UniCredit Strengthened Capital in Better-Than-Expected 4Q -- Earnings Review

06 Febrero 2020 - 4:44AM

Noticias Dow Jones

By Pietro Lombardi

UniCredit SpA (UCG.MI) reported better-than-expected results

four the fourth quarter on Thursday. Here is what you need to

know:

NET LOSS: The Italian bank posted a loss of 835 million euros

($920 million) for the period, better than the EUR1.10 billion loss

analysts had forecast, according to a consensus provided by the

bank.

REVENUE: The top line also beat expectations. Revenue rose 3.4%

to EUR4.85 billion, boosted by fees-and-trading income, surpassing

expectations of EUR4.66 billion.

WHAT WE WATCHED:

-RETURNS TO SHAREHOLDERS: The bank said it would pay a dividend

of EUR0.63 a share for 2019 and proposed a share buyback of EUR467

million. The payout ratio could increase to 50% of underlying

earnings starting this year and extraordinary capital distribution

in 2021 and/or 2022 will also be considered. The plan presented in

December guided for capital distribution of 40% through 2022.

-CAPITAL: UniCredit significantly strengthened its capital

position in the quarter. The core tier 1 ratio--a key measure of

capital strength--rose to 13.09% at the end of December, including

the buyback, from 12.60% in September.

-ONE-OFFS: The results for the quarter were hit by a number of

one-offs, including restructuring costs in Germany and Austria,

costs related to the sale of a stake in Turkish bank Yapi Kredi,

and provisions for bad loans.

-REVENUE STREAMS: Fees rose 5.1% while trading income more than

doubled. This offset a 7.3% fall in net interest income--the

difference between what lenders earn from loans and pay for

deposits--a key profit driver for retail banks.

Write to Pietro Lombardi at pietro.lombardi@dowjones.com

(END) Dow Jones Newswires

February 06, 2020 05:29 ET (10:29 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

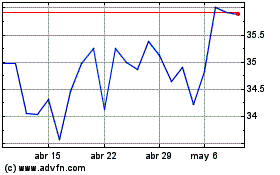

Unicredit (BIT:UCG)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Unicredit (BIT:UCG)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024