TIDMPYC

RNS Number : 7493E

Physiomics PLC

03 March 2020

3 March 2020

Physiomics Plc

("Physiomics") or (the "Company")

Interim Results Statement

for the six-month period ended 31 December 2019

Physiomics plc (AIM: PYC), the oncology consultancy using

mathematical models and its Virtual Tumour(TM) technology to

support the development of cancer treatment regimens and

personalised medicine solutions, today announces its financial

results for the six months ended 31 December 2019.

Summary financial results

-- Revenue of GBP343k (six months ended 31 December 2018: GBP324k)

-- Total income of GBP343k (six months ended 31 December 2018: GBP372k*)

-- Operating loss of GBP118k (six months ended 31 December 2018: GBP113k)

-- Cash and cash equivalents of GBP434k at 31 December 2019 (31 December 2018: GBP552k)

-- Shareholders' funds of GBP532k at 31 December 2019 (31 December 2018: GBP639k)

* Total income for the six months ended 31 December 2018

includes other operating income , being grant income , of GBP48k .

No grant income is included in the six months ended 31 December

2019.

Operational highlights

Key events in the period include:

-- Agreement with Bicycle Therapeutics and CRUK to analyse

clinical data from the first in man study of BT1718

-- Continued relationship with Merck KGaA for the provision of a

range of modelling and simulation services during the course of

2020

-- Follow-on contract with CellCentric Ltd for

pharmacokinetic/pharmacodynamic (PKPD) modelling in support of the

clinical development of its lead clinical asset CCS1477

Key event after the period end:

-- Two further contracts of undisclosed value with existing

client Bicycle Therapeutics have been announced today

Chairman and CEO's statement

Introduction

Revenue in the first half was around 6% ahead of the comparable

period in 2018, although total income was around 8% lower, as no

grant income was received during the period. Despite this,

operating losses were held steady at GBP118k, just GBP5k more than

the previous period. Careful management of cash helped the Company

to achieve a net cash inflow of GBP29k during the period, with the

Company having cash and cash equivalents of GBP434k as at 31

December 2019 (30 June 2019: GBP405k). The second half revenues for

the last two financial years have significantly exceeded those of

the first half and the Board expects this trend to continue in the

current financial year. Notably, in the last financial year, the

majority of the Company's grant income was recognised in the first

half whereas in the current financial year, any grant income

received would start to be recognised in the second half (January

to June 2020).

Business strategy update

The Company is very pleased to be attracting follow-on projects

with a range of clients including CellCentric and Bicycle

Therapeutics, as well as its long-term client Merck KGaA ("Merck").

These projects span a number of key approaches to cancer therapy,

including immuno-oncology, radiotherapy and DNA damage/repair

agents. In parallel with ensuring repeat business, the Company is

highly focused on identifying new clients and, to this end, it has

made, and will continue to make, significant investments in

marketing, including:

-- Attendance at key industry conferences;

-- Additional external business development support to

complement internal capabilities/capacity;

-- Digital marketing via targeted advertisements on the widely

used business platform, LinkedIn;

-- Subscription to databases allowing the Company to track

potential oncology clients as they attract funding and progress

their programs to stages of development where we can support them;

and

-- Direct marketing telephone campaigns targeted at relevant potential clients.

The Company is also in the final stages of securing a further

grant in respect of its personalised oncology offering. A further

announcement will be made in due course, as and when

appropriate.

Outlook

We are looking forward to a solid second half underpinned by

significant contracted revenues from Merck, Bicycle Therapeutics

and CellCentric, as well as other potential projects with existing

and new clients.

Enquiries:

Physiomics plc

Dr Jim Millen, CEO

+44 (0)1865 784 980

Strand Hanson Ltd (NOMAD)

Richard Tulloch & James Dance

+44 (0)20 7409 3494

Hybridan LLP (Broker)

Claire Louise Noyce

+44 (0)20 3764 2341

Notes to Editor

About Physiomics

Physiomics(R) is an oncology consultancy which uses mathematical

PKPD models as well as its proprietary Virtual Tumour(TM)

technology to predict the effects of cancer drugs and treatments

and improve the success rate of drug discovery and development

projects. The predictive capability of Virtual Tumour has been

confirmed by 55 projects, involving over 25 targets and 60 drugs,

and has worked with clients such as Merck, Merck & Co, Bayer

and Lilly.

Based in Oxford UK, the Company works with clients worldwide to

support their pre-clinical and clinical oncology development

programs. Its team of scientists and computer modelling experts

provide bespoke solutions encompassing data, analytics and insight.

Physiomics senior management has academic and commercial expertise,

including over 90 years collectively of working in oncology and/or

computational biology and over 100 publications in peer reviewed

journals.

For more information please visit:

www.physiomics-plc.com

www.twitter.com/Physiomics

www.linkedin.com/company/physiomics-plc/

Physiomics Plc

Unaudited Statement of Comprehensive Income for the half year ended 31 December 2019

Unaudited Unaudited Audited

Half year to Half year to Year ended

31-Dec-19 31-Dec-18 30-Jun-19

GBP'000 GBP'000 GBP'000

Revenue 343 324 719

Other operating income - 48 64

Total income 343 372 783

Operating expenses before exceptional costs (461) (485) (984)

Operating loss and loss before taxation (118) (113) (201)

UK corporation tax 36 49 97

Loss for the period attributable to equity shareholders (82) (64) (104)

--------------- --------------- -----------

Loss per share (pence)

Basic and diluted (0.11) p (0.09) p (0.14) p

Physiomics Plc

Unaudited Statement of financial position as at 31 December 2019

Unaudited Unaudited Audited

As at As at As at

31-Dec-19 31-Dec-18 30-Jun-19

GBP'000 GBP'000 GBP'000

Non-current assets

Intangible assets 4 - 1

Property, plant and equipment 14 19 19

18 19 20

Current assets

Trade and other receivables 152 269 269

Cash and cash equivalents 434 552 405

586 821 674

Total assets 604 840 694

------------ ---------- -----------

Current liabilities

Trade and other payables (72) (61) (85)

Deferred revenue - (140) (1)

------------ ---------- -----------

Total liabilities (72) (201) (86)

------------ ---------- -----------

Net assets 532 639 608

------------ ---------- -----------

Capital and reserves

Share capital 1,181 1,181 1,181

Capital reserves 5,426 5,411 5,420

Profit & loss account (6,075) (5,953) (5,993)

Equity shareholders' funds 532 639 608

------------ ---------- -----------

Physiomics Plc

Unaudited Statement of changes in equity for the half year ended 31 December 2019

Share Share-based Total

Share premium compensation Retained shareholders'

capital account reserve earnings funds

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 July 2018 1,181 5,228 170 (5,889) 690

Transfer to other reserves - - 13 - 13

Loss for the period - - - (64) (64)

At 31 December 2018 1,181 5,228 183 (5,953) 639

Transfer to other reserves - - 9 - 9

Loss for the period - - - (40) (40)

At 30 June 2019 1,181 5,228 192 (5,993) 608

Transfer to other reserves - - 6 - 6

Loss for the period - - - (82) (82)

At 31 December 2019 1,181 5,228 198 (6,075) 532

Physiomics Plc

Unaudited Cash Flow Statement for the half year ended 31 December 2019

Unaudited Unaudited Audited

Half year to Half year to Year ended

31-Dec-19 31-Dec-18 30-Jun-19

GBP'000 GBP'000 GBP'000

Cash flows from operating activities:

Operating loss (118) (113) (201)

Amortisation and depreciation 5 3 8

Share-based compensation 7 13 22

(Increase) decrease in receivables 57 (30) (13)

Increase / (decrease) in payables (12) 5 25

Increase / (decrease) in deferred revenue (1) 72 (67)

Cash generated from operations (62) (50) (226)

UK corporation tax received 95 47 82

Net cash generated from operating activities 33 (3) (144)

Cash flows from investing activities:

Purchase of non-current assets, net of grants received (4) (17) (23)

Net cash used by investing activities (4) (17) (23)

------------- ------------- -----------

Net (decrease) / increase in cash and cash equivalents 29 (20) (167)

Cash and cash equivalents at beginning of period 405 572 572

Cash and cash equivalents at end of period 434 552 405

------------- ------------- -----------

Physiomics Plc

Notes to the Interim Financial Statements

1. General information

Physiomics Plc is a public limited company ("the Company")

incorporated in England & Wales (registration number 4225086).

The Company is domiciled in the United Kingdom and its registered

address is The Magdalen Centre, Robert Robinson Avenue, The Oxford

Science Park, Oxford, OX4 4GA. The Company's ordinary shares are

traded on the AIM Market of the London Stock Exchange ("AIM").

Copies of the interim report are available from the Company's

website, www.physiomics-plc.com. Further copies of the Interim

Report and Annual Report and Accounts may be obtained from the

address above.

The Company's principal activity is the provision of services to

pharmaceutical companies in the area of outsourced systems and

computational biology.

2. Basis of preparation

The interim financial statements of the Company for the six

months ended 31 December 2019, which are unaudited, have been

prepared in accordance with the accounting policies set out in the

annual report and accounts for the year ended 30 June 2019, which

were prepared under International Financial Reporting Standards

("IFRS").

The financial information contained in the interim report does

not constitute statutory accounts as defined in Section 435 of the

Companies Act 2006. The financial information for the full

preceding year is based on the statutory accounts for the year

ended 30 June 2019. Those accounts, upon which the auditors,

Shipleys LLP, issued a report which was unqualified but contained

an emphasis of matter paragraph, have been delivered to the

Registrar of Companies.

As permitted, this interim report has been prepared in

accordance with the AIM Rules for Companies and not in accordance

with IAS 34 "Interim Financial Reporting" therefore it is not fully

compliant with IFRS.

The interim financial statements are presented in sterling and

all values are rounded to the nearest thousand pounds (GBP'000)

except when otherwise indicated.

3. Loss per share

Basic loss per share is 0.11p (H1 2018: loss per share 0.09p).

The basic loss per ordinary share is calculated by dividing the

loss of GBP82,148 (H1 2018: loss GBP63,935) by 71,910,394 (H1 2018:

71,910,394), the weighted average number of shares in issue during

the period.

The loss attributable to equity holders (holders of ordinary

shares) of the Company for calculating the fully diluted loss per

share is identical to that used for calculating the loss per share.

The exercise of share options would have the effect of reducing the

loss per share and is therefore anti- dilutive.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR EAKDAEDKEEFA

(END) Dow Jones Newswires

March 03, 2020 02:01 ET (07:01 GMT)

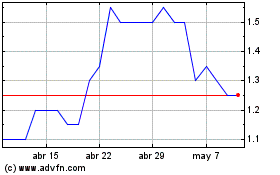

Physiomics (LSE:PYC)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Physiomics (LSE:PYC)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024