TIDMNAR

RNS Number : 7453E

Northamber PLC

03 March 2020

Northamber PLC

("Northamber" or the "Company" or the "Group")

Interim Report for the Six months to 31 December 2019

Chairman's Statement

Results

It is pleasing to be able to report that we have seen revenues

increase in the first half from GBP24.2 million to GBP26.3 million

for the comparative period last year especially as this has been

combined with an increase of percentage Gross Margin from 8.41% to

8.76%; the cumulative effect of both was to increase Gross Profit

from GBP2.04 million to GBP2.3 million. Revenue and margin growth

has been supported by growth from some of our strategic focus areas

including Audio Visual and Solutions.

To support this increase in Gross Profit and the planned

continued growth in Gross Profits our Distribution costs increased

year on year from GBP1.39 million to GBP1.53 million.

Administrative costs remained largely consistent year on year as we

continued our focus on cost management meaning that our loss from

operations for the first half was reduced from GBP0.5 million to

GBP0.4million.

The Group sold its Weybridge distribution centre for GBP16.4

million against a net book value of GBP6.02 million. The Group also

paid GBP0.18 million for legal and professional costs for the sale

of the property. The gain on the sale is reported as an Exceptional

Item. The Board were cautious to ensure this sale would not disrupt

our core operations and were pleased to have agreed a sale and

leaseback on the Weybridge distribution centre (at a rental cost of

GBP85k for the first half) to allow us time to find a new suitable

site and effect a move with the minimum possible disruption to our

trading activity. A new warehouse has been purchased in Swindon for

GBP3.2 million and we expect to complete the move from Weybridge

during the second half of this financial year.

Financial position

Maintaining our prudence in financial matters, our working

capital management is reflected in the Net Current Assets ratio

which at 3.7 times (2018: 2.6 times) is a significant

improvement.

Cash was GBP14.7 million at 31 December 2019 compared with

GBP2.9 million at 31 December 2018, reflecting the sale of the

distribution centre and the purchase of the new warehouse property.

With Fixed Assets at book value at GBP5.2 million, including two

unencumbered freehold properties, the Company's overall financial

position is sound.

Net Assets at 91.3p per share are considerably in excess of the

average price of the ordinary shares throughout the period.

Board

With great sadness, we lost our founder and Chairman David

Phillips in December 2019. David made a very significant

contribution to the development and leadership of the Company since

he founded Northamber in 1980 and he will be greatly missed.

We are pleased to welcome David's son Alex Phillips who has

recently joined our very experienced Board as Commercial Director.

Alex joined the Company in 2013 as Director of Strategy and gained

valuable experience of the business and the wider sector.

Dividend

As in previous years, your Board has had regard to the strength

of our debt free, tangible asset strong balance sheet and is

proposing the interim dividend be 0.3p, at a total cost of

GBP82,070. The dividend will be paid on 15 May 2020 to shareholders

on the register as at 16 April 2020.

Staff

We continue to invest in our evolving business model with added

skills based services and which are heavily reliant on our staff to

achieve our business case evolution and I am very grateful to all

of our staff for their continued support and flexibility.

Event after the reporting date.

In January 2020 the Company acquired Audio Visual Material

Limited (AVM), an Audio Visual Distributor, to enhance and expand

Northamber's specialist AV division to focus on driving higher

margin profitable growth. I am pleased to report the integration of

AVM is going well and the Board is confident that the business will

make an important contribution to Northamber in the years

ahead.

Outlook

Whilst we are optimistic in the long-term strategy, we remain

cautious due to the economic uncertainty, Brexit and the potential

impact of coronavirus on the supply chain. Our continued focus on

the new higher margin value categories continues to be an area we

are confident and excited about, and where we see future

opportunities for organic growth. We will continue to review

non-organic opportunities for growth should an appropriate

acquisition be identified which meets our strict criteria and adds

value for our shareholders.

G.P.Walters

Acting Chairman

3 March 2020

Consolidated Statement of Comprehensive Income

6 months to 31 December 2019

6 months 6 months Year

Ended Ended Ended

31.12.19 31.12.18 30.06.19

GBP'000 GBP'000 GBP'000

Unaudited Unaudited Audited

Revenue 26,273 24,234 50,329

Cost of sales (23,972) (22,197) (45,998)

---------- ------------ ---------

Gross Profit 2,301 2,037 4,331

Distribution cost (1,533) (1,392) (2,849)

Administrative costs (1,152) (1,142) (2,352)

---------- ------------ ---------

Loss from operations (384) (497) (870)

Investment revenue 167 144 272

---------- ------------ ---------

Loss before Exceptional

Items and tax (217) (353) (598)

Exceptional Item 10,203 - -

---------- ------------ ---------

Profit/ (Loss) before Tax 9,986 (353) (598)

Tax(charge) (1,643) - -

---------- ------------ ---------

Profit/(Loss) and total

comprehensive income

for the period 8,343 (353) (598)

---------- ------------ ---------

Basic and diluted profit/

(loss) per ordinary share 30.50p (1.28)p (2.17)p

Consolidated Statement of Financial

Position

As at 31 December 2019

As at As at As at

31.12.19 31.12.18 30.06.19

GBP'000 GBP'000 GBP'000

Unaudited Unaudited Audited

Non current assets

Property, plant and equipment 5,169 7,799 1,792

---------- ---------- ---------

Current assets

Inventories 4,458 4,193 3,320

Trade and other receivables 8,137 7,662 9,492

Cash and cash equivalents 14,675 2,931 3,446

Assets classified as held

for sale - - 6,019

27,270 14,786 22,277

---------- ---------- ---------

Total assets 32,439 22,585 24,069

---------- ---------- ---------

Current liabilities

Trade and other payables (7,461) (5,643) (7,434)

---------- ---------- ---------

Total liabilities (7,461) (5,643) (7,434)

---------- ---------- ---------

Net assets 24,978 16,942 16,635

---------- ---------- ---------

Equity

Share capital 273 273 273

Share premium account 5,734 5,734 5,734

Capital redemption reserve

fund 1,513 1,513 1,513

Treasury shares (7) - (7)

Retained earnings 17,465 9,422 9,122

Equity shareholders' funds 24,978 16,942 16,635

---------- ---------- ---------

Company Statement of Financial Position

As at 31 December 2019

As at As at As at

31.12.19 31.12.18 30.06.19

GBP'000 GBP'000 GBP'000

Unaudited Unaudited Audited

Non current assets

Property, plant and equipment 1,730 1,783 1,792

Investments 6,588 6,588 6,588

---------- ---------- ---------

8,318 8,371 8,380

Current assets

Inventories 4,458 4,193 3,320

Trade and other receivables 7,974 7,665 9,492

Cash and cash equivalents 3,012 2,871 3,320

15,444 14,729 16,132

---------- ---------- ---------

Total assets 23,762 23,100 24,512

---------- ---------- ---------

Current liabilities

Trade and other payables (10,945) (9,442) (11,412)

---------- ---------- ---------

Total liabilities (10,945) (9,442) (11,412)

---------- ---------- ---------

Net assets 12,817 13,658 13,100

---------- ---------- ---------

Equity

Share capital 273 273 273

Share premium account 5,734 5,734 5,734

Capital redemption reserve

fund 1,513 1,513 1,513

Treasury shares (7) - (7)

Retained earnings 5,304 6,138 5,587

Equity shareholders' funds 12,817 13,658 13,100

---------- ---------- ---------

Consolidated Statement of Changes

in Equity

As at 31 December 2019

Share Capital

Share premium redemption Treasury Retained Total

capital account reserve Shares earnings Equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Period to 31 December

2018

Unaudited

Balance at 1 July 2018 281 5,734 1,505 - 10,000 17,520

Dividends - - - - - -

Loss and total comprehensive

Purchase of own Shares

for cancellation (8) - 8 (225) (225)

loss for the period - - - - (353) (353)

---------- --------- --------------------- --------- -----------

Balance at 31 December

2018 273 5,734 1,513 - 9,422 16,942

---------- --------- --------------------- --------- ----------- --------

Period to 31 December

2019

Unaudited

Balance at 1 July 2019 273 5,734 1,513 (7) 9,122 16,635

Dividends - - - - - -

Profit and total comprehensive - - - - 8,343 8,343

Profit for the period

---------- --------- --------------------- --------- -----------

Balance at 31 December

2019 273 5,734 1,513 (7) 17,465 24,978

---------- --------- --------------------- --------- ----------- --------

Year to 30 June 2019

Audited

Balance at 1 July 2018 281 5,734 1,505 - 10,000 17,520

Dividends - - - - (55) (55)

Purchase and cancellation

of shares (8) 8 (225) (225)

Purchase of Treasury

shares (7) (7)

Transactions with owners (8) - 8 (7) (280) (287)

Loss and total comprehensive

loss for the period - - - (598) (598)

---------- --------- --------------------- --------- -----------

Balance at 30 June

2019 273 5,734 1,513 (7) 9,122 16,635

---------- --------- --------------------- --------- ----------- --------

Company Statement of Changes in Equity

As at 31 December 2019

Share Capital

Share premium redemption Treasury Retained Total

capital account reserve Shares earnings Equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Period to 31 December

2018

Unaudited

Balance at 1 July 2018 281 5,734 1,505 - 6,980 14,500

Dividends - - - - -

Purchase and cancellation

of shares (8) - 8 (225) (225)

Loss and total comprehensive

loss for the period - - - - (617) (617)

--------- --------- ------------ --------- ----------

Balance at 31 December

2018 273 5,734 1,513 - 6,138 13,658

--------- --------- ------------ --------- ---------- --------

Period to 31 December

2019

Unaudited

Balance at 1 July 2019 273 5,734 1,513 (7) 5,587 13,100

Dividends - - - - -

Purchase of own shares

for cancellation - -

Loss and total comprehensive

loss for the period - - - - (283) (283)

--------- --------- ------------ --------- ----------

Balance at 31 December

2019 273 5,734 1,513 (7) 5,304 12,817

--------- --------- ------------ --------- ---------- --------

Year to 30 June 2019

Audited

Balance at 1 July 2018 281 5,734 1,505 6,980 14,500

Dividends - - - (55) (55)

Purchase and cancellation

of shares (8) 8 (225) (225)

Purchase of Treasury

shares (7) (7)

Transactions with owners (8) - 8 (7) (280) (287)

Loss and total comprehensive

loss for the period - - - - (1,113) (1,113)

--------- --------- ------------ --------- ----------

Balance at 30 June

2019 273 5,734 1,513 (7) 5,587 13,100

--------- --------- ------------ --------- ---------- --------

Consolidated Statement of Cash

Flows

6 months to 31 December 2019

6 months 6 months Year

Ended Ended Ended

31.12.19 31.12.18 30.06.19

GBP'000 GBP'000 GBP'000

Unaudited Unaudited Audited

Cash from operating activities

Operating (loss) from

continuing operations (384) (497) (870)

Depreciation of property,

plant

and equipment 62 95 153

(Profit)/loss on disposal

of property, - - -

plant and equipment

-------------- ---------- -----------

Operating (loss) before changes

in

working capital (322) (402) (717)

(Increase)/decrease in inventories (1,138) (815) 58

Decrease/(increase) in trade

and

other receivables 1,355 483 (1,346)

(Decrease)/increase in trade

and

other payables (1,616) (1,321) 470

-------------- ---------- -----------

Cash (used)/generated from

operations (1,721) (2,055) (1,535)

Income taxes received/(paid) - - -

Net cash from operating activities (1,721) (2,055) (1,535)

-------------- ---------- -----------

Cash flows from investing

activities

Interest received 167 144 272

Proceeds from disposal of

property,

plant and equipment 16,222 - -

Purchase of property, plant

and

Equipment (3,439) - (71)

Net cash from investing activities 12,950 144 201

-------------- ---------- -----------

Cash flows from financing

activities

Dividends paid to equity shareholders - - (55)

Purchase of own shares for

cancellation - (225) (225)

Purchase of Treasury shares - - (7)

Net cash used in financing

activities - (225) (287)

-------------- ---------- -----------

Net (decrease)/increase in

cash and

cash equivalents 11,229 (2,136) (1,621)

Cash and cash equivalents

at

beginning of period 3,446 5,067 5,067

-------------- ---------- -----------

Cash and cash equivalents at end

of period 14,675 2,931 3,446

-------------- ---------- -----------

Company Statement of Cash Flows

6 months to 31 December 2019

6 months 6 months Year

Ended Ended Ended

31.12.19 31.12.18 30.06.19

GBP'000 GBP'000 GBP'000

Unaudited Unaudited Audited

Cash from operating activities

Operating (loss) from

continuing operations (393) (696) (1,385)

Depreciation of property, plant

and equipment 62 58 120

(Profit)/loss on disposal of

property,

plant and equipment - - -

---------- ---------- -----------

Operating (loss) before changes

in

working capital (331) (638) (1,265)

(Increase)/decrease in inventories (1,138) (815) 58

Decrease/(increase) in trade

and

other receivables 1,518 480 (1,347)

(Decrease)/increase in trade

and

other payables (467) (1,044) 926

---------- ---------- -----------

Cash (used)/generated from operations (418) (2,017) (1,628)

Income taxes received/(paid) - - -

Net cash from operating activities (418) (2,017) (1,628)

---------- ---------- -----------

Cash flows from investing activities

Interest received 110 79 272

Proceeds from disposal of property,

plant and equipment - - -

Purchase of property, plant

and

Equipment - - (71)

Net cash from investing activities 110 79 201

---------- ---------- -----------

Cash flows from financing activities

Dividends paid to equity shareholders - - (55)

Purchase of own shares for cancellation - (225) (225)

Purchase of Treasury shares - - (7)

---------- ---------- -----------

Net cash used in financing activities - (225) (287)

---------- ---------- -----------

Net (decrease)/increase in cash

and

cash equivalents (308) (2,163) (1,714)

Cash and cash equivalents at

beginning of period 3,320 5,034 5,034

---------- ---------- -----------

Cash and cash equivalents at end

of period 3,012 2,871 3,320

---------- ---------- -----------

Notes to the financial statements

1. Corporate Information

The financial information for the half year ended 31 December

2019 set out in this interim report does not constitute statutory

accounts as defined in Section 434 of the Companies Act 2006. The

Group's statutory financial statements for the year ended 30 June

2019 have been filed with the Registrar of Companies. The auditor's

report on those financial statements was unqualified and did not

contain statements under Sections 498(2) and 498(3) of the

Companies Act 2006. The interim results are unaudited. Northamber

Plc is a public limited company incorporated and domiciled in

England and Wales. The Company's shares are publicly traded on the

London Stock Exchange's AIM market.

2. Basis of preparation

These interim consolidated financial statements are for the six

months ended 31 December 2019. They have been prepared in

accordance with IAS34 Interim Financial Reporting. They do not

include all the information required for full annual financial

statements, and should be read in conjunction with the consolidated

financial statements of the Group for the year ended 30 June

2019.

These interim consolidated financial statements have been

prepared under the historical cost convention.

These interim consolidated financial statements (the interim

financial statements) have been prepared in accordance with

accounting policies adopted in the last annual financial statements

for the year to 30 June 2019 except for the adoption of IAS1

Presentation of Financial Statements (Revised 2007).

The adoption of IAS1 (Revised 2007) does not affect the

financial position or profits of the Group, but gives rise to

additional disclosures. The measurement and recognition of the

Group's assets, liabilities, income and expenses is unchanged. A

separate 'Statement of changes in equity' is now presented.

The accounting policies have been applied consistently

throughout the Group for the purposes of preparation of these

interim consolidated financial statements.

3. Basis of Consolidation

For the periods covered in these interim consolidated financial

statements all trading has been carried out by the parent company

alone. The Group includes some non-trading dormant subsidiaries.

All the assets and liabilities of all subsidiaries have been

included in the statements of financial position.

4. Segmental Reporting

Although the sales of the Group are predominantly to the UK

there are sales to other countries and the following schedule sets

out the split of the sales for the period. Revenue is attributable

to individual countries based on the location of the customer.

There are no non current assets outside the UK.

UK Other Total

GBP'000 GBP'000 GBP'000

6 months to December 2019

Total Segment revenue 26,172 101 26,273

Year to 30 June 2019

Total Segment revenue 49,655 674 50,329

One customer accounted for more than 10% of the Group's revenue

for the period, being GBP3.27million.

5. Taxation

The interim period tax charge is accrued on the estimated

average annual effective tax rate of 19%.

6. Earnings per Share

The calculation of earnings per share is based on the Profit

after tax for the six months to 31 December 2019 of GBP8,343,000

(2018: loss GBP353,000) and a weighted average of 27,356,586 (2018:

27,639,779) ordinary shares in issue.

7. Property, Plant and Equipment

The Group sold its freehold distribution centre on 8 July 2019

and purchased a new warehouse property on 12 December 2019.

8. Risks and Uncertainties

The principal risks and uncertainties affecting the business

activities of the Group are detailed in the strategic report which

can be found on pages 7 to 11 of the Annual Report and Accounts for

the year ended 30 June 2019 (the Annual Report). A copy of the

Annual Report is available on the Company's web site at

www.northamber.com.

The risks affecting the business remain the same as in the

Annual Report. In summary these include:-

Market risk particularly those relating to the suppliers of

products to the Group

Financial risks including exchange rate risk, liquidity risk,

interest rate risk and credit risk

In the opinion of the Directors, these will remain the principal

risks for the remainder of the year, however, the Directors have

reviewed the Company's risk analysis and are of the opinion that

steps have been taken to minimise the potential impact of such

risks.

9. Related Party Transactions

Mr D M Phillips (Deceased) is the ultimate controlling party of

the Company.

During the six months period, the Company paid GBP12,925 (2018:

GBP235,500) rent to Anitass Limited, a wholly owned subsidiary. At

31 December 2019 Northamber plc owed Anitass Ltd GBP4,510,000

(2018: GBP3,793,000).

10. Directors' Confirmation

The Directors confirm that to the best of their knowledge these

condensed consolidated half year financial statements have been

prepared in accordance with IAS 34 and that the interim management

report herein includes a fair review of the information required by

DTR 4.2.7R, an indication of important events during the first 6

months and descriptions of principal risks and uncertainties for

the remaining six months of the year, and DTR 4.2.8R the disclosure

of related party transactions and changes therein.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR JTMFTMTBMBAM

(END) Dow Jones Newswires

March 03, 2020 02:00 ET (07:00 GMT)

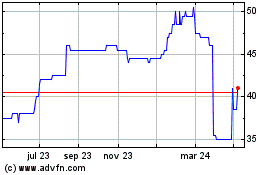

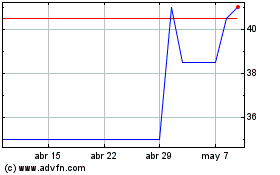

Northamber (LSE:NAR)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Northamber (LSE:NAR)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024