Google Shows Off YouTube's Ad Heft -- WSJ

05 Febrero 2020 - 2:02AM

Noticias Dow Jones

By Patience Haggin

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (February 5, 2020).

If YouTube were a stand-alone company, it would be among the

biggest advertising players in the world. Yet the online video

service isn't as large as many outsiders expected.

Those were the revelations Monday when Google detailed YouTube's

financials for the first time in its fourth-quarter earnings

report.

There is a lot Google didn't say -- for example, how much profit

or loss YouTube makes. But this much is clear: YouTube is an

advertising and streaming juggernaut, and Google's 2006 acquisition

of the startup for $1.65 billion was one of the great bargains of

Silicon Valley history.

YouTube logged $15.1 billion in 2019 revenue, according to

figures released Monday by parent Alphabet Inc. The company said a

majority of those revenues get paid out to content creators.

YouTube's ad revenue landed on the lower end of Wall Street

estimates. Citi analysts had earlier pegged it at $19 billion,

while some other analysts had projected it was upward of $25

billion.

"When there's a black box, people's imaginations can run wild.

And I think that explains why expectations were all over the

place," said digital-ad consultant Ratko Vidakovic.

Regardless of Wall Street's expectations, as a separate business

YouTube would be the third-largest seller of advertising behind

Google's flagship online businesses and Facebook Inc.

YouTube's ad business -- on a gross basis, before the payouts to

creators -- is larger than that of Comcast Corp., which reported

about $13.9 billion in 2019 advertising revenue across several

different businesses. It is also larger than Amazon.com's $14.1

billion "other" revenue, which includes its ad business.

YouTube's $4.72 billion in fourth-quarter revenue isn't far from

that of Netflix Inc., its subscription-supported rival. Netflix

reported fourth-quarter revenue of $5.47 billion. Both YouTube and

Netflix reported similar growth rates of 31%.

The numbers give YouTube investors and executives reasons to

salivate over untapped room for growth. YouTube takes in between $7

and $8 a year in advertising for each of its two billion global

users -- monetizing them at a rate lower than other social

networks. Facebook, for instance, took in $8.52 per user just in

the fourth quarter alone. For users in lucrative markets like the

U.S. and Canada, it took in more than $41 per user.

Alphabet Chief Executive Sundar Pichai said on the earnings call

that this left the company "significantly more room" to generate

revenue from those users.

Among the bright spots in the disclosures: YouTube's

subscription services beat expectations. YouTube's $3 billion in

non-advertising revenue is mostly subscription revenue, Mr. Pichai

said. Live-TV service YouTube TV has over two million paid

subscribers -- a figure that would make it about the eighth most

popular pay-TV service, right behind traditional cable

providers.

YouTube's paid music and premium services has over 20 million

subscribers -- a figure that puts it in fourth place globally,

behind Spotify SA, Apple Inc. and Amazon.

Many questions about YouTube's overall business remain

unanswered, including its geographic revenue breakdown, what share

of advertising customers are large brands, its cost of revenue and

how much it spends policing content.

Ruth Porat, Alphabet's chief financial officer, said in the

Monday earnings call that YouTube has additional costs beyond the

payouts to creators, including for infrastructure, networking and

content responsibility efforts. She didn't provide a breakdown of

those costs.

YouTube's ad-revenue growth slowed in the fourth quarter -- a

surprise considering that the holiday season typically delivers a

boom quarter for ad-supported businesses.

Competition from Bytedance Inc.-owned video-sharing app TikTok

could have been a factor in the fourth-quarter slowdown, said Brian

Wieser, global president for business intelligence at ad agency

GroupM, owned by WPP PLC.

YouTube disclosed annual ad revenue going back as far as 2017.

Several large advertisers fled the platform in the spring of 2017

after news reports showed their ads were appearing next to content

promoting hate speech and terrorism. The exodus may have dented

YouTube's revenues in that year, providing favorable comparisons

for Google to showcase to Wall Street in the ensuing years, said

Mr. Wieser. Google reported $11.2 billion in YouTube ad revenue for

2018, up 37% from 2017.

Rob Copeland contributed to this article.

Write to Patience Haggin at patience.haggin@wsj.com

(END) Dow Jones Newswires

February 05, 2020 02:47 ET (07:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

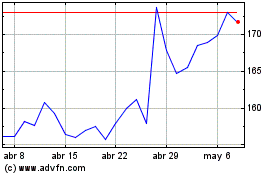

Alphabet (NASDAQ:GOOG)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Alphabet (NASDAQ:GOOG)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024