UniCredit 4Q Beat Expectations Despite Swing to Loss on One-Offs

06 Febrero 2020 - 7:52AM

Noticias Dow Jones

By Giovanni Legorano and Pietro Lombardi

UniCredit SpA (UCG.MI), Italy's largest bank, posted

better-than-expected results for the fourth quarter of 2019,

although it swung to a net loss for the period largely due to

one-off costs and provisions.

The bank also said it may return a bigger share of profits to

shareholders in the coming years.

Shares jumped in reaction to the better results and higher

dividend prospects. At midmorning they were trading around 5%

higher.

"We see only positive news from this set of results: better than

expected fourth-quarter results, stronger capital base, and

possible upwards revision of the dividend policy," Banca IMI

analyst Manuela Meroni said.

The results served as a capstone to a strategic plan the bank

launched to tackle a number of issues, including a large pile of

bad loans. Under the strategy, it cut costs and sold soured loans

worth billions of euros.

The deep overhaul included the sale of number of assets

including Polish lender Bank Pekao SA and asset management firm

Pioneer Investments. More recently, it sold its stakes in online

lender FinecoBank SpA and in Mediobanca SpA.

Earlier on Thursday it completed the sale of a 12% stake in Yapi

ve Kredi Bankasi AS (YKBNK.IS) via an accelerated bookbuilding. It

now owns 20% of the Turkish lender and will book a loss on the sale

of 820 million euros ($906.1 million) in the first quarter of this

year.

In December the lender unveiled a new four-year plan under which

it pledged share buybacks and dividend increases, as well as job

and cost cuts.

The margins it makes on lending have also been affected by lower

lending volumes due to sluggish economic growth in key markets such

as Italy.

The bank compensated the declining revenue on loans with higher

fees and commissions and lower costs.

The loss for the fourth quarter was EUR835 million, better than

the EUR1.10 billion loss analysts had forecast, according to a

consensus provided by the bank. This compares with a profit of

EUR1.99 billion a year earlier when an extraordinary tax effect

boosted results.

On an underlying basis, net profit rose almost 69%.

The payout ratio could increase to 50% of underlying earnings

starting this year and extraordinary capital distribution in 2021

or 2022 or both years will also be considered. The plan presented

in December guided for capital distribution of 40% through

2022.

Revenue rose 3.4% to EUR4.85 billion, boosted by fees and

trading income, also topping expectations of EUR4.66 billion.

Fees rose 5.1% while trading income more than doubled. This

offset a 7.3% fall in net interest income--the difference between

what lenders earn from loans and pay for deposits, and which is a

key profit driver for retail banks.

The results for the quarter were hit by a number of one-offs,

including restructuring costs in Germany and Austria, costs related

to the sale of a stake in Turkish bank Yapi Kredi, and provisions

for bad loans.

Write to Giovanni Legorano at Giovanni.Legorano@wsj.com and

Pietro Lombardi at pietro.lombardi@dowjones.com

(END) Dow Jones Newswires

February 06, 2020 08:37 ET (13:37 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

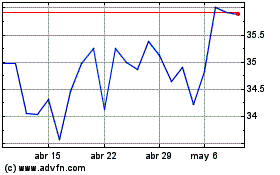

Unicredit (BIT:UCG)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Unicredit (BIT:UCG)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024