By Tripp Mickle

Coronavirus has given new meaning to something Apple Inc.

executives have been saying for years: Apple needs another

China.

The rapid spread of the virus is the latest test of Apple's

dependency on the world's most populous nation, one that has

disrupted the supply chain for an array of products and fostered

uncertainty about future production.

The outbreak prompted China to keep many factories closed after

the Lunar New Year holiday that ended last weekend. Apple and

Foxconn Technology Co., the largest manufacturer of its devices,

have said production will resume after a 10-day delay on Feb. 10.

But signs are emerging that the impact on the companies is likely

to extend well beyond then, according to analysts and manufacturing

executives. Apple is expected to ship 5% to 10% fewer iPhones in

the current quarter, according to analysts.

An Apple spokeswoman declined to comment further.

Confirmed coronavirus cases have passed 24,000 and deaths have

reached at least 490, all but two in China. That exceeds the 349

who died in mainland China during the SARS crisis of 2002 and 2003.

The country continues to take aggressive measures to contain the

outbreak, all of which complicate global companies' efforts to keep

production flowing.

The uncertainty has disrupted China's economy. To curtail the

virus's spread, some local governments have asked people to stay

away from work. In some areas, only one person per household is

allowed to go out every two days to buy food and supplies.

Chief Executive Tim Cook has successfully weathered a number of

challenges that emerged around China in recent years. A weaker

economy and stronger local competition in China last year hurt

iPhone sales, triggering a stock-price decline that reached 10%

before market enthusiasm around new handsets sent shares surging. A

tariff war between China and the U.S. has loomed over the company

since 2018, although Mr. Cook persuaded President Trump to avert

serious damage to Apple.

The outbreak has the potential to hurt Apple in two ways:

cutting into sales in its second-most important market and roiling

a supply chain that relies on China to make most of the iPhones,

iPads and Macs sold world-wide.

The 10-day delay in production can be made up with overtime

work, said Dan Panzica, a former technology operations executive

with Foxconn. But he said shipments of parts and components to

factories could be delayed, and workers who went home to celebrate

the Lunar New Year may not return, out of caution.

"This is a much bigger impact than the Trump tariffs," Mr.

Panzica said. "Then you could move things. Now, you can't."

Apple is among the companies most vulnerable to the outbreak

because it hasn't diversified its manufacturing. Though in recent

years it looked at assembling iPhones outside China, including in

Vietnam, it found the costs of facilities and training too high and

opted to keep exporting most from China, The Wall Street Journal

previously reported.

Apple produces some iPhones in India, but has said that most are

sold domestically to avoid India's steep levies on imported

goods.

Samsung, the world's largest smartphone maker by shipments, last

year wound down production in China -- part of a years-old strategy

of diversifying its manufacturing base by shifting production to

India, Vietnam and elsewhere.

Huawei Technologies Co., the second-largest maker, this week

reopened its factory in the city of Dongguan, near Shenzhen, a

spokesman said, thanks to an exception the local government makes

for critical industries. The factory accounts for about 10% of the

company's output.

Apple's leaders have long considered its manufacturing reliance

on China both a strength and a vulnerability, according to former

executives. In general, Apple executives have worried more about a

disruption in exports from the country than a loss of sales inside

Greater China, a market that includes Hong Kong and Taiwan and

accounts for about a fifth of revenue.

Last week, Mr. Cook said Apple was developing plans to make up

for any lost production from Wuhan, the epicenter of the outbreak,

where the company says two of its top 200 suppliers are based. He

said it is harder to predict the consequences of the 10-day delay

in factory openings elsewhere.

Apple is in the process of ramping up production of an update to

the low-cost iPhone SE -- released in 2016 for $399 -- according to

analysts. It was expected to ship the phone in March but could

consider delaying that because of disruptions caused by the

epidemic, said Isaiah Research, a Taiwan-based firm focused on the

supply chain.

Foxconn is contending with a strict quarantine in Zhengzhou

city, home to its largest iPhone plant. The city, about 320 miles

north of Wuhan, has established single entry points at government,

commercial and residential buildings where people arriving have

their temperatures checked -- a policy that has stoked concern

inside Foxconn about whether it can resume production Feb. 10, a

person familiar with the matter said.

The contract manufacturer has said it plans to resume operations

at mainland plants Feb. 10. A committee led by its chairman is

dealing with the outbreak.

Apple is known for its operational prowess and has a record of

navigating supply-chain challenges. After a 2011 earthquake

triggered the Fukushima nuclear crisis in Japan, Apple created a

new factory outside the exclusion zone to maintain production of

optical drives it needed, according to a person familiar with the

matter. When monsoons flooded factories in Thailand later that same

year, Apple turned to the Thai Navy to load boats with the heavy

equipment it needed for production, the person said.

But those events only affected a sliver of Apple's supply chain.

The coronavirus in China affects the very heart of it.

Some have questioned whether enough workers will be available

for Apple to increase production, given that many traveled for the

Lunar New Year holidays and probably face limitations on their

mobility or even a quarantine.

"They'll open the doors but how many production operators will

return? How many line operators will return?" Mr. Panzica said. "It

won't be a typical smooth start."

Yang Jie and Dan Strumpf contributed to this article.

Write to Tripp Mickle at Tripp.Mickle@wsj.com

(END) Dow Jones Newswires

February 05, 2020 09:07 ET (14:07 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

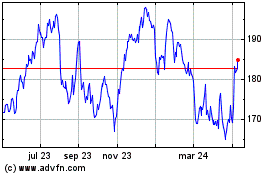

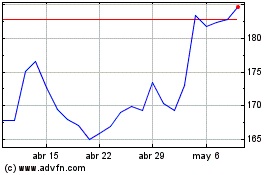

Apple (NASDAQ:AAPL)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Apple (NASDAQ:AAPL)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024