colchester Office South East

Key highlights in the quarter included:

Industrial

At Shipton Way, Rushden, we agreed to pre-lease the entire building to Whistl,

the UK's leading delivery management company. They will take a new 10-year

lease, subject to a break in 2025, at an annual rent of GBP1.6 million. They will

become the Company's largest single occupier from October 2020, when the

existing occupier vacates.

At Parkbury, Radlett, we extended a lease with the largest occupier on the

estate which was due to expire in November 2020. This secures a new 10-year

reversionary lease, subject to a break in 2025, with stepped rental increases

to GBP1.0 million per annum.

At Trent Road, Grantham, we extended a lease that was due to expire in 2023

until 2029, subject to a break in 2026, at GBP1.2 million per annum.

We let units in Barking, Epsom and Wokingham, for a combined GBP0.2 million per

annum, in line with the September ERV.

A lease was surrendered at Datapoint, London E16, and is currently being

refurbished along with the adjoining unit that came back on a lease expiry

during the period. We expect to secure new lettings at rents significantly

ahead of the previous passing rent and already have good interest. As a result

of this transaction, Picton received GBP0.2 million of additional income.

The GBP2.3 million refurbishment of the distribution unit in Rugby, our second

largest void, is due to complete in Q1 2020 and we have good interest.

Office

At Tower Wharf, Bristol we moved a break option due in August 2020, securing at

least another three years term certain. The rent review was agreed at the same

time, securing a 29% uplift to GBP0.4 million per annum, 4% ahead of the

September ERV.

At Waterside House in Leeds, following refurbishment works, we completed a

lease of the whole building with a Government department, securing 10 years

term certain at a rent of GBP0.3 million per annum, in line with the September

ERV.

We let units in Colchester, Glasgow and Marlow, for a combined GBP0.2 million per

annum, 4% ahead of the September ERV.

The GBP0.6 million refurbishment of the common areas and 4th floor at Metro,

Manchester is now complete, and we have already identified an occupier for the

vacant floor, subject to contract.

The sale of Citylink, Croydon, completed for GBP18.2 million. The 48,000 sq ft

detached office building, constructed in 1986, is let to RBS and Fairfield

School of Business. The building was sold with 10% vacancy and the potential

for vacant possession in 2022. The sale price reflects a net initial yield of

4.8% and was 3% ahead of the September 2019 valuation. The property was

acquired in 2005 for GBP9.1 million.

Retail and Leisure

At Parc Tawe in Swansea, Lidl relocated to the refurbished former Homebase and

we entered into an Agreement for Lease in respect of their old unit with Farm

Foods on a 15-year lease at a rent of GBP0.1 million per annum, in line with the

September ERV. The GBP0.4 million common area refurbishment works will complete

in Q1 2020.

The GBP0.7 million refurbishment of Angouleme Retail Park in Bury is due to

complete in Q1 2020 and we have good interest in one of the two vacant units.

The refurbishment of the retail and office accommodation at the renamed

Stanford Building in Covent Garden, is progressing as planned with completion

due in April 2020.

MARKET BACKGROUND

According to the MSCI Monthly Index, the All Property total return was 0.3% for

the quarter to December 2019, compared to 0.7% for the previous quarter.

Capital growth was -1.0% (September 2019: -0.6%) and rental growth was -0.2%

for the quarter (September 2019: 0.2%). A more detailed breakdown of the MSCI

Monthly Digest is shown below:

MSCI rental growth

Number of MSCI segments

Quarterly growth Positive growth Negative growth

Industrial 0.7% 7 -

Office 0.5% 9 1

Retail -1.7% - 20

All Property -0.2% 16 21

MSCI capital value growth

Number of MSCI segments

Quarterly growth Positive growth Negative growth

Industrial 0.7% 5 2

Office 0.3% 6 4

Retail -4.4% 1 19

All Property -1.0% 12 25

ENDS

END

(END) Dow Jones Newswires

February 03, 2020 02:00 ET (07:00 GMT)

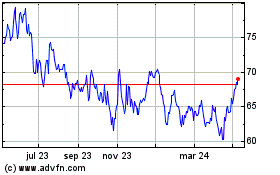

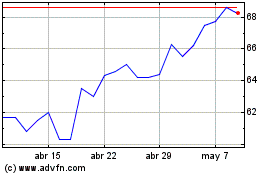

Picton Property Income Ld (LSE:PCTN)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Picton Property Income Ld (LSE:PCTN)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024