UniCredit Shares Jump on 4Q Results

06 Febrero 2020 - 4:13AM

Noticias Dow Jones

By Pietro Lombardi

Shares in UniCredit SpA (UCG.MI) trade sharply higher on

Thursday after the bank posted better-than-expected results for the

fourth quarter and said it may return a bigger share of profits to

shareholders in the coming years.

The consensus-beating performance closes a strategic plan the

bank launched to tackle a number of issues, including a large pile

of bad loans. Under the strategy, it cut costs and disposed of

soured loans worth billions of euros. After completing a deep

overhaul, which also included selling assets, in December the

lender established a new four-year plan under which it pledged

share buybacks and dividend increases, as well as job and cost

cuts.

The loss for the period was 835 million euros ($920 million),

better than the EUR1.10 billion loss analysts had forecast,

according to a consensus provided by the bank. This compares with a

profit of EUR1.99 billion a year earlier when an extraordinary tax

effect boosted results.

On an underlying basis, net profit rose almost 69%.

The payout ratio could increase to 50% of underlying earnings

starting this year and extraordinary capital distribution in 2021

and/or 2022 will also be considered. The plan presented in December

guided for capital distribution of 40% through 2022.

"We see only positive news from this set of results: better than

expected 4Q19 results, stronger capital base, and possible upwards

revision of the dividend policy," Banca IMI analyst Manuela Meroni

said.

The bank said it would pay a dividend of EUR0.63 a share for

2019 and proposed a share buyback of EUR467 million.

UniCredit significantly strengthened its capital position in the

quarter. The core tier 1 ratio--a key measure of capital

strength--rose to 13.09% at the end of December, including the

buyback, from 12.60% in September.

"We enjoy a solid balance sheet," Chief Executive Jean Pierre

Mustier said.

"We will consider increasing the capital distribution to 50% for

FY2020, paid in 2021, and for the remainder of the plan. As we have

said before, we much prefer share buybacks over M&A. This has

not changed."

Revenue rose 3.4% to EUR4.85 billion, boosted by fees and

trading income, also topping expectations of EUR4.66 billion.

Fees rose 5.1% while trading income more than doubled. This

offset a 7.3% fall in net interest income--the difference between

what lenders earn from loans and pay for deposits--and is a key

profit driver for retail banks.

The results for the quarter were hit by a number of one-offs,

including restructuring costs in Germany and Austria, costs related

to the sale of a stake in Turkish bank Yapi Kredi, and provisions

for bad loans.

At 0940 GMT, UniCredit shares trade 5.8% higher.

Write to Pietro Lombardi at pietro.lombardi@dowjones.com

(END) Dow Jones Newswires

February 06, 2020 04:58 ET (09:58 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

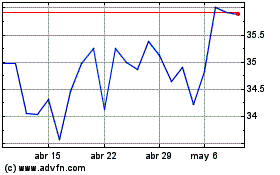

Unicredit (BIT:UCG)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Unicredit (BIT:UCG)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024