TIDMNICL

RNS Number : 1055E

Nichols PLC

26 February 2020

Date: Embargoed until 0700 Wednesday 26 February 2020

Contacts: Marnie Millard, Group Chief Executive Officer

Tim Croston, Group Chief Financial Officer

Andrew Milne, Group Chief Operating Officer

Nichols plc

Telephone: 01925 222 222

Website: www.nicholsplc.co.uk

Alex Brennan/ Hattie Steve Pearce/ Rachel Hayes

Dreyfus N+1 Singer

Hudson Sandler

Telephone: 020 7796 (Nominated Adviser and Broker)

4133

Email: nichols@hudsonsandler.com Telephone: 0207 496 3000

Website: www.n1singer.com

Nichols plc

2019 PRELIMINARY RESULT

Nichols plc ('Nichols' or the 'Group'), the soft drinks Group,

announces its Preliminary results for the year ended 31 December

2019 (the 'period').

*EBITDA is the statutory Year ended Year ended

profit before tax, interest, 31 Dec 2019 31 Dec 2018

depreciation and amortisation

GBPm GBPm

------------- ------------- ------

Group Revenue 147.0 142.0 +3.5%

------------- ------------- ------

Operating Profit 32.4 31.6 +2.5%

------------- ------------- ------

Operating Profit margin 22.1% 22.3%

------------- ------------- ------

EBITDA* 37.0 33.8 +9.5%

------------- ------------- ------

Profit Before Tax 32.4 31.8 +2.1%

------------- ------------- ------

PBT margin 22.1% 22.4%

------------- ------------- ------

Earnings Per Share (basic) 72.81p 69.23p +5.2%

------------- ------------- ------

Final dividend 28.0p 26.8p +4.5%

------------- ------------- ------

John Nichols, Non-Executive Chairman, said:

"I am pleased to report on a year of further progress during

which Nichols achieved continued revenue growth in both our

International and UK businesses. As a result, the Group delivered

year-on-year increases in profit before tax and earnings per share

and we are today proposing a final dividend of 28.0 pence per

share, resulting in a 6.0% increase in the full year dividend.

The Group's performance demonstrates the strength of our

diversified business model, which provides a strong platform to

deliver continued growth."

Chairman's Statement

I am pleased to announce another strong performance from Nichols

plc. During the year, the Group delivered further progress against

its strategic objectives, successfully increasing revenue, profit

and earnings per share. This performance was delivered against

challenging market conditions as has been widely reported

elsewhere.

Trading

Total Group revenue increased by 3.5% to GBP147.0m (2018:

GBP142.0m). Both our UK and International businesses contributed to

this positive performance.

UK sales grew by 2.5% to GBP117.5m (2018: GBP114.6m).

Within the UK business, Vimto brand sales performed well,

increasing by 0.8% against very strong prior year comparatives

(2018: +12.9%). This performance was primarily driven by the Still

category where sales of Vimto dilutes grew by 15% and continued to

gain market share.

Elsewhere in our UK business, Out of Home sales increased by

8.0% to GBP45.5m (2018: GBP42.2m) and now contribute 31% of Group

revenue. This increase was largely driven by the acquisition of one

of our post mix and coffee distributors (Adrian Mecklenburgh

Limited) and the growth of frozen beverages into the cinema

channel. The continued growth in Out of Home demonstrates our

diversified strategy and is a result of the significant investment

in this part of our business over recent years.

International sales grew by 7.5% to GBP29.5m (2018: GBP27.4m).

In our African markets, revenues were GBP13.0m compared to GBP13.6m

in the prior year. Sales to the Middle East grew by 20.6% to

GBP11.6m against softer prior year comparatives (2018: GBP9.6m). As

anticipated, this performance reflects a return to normal levels of

concentrate sales during the year. Within the region, we achieved

our best ever sales performance of the Vimto brand during Ramadan

2019.

Elsewhere in our International regions, there was good growth in

the USA, which is primarily a Stills market (+23.1% to GBP1.4m) and

Europe which is primarily a Carbonate market (+5.2% to

GBP3.3m).

Group Profit Before Tax was GBP32.4m for the year, an increase

of 2.1% compared to the prior year (2018: GBP31.8m).

Dividend

As a reflection of the Board's confidence in the Group's

long-term financial position and the performance in the year, we

are pleased to recommend a final dividend of 28.0 pence per share

(2018: 26.8 pence).

If approved by our shareholders, the total dividend for 2019

will be 40.4 pence per share (2018: 38.1 pence), an increase of

6.0% on the prior year. Subject to shareholder approval, the final

dividend will be paid on 1 May 2020 to shareholders registered on

20 March 2020; the ex-dividend date is 19 March 2020.

Summary

In summary, the Board is pleased with the Group's performance in

2019. Despite the market headwinds, the business has once again

delivered profitable sales growth, maintained its strong cash

generative model and as a Board, we are proposing a final dividend

of 28.0 pence per share, resulting in a 6.0% increase in the full

year dividend.

Outlook

Further to our trading announcement on 23 December 2019

regarding the new Sweetened Beverage Excise Tax in Saudi Arabia and

the UAE, we anticipate being in a position to update the market in

our Interim Results Announcement on 22 July 2020. At that point in

time, we will have the benefit of the data post the critical

Ramadan trading period.

Elsewhere across the Group, we are confident that our

diversified and profitable business model will support the

continued growth trend into 2020 and beyond.

John Nichols

Non-Executive Chairman

25 February 2020

Notes to Editors:

Nichols plc is an international soft drinks business with sales

in over 85 countries, selling products in both the Still and

Carbonate categories. The Group is home to the iconic Vimto brand

which is popular in the UK and around the world, particularly in

the Middle East and Africa. Other brands in its portfolio include

Feel Good, Starslush, ICEE, Levi Roots and Sunkist.

Chief Executive Officer's Statement

During 2019, we continued to evolve our strategy aimed at the

long-term, sustainable development of our business by delivering

growth opportunities across the Group. To support this, we launched

a series of initiatives to ensure our stakeholders share the

Board's exciting long-term vision for Nichols plc and have clarity

on our priorities over the coming years.

During 2019, the Group made further progress in the area of

sustainability, but we recognise that there is much more we can do.

In January 2020 we launched our revised Environmental, Social and

Governance agenda to our colleagues, which is focused on creating a

"Happier Future". Further details of our sustainability commitments

and vision are set out in our 2019 Annual Report. Not only are

these commitments the right thing to do, we firmly believe that the

"Happier Future" pillar of our strategy is critical to ensuring the

Group's sustainable growth for future generations.

Underpinning our strategy are the strengths of our unique

brands, a relentless focus on putting the customer front and centre

of everything we do, and our fantastic team. I would like to thank

our colleagues for all their hard work in delivering success

against some challenging trading conditions during the year. In

particular, I would like to show my appreciation to Tim Croston,

our outgoing Chief Financial Officer, for his significant

contribution to Nichols plc over his 15 years with the Group and to

wish him every success in his future ventures. As announced in

October 2019, Tim will step down from the Board by 30 June 2020 and

we are pleased to welcome David Rattigan as our new Chief Financial

Officer, who officially takes up the role on 2 March 2020.

Marnie Millard

Chief Executive Officer

25 February 2020

Chief Operating Officer's Report

2019 has again been a strong year for the whole Group with both

the UK and International regions contributing to the growth of the

business. This again highlights the strength of our diversified

business model, which gives us a strong platform to drive success

in the market place.

Total Group revenue grew by 3.5% to GBP147.0m. Sales of our

Still portfolio grew by 10.8% which was driven by the excellent

results in our Middle East region, reflecting an exceptional sales

performance during Ramadan 2019. Carbonates declined by 2.6% as a

result of the strong comparatives in our UK business from the

summer of 2018. Our gross profit grew by 7.9%, ahead of revenue

growth, with gross margin improving to 47.6% from 45.7% in 2018.

This pleasing result demonstrates the continued success of our

"Value over Volume" strategy.

All of the partners we work with across our entire business

continue to play an important role in helping us to achieve our

success and I would like to thank them all for their collaboration

and support during 2019.

UK Soft Drinks

(Statistics given below on the market are as measured by Nielsen

in the year to 28 December 2019.)

In 2019, volumes in the GBP8.7bn UK soft drinks market declined

by 2.4%. However, value sales grew by 0.8% against very strong

comparatives in the prior year (2018: +7.8%).

Within the soft drinks market, value growth was seen across

Cola, Energy, Iced Coffee and Fruit Carbonate categories. Fruit

drinks, Plain and Flavoured Water and Fruit Juice were all sectors

in decline in 2019.

Vimto grew in line with the total market, adding GBP0.8m to its

brand value (Nielsen data) in the twelve month period to a record

GBP90.3m.

The soft drinks category remains intensely competitive and

promotionally driven, but we continue to add value with our product

innovation under the sub brand Remix, growing at an impressive 30%

and adding GBP3.2m to the brand total year-on-year.

Vimto continues to outperform the market in Stills. Vimto Squash

achieved 8.7% growth versus a market decline of 1.4%, whilst Vimto

ready to drink has outperformed the market by 5.1 percentage

points.

All of our marketing campaigns in 2019 have been at the core of

driving the brand's growth. Our 'I see Vimto in you' campaign that

was launched successfully in the UK during 2018 was again used

throughout 2019. The teams received external recognition from the

industry for the success of the campaign by winning the Drum, Fab

and Prolific North Awards. Our consumers continue to love the

brand, as demonstrated by us achieving our highest ever household

penetration in the UK at 6.7m households (+500k households vs. 2018

as measured by Kantar).

Within the UK packaged sector, the exceptionally strong

performance of our dilutes portfolio has been the key driving force

of our success. We have achieved sales revenue growth of 15% in

2019. This has driven strong market share growth and has firmly

consolidated our position as the UK's No.2 squash brand.

Our continued focus on health has seen our 'No Added Sugar'

portfolio grow by 7% as consumer tastes and preferences continue to

evolve.

Innovation has once again played a crucial role in our success

and our Remix brand portfolio has delivered sales growth of 14%.

Offering new and exciting flavours is critical to bringing new

younger consumers into the brand to ensure Vimto's longevity in the

marketplace.

We continue to work in collaboration with all of our customers

across the UK grocery, foodservice, wholesale and discount

channels. We were proud to have been awarded The Grocer's 'Soft

Drinks Supplier of the Year Award', voted by our customers who

highlighted our strong category management approach, clear

long-term strategic focus and the high quality of our sales people.

We will continue to put our customers at the heart of what we do to

ensure we deliver long-term success together.

UK On-Trade

(As measured by CGA Total Out of Home, Licensed &

Foodservice in the 12 months to 31 October 2019.)

Soft drinks remain a hugely important part of Out of Home sales,

particularly when we look at the Licensed sector total drinks sales

mix. In Licensed outlets, soft drinks sales volume totals 750m

litres annually, representing a quarter share of total drinks sales

volume and nearly 15% of sales value.

When we look at the trends in comparison to other categories in

Licensed, the sales of soft drinks are in line with total drinks

sales and ahead of Beer, Cider & Wine. Soft drinks sales are

outperforming other categories, which have been greater impacted by

cautious consumer spending and a decline in eating out visits

compared to 2018.

In the UK, sales of soft drinks in Licensed & Foodservice

combined saw a drop in consumption during 2019 vs. 2018, as volume

declined 2.2% to 1.8 billion litres for the year. This was driven

by a 3.3% decline in Foodservice as well as the impact of the

number of Licensed & Foodservice outlets in the UK declining

1.8%.

Sales by value are up 1.3% year-on-year at GBP7.3bn for total

Out of Home. Value over volume sales have been driven through a

combination of premium sales in Licensed and taxation from the Soft

Drinks Industry Levy.

The Out of Home channel has delivered strong sales growth of 8%

in 2019. A key driver of this growth has been due to the launch of

our new ICEE Frozen Carbonated range, with leading edge equipment,

into the cinema channel. We have delivered a range of innovative

flavours, supported by a marketing campaign in venues and on cinema

screens.

Acquisitions have played a vital role in our success within Out

of Home in 2019. Having acquired The Noisy Drink Company North West

Limited in 2018, we made a further acquisition of one of our

distributor partners, Adrian Mecklenburgh Limited (AML), in

February 2019. AML sell both bag-in-box soft drinks and liquid

coffee via dispense equipment within the Kent region and also has

the rights to sell liquid coffee in partnership with Douwe Egberts

in both Kent and Central London. This now gives us the opportunity

to enter the fast growing coffee market with a strong branded

partner in key UK geographies.

A key pillar of our long-term strategy is to offer leading

brands across all of our markets and we are pleased to have secured

a new long-term partnership with Coca-Cola Europe Partners that

allows us to continue to offer our customers in the Out of Home

channel bag-in-box Coca-Cola.

We have also opened a new state of the art technical centre and

showroom in Swindon allowing our customers to see our world class

equipment and brands all under one roof. We have also created a new

technical apprenticeship scheme in conjunction with local

Governments, giving young people the opportunity to learn new

skills within our business.

Vimto International

Despite the backdrop of difficult trading conditions in the

Middle East region, in 2019 we have delivered one of our strongest

ever Ramadan campaigns; a fully integrated 360-degree marketing

campaign called '#Always Shining', coupled with outstanding

in-store execution, delivered 8% sales growth.

The '#Always Shining' campaign focused on the evolving role of

Middle Eastern women in their diverse roles from a warm, welcoming

family home to the busy world of work.

Innovation has played a pivotal role in our success across the

region in 2019. One example of this is the launch of a brand new

blue raspberry flavour in still 250ml PET plastic bottles and a

400ml carbonated range, which consumers have reacted very

positively to the flavour profile and the products have made a

significant contribution throughout the campaign.

Against some challenging trading conditions in Africa, we have

again opened new markets within the continent during the year. We

have partnered with Bakhresa, who are a well-established

distributor within Tanzania and launched a range of Vimto products

across the various trading channels. The products have been well

received by consumers during the season. Overall, sales within our

African region totalled GBP13.0m (2018: GBP13.6m), 3.8% behind the

prior year.

The momentum we have seen in the USA with our long-standing

partner, Ziyad, continues to progress well and with a strong focus

on in-store execution, double-digit sales growth was delivered

during the key summer trading period.

Across our European markets, we have focused on driving deeper

distribution, which has resulted in new business wins and strong

revenue growth.

Brand Licensing

Our brand licensing division ensure the iconic Vimto flavour is

enjoyed across a variety of ranges by our consumers and launched

some exciting new products during the year. A key highlight during

2019 was our Jelly Babies being awarded the 'Grocer Best Product

Award 2019'.

Andrew Milne

Chief Operating Officer

25 February 2020

Financial Review

Income Statement

Year ended 31 December Year ended 31 December

2019 2018

GBPm GBPm

----------------------- -----------------------

Revenue 147.0 142.0

----------------------- -----------------------

Gross Profit 70.0 64.9

----------------------- -----------------------

GP% 47.6% 45.7%

----------------------- -----------------------

Distribution expenses (7.4) (7.2)

----------------------- -----------------------

Operating expenses excluding

depreciation & amortisation (25.6) (23.8)

----------------------- -----------------------

EBITDA 37.0 33.8

----------------------- -----------------------

Depreciation & amortisation

excluding impact of

IFRS 16 (3.5) (2.2)

----------------------- -----------------------

Depreciation as a result (1.0) -

of IFRS 16

----------------------- -----------------------

Operating Profit 32.4 31.6

----------------------- -----------------------

Operating profit margin 22.1% 22.3%

----------------------- -----------------------

Finance income 0.2 0.2

----------------------- -----------------------

Finance expense (0.3) (0.1)

----------------------- -----------------------

Profit Before Tax 32.4 31.8

----------------------- -----------------------

PBT % 22.1% 22.4%

----------------------- -----------------------

Tax (5.6) (6.2)

----------------------- -----------------------

Profit after tax 26.8 25.5

----------------------- -----------------------

Revenue

Group revenue for the year was GBP147.0m, an increase of 3.5%

compared to 2018. Excluding the acquisition of Adrian Mecklenburgh

Limited (AML), like for like Group revenue was GBP144.0m, an

increase of 1.4% compared to 2018.

The year-on-year growth came entirely from the Still category,

where revenues increased by 10.8% to GBP71.7m (2018: GBP64.7m).

This growth was driven by the Vimto dilutes category in the UK

where sales were up 14.8% and shipments of Vimto concentrate to the

Middle East, which were 20.6% ahead of 2018, albeit against softer

prior year comparatives.

The Carbonate category sales were GBP75.3m, 2.6% down on the

prior year (2018: GBP77.4m) which was indicative of the industry

wide slow-down in 2019 in comparison to 2018, when we had the

record summer weather.

It is pleasing to report that both our UK and International

business delivered growth in the year, which again demonstrates the

value of our diversified business model.

Revenue FY 2019 FY 2018 Movement

GBPm GBPm

-------- -------- ---------

UK 117.5 114.6 +2.5%

-------- -------- ---------

International 29.5 27.4 +7.5%

-------- -------- ---------

Gross Profit

Gross Profit was GBP70.0m, an increase of 7.9% in comparison to

the prior year. The increase was relatively ahead of revenue

performance due to the strong growth in the Middle East. As a

result, Gross Margin improved to 47.6% from 45.7% in 2018.

Distribution Expenses

Distribution expenses totalled GBP7.4m which was a marginal

(2.6%) increase on the prior year and commensurate with UK revenue

growth, which incurs the majority of Nichols' distributions

costs.

Operating Expenses excluding Depreciation and Amortisation

Operating expenses excluding depreciation and amortisation were

GBP25.6m, an increase of GBP1.8m in comparison to 2018.

The significant cost increases during the year were:

-- GBP1.3m incremental overheads from the acquisition of AML

-- GBP1.0m net adverse forex cost in contrast to a gain in 2018

-- GBP0.4m incremental uplift in wages & salaries

A credit of GBP1.0m has been recognised within operating

expenses during the year, following a fair value assessment of the

deferred consideration payable as part of the acquisition of

AML.

Nichols plc adopted IFRS 16, Leases for the first time in 2019.

The Group adopted IFRS 16 using the modified retrospective

approach, without the restatement of comparative figures. This had

the effect of removing approximately GBP1.1m of lease charges from

operating expenses. However, the corresponding increase in

depreciation and finance charges negated any impact on Profit

Before Tax.

Earnings Before Interest, Tax, Depreciation and Amortisation

(EBITDA)

EBITDA for the year was GBP37.0m, an increase of 9.5% (GBP3.2m)

compared to the prior year.

As explained above, the adoption of IFRS 16 had the effect of

inflating EBITDA by GBP1.1m due to the removal of operating lease

charges. EBITDA on a like for like basis (i.e. excluding the impact

of IFRS 16) would have been GBP35.8m which would have been 5.9%

ahead of the prior year and still broadly in line with the Gross

Profit increase.

Depreciation and Amortisation

Like for like depreciation and amortisation has increased to

GBP3.5m from GBP2.2m in the prior year. The increase is mainly

caused by incremental depreciation of freezer equipment, which

supports the growth in our Out of Home business and additional

amortisation of intangibles associated with recent

acquisitions.

Additional depreciation as a result of adopting IFRS 16 is

approximately GBP1.0m for the year, which nets off against a

similar value of lease charges in prior years. Therefore, there is

no significant impact on Profit Before Tax from the adoption of

IFRS 16 and no cash impact.

Operating Profit

Operating Profit for the year was GBP32.4m, an increase of 2.5%

compared to 2018.

The operating margin was 22.1% which was similar to the prior

year (2018: 22.3%).

Finance Income and Expense

Finance income of GBP0.2m (2018: GBP0.2m) relates to the bank

interest received during the year on the Group's cash deposits.

The finance expense of GBP0.3m (2018: GBP0.1m) is made up of

GBP0.2m relating to IFRS16 interest charges and a GBP0.1m net

interest charge for the defined contribution pension scheme.

Profit Before Tax (PBT)

Profit Before Tax was GBP32.4m for the year, an increase of 2.1%

compared to the prior year (2018: GBP31.8m).

The margin return on sales was 22.1% compared to 22.4% in the

prior year.

Taxation

The effective rate of Corporation Tax for Nichols plc in 2019

was 17.2% (2018: 19.6%). This is lower than the standard rate of

19%.

Nichols plc repatriates all worldwide profit to the United

Kingdom.

Statement of Financial Position

The Group cash balance at the end of 2019 was GBP40.9m (2018:

GBP38.9m).

Nichols plc's business model continues to be very cash

generative, the operating profit cash conversion was 105% (2018:

91%). The cash conversion metric is calculated as 'net cash

generated from operating activities' as a percentage of 'profit for

the financial year'.

By exception, other points of note regarding the Statement of

Financial Position are as follows:

-- There has been a significant increase in the value of

property, plant and equipment during the year. The NBV at the

year-end was GBP21.7m compared to GBP14.6m in 2018. Increased

investment in freezer equipment to support the growth in our Out of

Home business (GBP4.0m) and leased assets capitalised (GBP4.6m) due

to the adoption of IFRS 16, as mentioned elsewhere, are the key

contributors to this increase.

-- The increase in goodwill of GBP4.1m is due to the acquisition

of AML referred to above. The total carrying value of goodwill at

the year end was GBP38.6m (2018: GBP34.5m).

-- Inventories of GBP8.3m were held at the year end (2018:

GBP7.2m), an increase of 16.7%. GBP0.3m of the increase is due to

the inclusion of stocks owned by AML following the acquisition.

-- Non-current liabilities - Trade and other payables. The

balance of GBP3.0m is largely the recognition of lease liabilities

as part of adopting IFRS 16 during the year.

-- It is pleasing to see the pension obligation has reduced to

GBP0.3m (2018: GBP2.8m). The reduction in the pension obligation is

due to a significant increase in the fair value of the scheme's

assets during the year.

KEY PERFORMANCE INDICATORS

The following Key Performance Indicators are used by management

to monitor the Group's profit performance:

Revenue Growth +3.5% (2018: +7.0%)

The increase in the current year's revenue as a percentage of

the prior year's value.

Gross Margin 47.6% (2018: 45.7%)

Gross Profit as a percentage of revenue. This KPI is monitored

at segment (Still and Carbonate) and product level.

Operating Profit Margin 22.1% (2018: 22.3%)

Group profit before financing income or expense as a percentage

of revenue. This is considered for the Group as a whole rather than

at product level.

EBITDA GBP37.0m (2018: GBP33.8m)

EBITDA is defined as profit before interest, tax, depreciation

and amortisation.

As mentioned above, Nichols has adopted IFRS16 during the year,

which has a positive effect on EBITDA, by adding back the expense

previously referred to as operating lease charges. Therefore, the

accounting change distorts the year on year comparison during this

year of transition. Without the IFRS 16 change, 2019 EBITDA would

have been GBP35.8m.

Tim Croston

Chief Financial Officer

25 February 2020

Consolidated income statement

Year ended 31 December 2019

2019 2018

Total Total

GBP'000 GBP'000

Revenue 146,985 142,037

Cost of sales (77,027) (77,170)

------------------------------ --------- -------------

Gross profit 69,958 64,867

Distribution expenses (7,423) (7,236)

Administrative expenses (30,096) (25,993)

------------------------------ --------- -------------

Operating profit 32,439 31,638

Finance income 235 192

Finance expense (252) (77)

Profit before taxation 32,422 31,753

Taxation (5,587) (6,238)

------------------------------ --------- -------------

Profit for the financial

year 26,835 25,515

------------------------------ --------- -------------

Earnings per share (basic) 72.81p 69.23p

Earnings per share (diluted) 72.77p 69.19p

All results relate to continuing operations.

Consolidated statement of comprehensive income

Year ended 31 December 2019

2019 2018

GBP'000 GBP'000

Profit for the financial year 26,835 25,515

Items that will not be reclassified

subsequently to profit or loss

Re-measurement of net defined

benefit liability 1,704 (412)

Deferred taxation on pension obligations

and employee benefits (297) (44)

Other comprehensive income/ (expense)

for the year 1,407 (456)

Total comprehensive income for

the year 28,242 25,059

Statement of financial position

Year ended 31 December 2019

Group Parent

2019 2018 2019 2018

ASSETS GBP'000 GBP'000 GBP'000 GBP'000

Non-current assets

Property, plant and equipment 21,742 14,572 7,098 4,430

Goodwill 38,585 34,451 2,504 2,504

Investments - - 16,566 16,566

Intangibles 8,065 7,748 1,316 1,316

Deferred tax assets 283 835 283 835

----------------------------------- -------- -------- -------- --------

Total non-current assets 68,675 57,606 27,767 25,651

Current assets

Inventories 8,361 7,164 4,402 3,894

Trade and other receivables 38,363 38,153 40,227 35,239

Cash and cash equivalents 40,944 38,896 20,094 20,070

----------------------------------- -------- -------- -------- --------

Total current assets 87,668 84,213 64,723 59,203

----------------------------------- -------- -------- -------- --------

Total assets 156,343 141,819 92,490 84,854

----------------------------------- -------- -------- -------- --------

LIABILITIES

Current liabilities

Trade and other payables 23,260 22,339 29,411 22,248

Current tax liabilities 2,675 2,814 99 391

Total current liabilities 25,935 25,153 29,510 22,639

Non-current liabilities

Other payables 3,028 - 1,791 -

Pension obligations and employee

benefits 253 2,755 253 2,755

Deferred tax liabilities 1,785 1,801 - -

-------- -------- -------- --------

Total non-current liabilities 5,066 4,556 2,044 2,755

Total liabilities 31,001 29,709 31,554 25,394

----------------------------------- -------- -------- -------- --------

Net assets 125,342 112,110 60,936 59,460

----------------------------------- -------- -------- -------- --------

EQUITY

Share capital 3,697 3,697 3,697 3,697

Share premium reserve 3,255 3,255 3,255 3,255

Capital redemption reserve 1,209 1,209 1,209 1,209

Other reserves 253 666 1,028 1,441

Retained earnings 116,928 103,283 51,747 49,858

Total equity 125,342 112,110 60,936 59,460

----------------------------------- -------- -------- -------- --------

Consolidated statement of cash flows

Year ended 31 December 2019

2019 2018

GBP'000 GBP'000 GBP'000 GBP'000

Cash flows from operating activities

Profit for the financial year 26,835 25,515

Adjustments for:

Depreciation and amortisation 4,541 2,179

Loss on sale of property, plant and

equipment 19 127

Finance income (235) (192)

Finance expense 252 77

Tax expense recognised in the income

statement 5,587 6,238

Change in inventories (925) (2,274)

Change in trade and other receivables 1,263 (3,347)

Change in trade and other payables (2,462) 1,197

Change in pension obligations (798) (578)

7,242 3,427

Cash generated from operating activities 34,077 28,942

Tax paid (5,888) (5,679)

--------- -----------

Net cash generated from operating

activities 28,189 23,263

Cash flows from investing activities

Finance income 235 192

Proceeds from sale of property, plant 11 -

and equipment

Acquisition of property, plant and

equipment (5,910) (3,857)

Acquisition of trade and assets - (143)

Acquisition of subsidiary (4,893) (3,814)

Net cash used in investing activities (10,557) (7,622)

Cash flows from financing activities

Payment of lease liabilities (1,118) -

Dividends paid (14,466) (12,803)

-------------------------------------------- ---------- --------- --------- -----------

Net cash used in financing activities (15,584) (12,803)

Net increase in cash and cash equivalents 2,048 2,838

Cash and cash equivalents at 1 January 38,896 36,058

-------------------------------------------- ---------- --------- --------- -----------

Cash and cash equivalents at 31 December 40,944 38,896

-------------------------------------------- ---------- --------- --------- -----------

Consolidated statement of changes in equity

Year ended 31 December 2019

Called Share Capital Other Retained Total

up share premium redemption reserves earnings equity

capital reserve reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 January 2018 3,697 3,255 1,209 134 91,027 99,322

Dividends - - - - (12,803) (12,803)

Movement in ESOT - - - 23 - 23

Credit to equity for

equity-settled share

based payments - - - 509 - 509

Transactions with owners - - - 532 (12,803) (12,271)

-------------------------- ---------- --------- ------------ ---------- ---------- ---------

Profit for the year - - - - 25,515 25,515

Other comprehensive

expense - - - - (456) (456)

-------------------------- ---------- --------- ------------ ---------- ---------- ---------

Total comprehensive

income - - - - 25,059 25,059

-------------------------- ---------- --------- ------------ ---------- ---------- ---------

At 1 January 2019 3,697 3,255 1,209 666 103,283 112,110

Dividends - - - - (14,466) (14,466)

Movement in ESOT - - - (214) - (214)

Debit to equity for

equity-settled share

based payments - - - (199) - (199)

Movement in deferred

tax - - - - (131) (131)

Transactions with owners - - - (413) (14,597) (15,010)

-------------------------- ---------- --------- ------------ ---------- ---------- ---------

Profit for the year - - - - 26,835 26,835

Other comprehensive

income - - - - 1,407 1,407

-------------------------- ---------- --------- ------------ ---------- ---------- ---------

Total comprehensive

income - - - - 28,242 28,242

-------------------------- ---------- --------- ------------ ---------- ---------- ---------

At 31 December 2019 3,697 3,255 1,209 253 116,928 125,342

-------------------------- ---------- --------- ------------ ---------- ---------- ---------

Nichols plc

NOTES TO THE PRELIMINARY FINANCIAL INFORMATION

Basis of preparation

The preliminary financial information does not constitute

statutory accounts for the financial years ended 31 December 2019

and 31 December 2018, but has been derived from those accounts.

With effect from 1 January 2019, the Group has implemented two new

accounting standards; IFRS 16, Leases and IFRIC 23, Uncertainty

Over Tax Treatments. All other accounting policies remained

unchanged from those set out in the 2018 annual report.

The adoption of IFRS 16 has resulted in the Group identifying

non-cancellable operating lease commitments relating to property

leases for operational sites and motor vehicles. The Group has

applied the modified retrospective transition approach to its

leases with effect from 1 January 2019, whereby the asset and

liability values recognised are equal to one another, with no

adjustment to opening reserves. The impact of adopting IFRS 16 on a

modified retrospective basis was therefore to recognise a

right-of-use asset and a lease liability of GBP3.1m at 1 January

2019.

IFRIC 23 provides guidance on the accounting for current and

deferred tax liabilities and assets in circumstances in which there

is uncertainty over income tax treatments. The Group elected to

apply IFRIC 23 retrospectively with the cumulative effect recorded

in retained earnings as at the date of initial application, being 1

January 2019. The adoption of IFRIC 23 has had no material effect

on transition.

Statutory accounts for 2018 have been delivered to the Registrar

of Companies and those for the financial year ended 31 December

2019 will be delivered following the Company's Annual General

Meeting. The auditors have reported on those accounts and their

reports were unqualified, did not draw attention to any matters by

way of emphasis, and did not contain a statement under 498(2) or

498(3) of the Companies Act 2006.

Earnings per share

The calculation of basic earnings per share is based on earnings

attributable to ordinary shareholders divided by the weighted

average number of shares in issue during the year. Shares held in

the Employee Share Ownership Trust and Employee Benefit Trust are

treated as cancelled for the purposes of this calculation.

The calculation of diluted earnings per share is based on the

basic earnings per share adjusted to allow for the assumed

conversion of all dilutive options.

Basic earnings per share is 72.81 pence (2018: 69.23 pence).

Segmental information

The Board analyses the Group's internal reports to enable an

assessment of performance and allocation of resources. The

operating segments are based on these reports.

The Board considers the business from a product perspective and

reviews the Group on the operating segments identified below. There

has been no change to the segments during the year. Based on the

nature of the products sold by the Group, the types of customers

and methods of distribution, management consider reporting

operating segments at the Still and Carbonate level to be

reasonable. Gross profit is the measure used to assess the

performance of each operating segment as identified as a KPI in the

annual report.

Revenue Gross Profit

2019 2018 2019 2018

GBP'000 GBP'000 GBP'000 GBP'000

Still 71,661 64,683 42,712 35,398

Carbonate 75,324 77,354 27,246 29,469

Total 146,985 142,037 69,958 64,867

There are no sales between the two operating segments, and all

revenue is earned from external customers.

The operating segments gross profit is reconciled to profit

before taxation as per the consolidated income statement.

The Group's assets are managed centrally by the Board and

consequently there is no reconciliation between the Group's assets

per the statement of financial position and the segment assets.

Annual report

The annual report will be mailed to shareholders and made

available on our website on or around 16 March 2020. Copies will be

available after that date from: The Secretary, Nichols plc, Laurel

House, Woodlands Park, Ashton Road, Newton-le-Willows, WA12

0HH.

Annual General Meeting

The Annual General Meeting will be held at Nichols plc, Laurel

House, Woodlands Park, Ashton Road, Newton-le-Willows, WA12 0HH on

Wednesday 29 April 2020 at 11.00am.

Copies of the announcement can be found on the Investor

Relations section of the Company's website:

www.nicholsplc.co.uk.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR TAMFTMTJTBRM

(END) Dow Jones Newswires

February 26, 2020 02:00 ET (07:00 GMT)

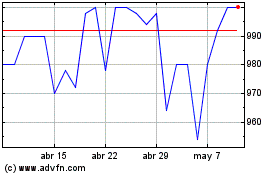

Nichols (LSE:NICL)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Nichols (LSE:NICL)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024