Euro Muted After ECB Minutes

20 Febrero 2020 - 3:17AM

RTTF2

The euro showed muted trading against its major counterparts in

the European trading session on Thursday, after minutes from the

European Central Bank's January meeting showed that policymakers

agreed that the latest data pointed to a moderate growth in the

euro area economy, but they would await additional data to see if

there were firmer grounds for optimism.

Incoming economic data confirmed the Governing Council's

previous assessment of ongoing but moderate growth, with slightly

more positive signals from forward-looking indicators, the minutes

of the bank's January 22-23 meeting showed.

Considering the tentative signs of stabilization in the euro

area economy, the Governing Council would await further data to see

if there were firmer grounds for optimism.

Members assessed that underlying inflation had remained

generally muted, although there were further indications of a

moderate increase in line with previous expectations.

The risk of adverse spillovers from the continued weakness in

the manufacturing sector to other sectors of the economy still

required to be monitored closely.

Survey by the market research firm GfK showed that Germany's

consumer confidence is set to ease slightly in March, as a modest

gain in economic expectations were offset by moderate losses in

income outlook and the propensity to buy.

The forward-looking GfK consumer confidence index fell to 9.8

points for March from 9.9 in February. That was in line with

economists' expectations.

The currency showed mixed trading in the Asian session. While it

held steady against the franc and the pound, it rose against the

greenback and the yen.

The EUR/GBP pair touched a weekly high of 0.8397 earlier in the

session and held steady in subsequent deals. At Wednesday's close,

the pair was valued at 0.8358.

The euro bounced off to 1.0806 against the greenback, from an

early near a 3-year low of 1.0778, and traded steadily thereafter.

This may be compared to a 2-day peak of 1.0815 set in the Asian

session. On the upside, resistance is seen closer to the 1.10

level.

After approaching a fresh 2-week peak of 121.10 against the yen

at 5:45 am ET, the single currency held steady. The pair had

finished Wednesday's trading at 120.31.

The euro slipped to a day's low of 1.0606 against the franc

earlier in the session and moved sideways thereafter. At

yesterday's trading close, the pair was worth 1.0632.

Data from the Federal Customs Administration showed that

Switzerland's exports rose for the first time in four months, while

imports declined in January.

Exports increased by a real 1.7 percent month-on-month in

January, whereas imports fell 1.8 percent.

Looking ahead, U.S. leading indicators for January are scheduled

for release at 10:00 am ET.

Simultaneously, Eurozone consumer sentiment for February is set

for release.

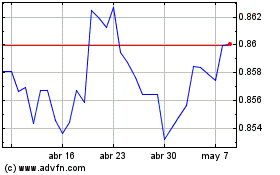

Euro vs Sterling (FX:EURGBP)

Gráfica de Divisa

De Mar 2024 a Abr 2024

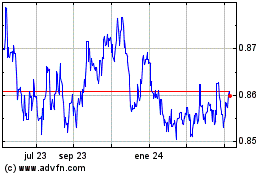

Euro vs Sterling (FX:EURGBP)

Gráfica de Divisa

De Abr 2023 a Abr 2024