Stocks Clinch Records, E*Trade Finds a Buyer and Walmart Disappoints

21 Febrero 2020 - 6:29AM

Noticias Dow Jones

By Paul Vigna

The stock market set records again this week, but investors

faced new concerns as well. Apple Inc. warned its sales would take

a hit from the coronavirus epidemic, and it is becoming clearer

that China's gross domestic product will suffer, too. It is shaping

up to be a down week for Wall Street.

Here is a look at some of the biggest winners -- and losers --

in the market.

WINNER: E*Trade

Investors who wanted to tap the stock market moneymaking machine

but couldn't afford to pay for one of those fancy, white-shoe Wall

Street firms could turn to a discount broker like E*Trade Financial

Corp. Now, Wall Street is turning to E*Trade, too.

Morgan Stanley on Thursday agreed to acquire E*Trade for $13

billion in stock, in what would be the largest deal by one of the

big U.S. banks since the financial crisis in 2008. Shares of

E*Trade surged as much as 27% on the news, their largest one-day

gain since 2009.

For E*Trade, the attraction was obvious. Its main rivals,

Charles Schwab Corp. and TD Ameritrade Holding Corp., agreed to a

merger last fall. E*Trade was the odd man out. There were doubts

about its ability to go it alone. The company didn't want to wait

around to see what happened.

Morgan Stanley didn't blithely decide to dilute its shareholders

by $13 billion, though. The deal will make the other House of

Morgan the biggest wealth manager in the world, with $3 trillion in

assets under management. Morgan Stanley is adhering to one of the

best-known axioms in corporate America: When you can't create

growth on your own, you have to go out and buy it.

This deal is just the latest sign that, for all the stock-market

records, Wall Street isn't a growth industry these days. The deal

will ramp up pressure on some of Morgan Stanley's competitors like

Goldman Sachs Group Inc.

Honorable Mentions: Members Exchange, a startup looking to

launch a rival to the New York Stock Exchange and Nasdaq Inc., said

it completed a funding round that included investments from Wall

Street heavy hitters Goldman Sachs and JPMorgan Chase & Co. It

is a sign that some of the Big Board's big clients are also looking

for ways to dilute the dominance of the incumbent exchanges.

Goldbugs: Gold futures rose above $1,600 an ounce, hitting their

highest point in seven years, as some investors look for havens in

expectation that the coronavirus outbreak will have a bigger

economic impact than currently expected.

LOSER: Retailers

Every time you see one of those blue Amazon delivery trucks, it

is another body blow to the bricks-and-mortar retailer. That was

made clear this week after Walmart Inc., the world's largest

retailer, posted sluggish holiday-sales numbers.

It isn't that Walmart lacks an online strategy. Its online

holiday sales did indeed rise. But that couldn't offset the fact

that fewer people are getting in their cars and doing their own

shopping.

Meanwhile, Pier 1 Imports Inc. finally threw in the towel. And

the wicker chairs. And the elephant-theme umbrella holders. The

funky home-goods retailer filed for bankruptcy protection Monday,

after years of trying to reinvent itself in a changing retail

landscape. Under its new plan, it will sell off the company, either

in whole or in parts.

Honorable Mention: Speaking of the lack of growth in the

financial markets, 35,000 or so U.S. and European staffers at HSBC

Holdings PLC are going to lose their jobs in the latest part of the

big bank's retrenchment. Once upon a time, HSBC had ambitions to be

a major global bank. Now it is narrowing its ambitions.

Next Week: Speaking of retailers, next week brings more earnings

reports, and retailers are in the spotlight. Look for reports from

Home Depot Inc. and Macy's Inc. (Tuesday), L Brands Inc.

(Wednesday) and Beyond Meat Inc. (Thursday).

On the economic front, a clutch of reports will provide new

insights into the health of the U.S. consumer and the economy. Look

for new-home sales (Wednesday), the second report on fourth-quarter

GDP (Thursday) and personal income and spending (Friday).

Write to Paul Vigna at paul.vigna@wsj.com

(END) Dow Jones Newswires

February 21, 2020 07:14 ET (12:14 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

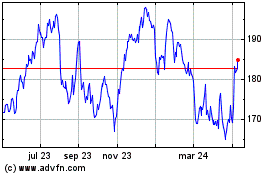

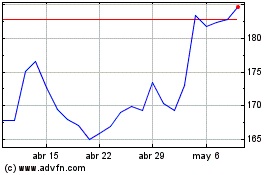

Apple (NASDAQ:AAPL)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Apple (NASDAQ:AAPL)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024