U.S. Housing Starts Pull Back After Reaching 13-Year High

19 Febrero 2020 - 3:39AM

RTTF2

A report released by the Commerce Department on Wednesday showed

a pullback in new residential construction in the U.S. in the month

of January.

The Commerce Department said housing starts slumped by 3.6

percent to an annual rate of 1.567 million in January after soaring

by 17.7 percent to a revised rate of 1.626 million in December.

Economists had expected housing starts to tumble by 11.4 percent

to a rate of 1.425 million from the 1.608 million originally

reported for the previous month.

With the decrease, housing starts pulled back after reaching

their highest level since hitting 1.649 million in December of

2006.

Single-family housing starts plunged by 5.9 percent to a rate of

1.010 million in January, which more than offset a 0.7 percent

increase in multi-family starts to rate of 557,000.

Meanwhile, the report said building permits spiked by 9.2

percent to an annual rate of 1.551 million in January after sliding

by 3.7 percent to a revised rate of 1.420 million in December.

Building permits, an indicator of future housing demand, had

been expected to rise by 2.4 percent to a rate of 1.450 million

from the 1.416 million originally reported for the previous

month.

With the much bigger than expected increase, building permits

reached their highest level since hitting 1.596 million in March of

2007.

Single-family authorizations shot up by 6.4 percent to a rate of

987,000 in January, and multi-family permits soared by 14.6 percent

to a rate of 564,000.

Compared to the same month a year ago, housing starts in

November were up by 21.4 percent, while building permits were up by

17.9 percent.

"Housing starts in January reversed only a small part of their

weather-induced December surge, and the underlying data point to

solid momentum going forward," said a note from economists at

Oxford Economics.

The noted added, "Housing is expected to make a small positive

contribution to GDP growth in Q1, which is currently tracking at

only 0.4% annualized."

On Tuesday, the National Association of Home Builders released a

separate report showing a slight deterioration in homebuilder

confidence in the month of February.

The report said the NAHB/Wells Fargo Housing Market Index edged

down to 74 in February after slipping to 75 in January. Economists

had expected the index to come in unchanged.

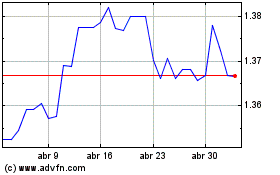

US Dollar vs CAD (FX:USDCAD)

Gráfica de Divisa

De Mar 2024 a Abr 2024

US Dollar vs CAD (FX:USDCAD)

Gráfica de Divisa

De Abr 2023 a Abr 2024