By Tripp Mickle

Apple Inc. became the first major U.S. company to say it won't

meet its revenue projections for the current quarter due to the

coronavirus outbreak, which it said had limited iPhone production

for world-wide sales and curtailed demand for its products in

China.

The tech giant had last month projected record revenue for the

current quarter of between $63 billion and $67 billion, which it

said was a wider than normal range due to the virus. The technology

giant on Monday didn't provide an updated sales estimate, saying

that the situation in China is evolving. It said it would provide

more information when it holds its earnings call in April.

Apple's announcement is the most prominent example yet of the

broad ripple effects of the coronavirus on global business and

markets as the outbreak continues to spread, hitting smartphone

sales and commodity prices and delaying production across

industries.

The difficulties are extending into supply chains around the

worldas assembly lines from Asia to Europe depend upon parts moving

swiftly from China into their plants.

Volkswagen AG said Monday it would postpone production restarts

at some Chinese plants for another week. Fiat Chrysler Automobiles

NV last week said it temporarily halted production in Serbia

because it could not get parts from China, which continues to deal

with manufacturing delays as it seeks to contain the spread of the

virus.

Oil prices have fallen 11% in recent weeks in anticipation of

reduced demand from the world's most populous country, and the

outbreak has also weighed on iron-ore prices. A dearth of Chinese

tourists in the U.S. has also hit a number of luxury brands such as

Estée Lauder Cos. and Capri Holdings Ltd. which owns the Versace

and Jimmy Choo brands. The timing of an initial public offering for

multibillion-dollar startup Airbnb Inc. may also be affected,

according to a person close to the company.

Chinese consumers are also an increasingly important market for

global brands. The coronavirus' impact on China, the world's

second-largest economy, will depend on how swiftly manufacturers

are able to resume production. The manufacturing sector is a core

pillar of the country's economy, accounting for nearly 30% of the

nation's gross domestic product in 2019.

On Monday, hundreds of Americans who had been passengers on a

quarantined Japanese cruise ship arrived in the U.S, including 14

people who tested positive for the coronavirus. The World Health

Organization reported 71,000 cases world-wide, with over 1,770

deaths. Only three deaths and 794 cases have occurred outside of

China, according to the WHO, with the majority of those cases being

on the cruise ship.

Apple's announcement is the second time in two years that the

company has reset revenue projections because of problems in China.

A year ago, it slashed guidance for the first time in more than 15

years because of weak iPhone demand in China and elsewhere in the

world.

The back-to-back revisions underscore how China, once one of

Apple's strengths, has emerged as one of its greatest challenges.

The company has relied on China's manufacturing sector -- with its

low-cost and abundant workforce -- to assemble the vast majority of

the products it sells worldwide. It also has become one of the most

successful U.S. brands in China, where it had $44 billion in sales

last year, nearly a fifth of the company's total revenue.

The twin dependency on China's manufacturing and consumer

sectors made Apple vulnerable as the new coronavirus paralyzed the

country. The Chinese government moved swiftly to contain the virus

by limiting movement across the country and locking down Wuhan, the

city at the epicenter of the outbreak. Concerns over the virus led

to the closure of stores across the country and caused a 10-day

delay in the resumption of manufacturing following the Lunar New

Year holiday.

Apple said its contract manufacturers were ramping up production

"more slowly than we had anticipated." As a result, it said that

there would be iPhone supply shortages that temporarily affect

world-wide sales.

It also said the closure of its own stores and many partner

stores across China had affected sales of its products. Many stores

have been operating at reduced hours and had very low customer

traffic, the company said. It added that it is gradually reopening

its stores and will continue to do so as soon as possible.

The company said that outside of China demand for its products

and services had been strong and in line with expectations.

The announcement Monday represented a swift reversal in Apple's

expectations for the quarter. In late January, Chief Executive Tim

Cook downplayed the risk of the virus, saying the company was

developing plans to make up for any lost production from Wuhan,

where two of Apple's top 200 suppliers are based. He said Apple

expected factories elsewhere to reopen after the 10-day delay.

"We factored our best thinking in the guidance that we provided

you," Mr. Cook said in January.

Apple said it is more than doubling a previously announced

donation to support public health efforts in China.

The virus threatens to derail Apple's business just as the

company was showing signs it had regained its momentum. After

weaker iPhone sales contributed to a 2% decline in total revenue

for the 2019 fiscal year ended in September, the company last month

reported record revenue and profit behind strong sales of its

flagship smartphone, as well as apps and AirPods wireless earbuds

[LINK: https://on.wsj.com/2uL4DHQ ].

Apple's shares have rallied over the past year behind the

release of its latest iPhone, enthusiasm about growing sales of

subscription services and anticipation of its first 5G smartphones

later this year. Its market value has more than doubled since early

last year to $1.4 trillion.

Still, Apple needed a steady supply of iPhones to extend its

sales growth into the current quarter. As the coronavirus spread,

travel restrictions made it difficult for its largest manufacturing

partner, Foxconn Technology Co., to secure workers for its

factories, according to people familiar with its supply chain. Some

plants have resumed limited production but are uncertain when they

will return to full capacity, one of these people said.

Foxconn is aiming to resume 50% of mainland China production by

the end of February, and 80% in mid-March, another person familiar

with the matter said.

Manufacturers must take measures to ensure the virus won't

spread within their factories, where oftentimes hundreds or

thousands of workers gather for one shift. For instance, in

Kunshan, a manufacturing hub near Shanghai where Foxconn has a

plant, the government is requiring companies to check all workers

at entrances and quarantine workers returning from regions where

the virus outbreak is severe.

The city also requires that companies have enough masks,

thermometers and disinfectants to last for at least three days.

Write to Tripp Mickle at Tripp.Mickle@wsj.com

(END) Dow Jones Newswires

February 17, 2020 18:21 ET (23:21 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

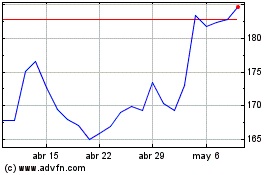

Apple (NASDAQ:AAPL)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

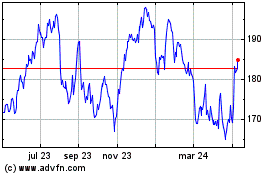

Apple (NASDAQ:AAPL)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024