Amended Statement of Beneficial Ownership (sc 13d/a)

10 Marzo 2020 - 8:00AM

Edgar (US Regulatory)

Securities

and Exchange Commission, Washington, D.C. 20549

SCHEDULE

13D

Under

the Securities Exchange Act of 1934

AMENDMENT

NO. 2*

APTORUM

GROUP LIMITED

(Name

of Issuer)

Class A Ordinary Shares, $1.00 par value per share

(Title of Class of Securities)

G6096M106

(CUSIP

Number)

17th Floor,

Guangdong Investment Tower

148

Connaught Road Central

Hong

Kong

Telephone:

+852 2117 6611

(Name,

Address and Telephone Number of Person Authorized to Receive Notices and Communications)

February

28, 2020

(Date

of Event which Requires Filing of this Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition which is the subject of this Schedule

13D, and is filing this schedule because of Rule 13d-1(e), 13-1(f) or 13d-1(g), check the following box ☐.

*

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to

the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided

in a prior cover page.

The

information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section

18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act

but shall be subject to all other provisions of the Act (however, see the Notes).

CUSIP

Number: G6096M106

|

(1)

|

Name

of Reporting Persons: Jurchen Investment Corporation (“Jurchen”)

|

|

|

|

|

|

S.S.

or I.R.S. Identification Nos. of above persons:

|

|

(2)

|

Check

the Appropriate Box if a Member of a Group (See Instructions)

|

|

|

|

|

|

(a)

|

☐

|

|

|

(b)

|

☐

|

|

(3)

|

SEC

Use Only

|

|

|

|

|

|

|

|

(4)

|

Source

of Funds (See Instructions)

|

|

|

|

|

|

OO

|

|

(5)

|

Check

if Disclosure of Legal Proceedings is required Pursuant to Items 2(d) or 2(e) ☐

|

|

|

|

|

|

|

|

(6)

|

Citizenship

or Place of Organization:

|

|

|

|

|

|

British

Virgin Islands

|

|

|

|

(7)

|

Sole

Voting Power:

|

|

|

|

|

|

|

Number

of

|

|

|

163,470,378(1)

|

|

Shares

|

|

(8)

|

Shared

Voting Power:

|

|

Beneficially

|

|

|

|

|

Owned

By

|

|

|

0

|

|

Each

|

|

(9)

|

Sole

Dispositive Power:

|

|

Reporting

|

|

|

|

|

Person

With

|

|

|

163,470,378(1)

|

|

|

|

(10)

|

Shared

Dispositive Power:

|

|

|

|

|

|

|

|

|

|

|

0

|

|

(11)

|

Aggregate

Amount Beneficially Owned by Each Reporting Person:

|

|

|

|

|

|

163,470,378(1)

|

|

(12)

|

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares (see Instructions). ☐

|

|

|

|

|

|

|

|

(13)

|

Percent

of Class Represented by Amount in Row (11):

|

|

|

|

|

|

70.36%

(2)

|

|

(14)

|

Type

of Reporting Person (See Instructions):

|

|

|

|

|

|

CO

|

|

(1)

|

This

includes (i) 2,315,148 Class A Ordinary Shares owned by Jurchen, (ii)16,061,469 Class B Ordinary Shares owned by Jurchen,

and (iii) warrants held by Jurchen to purchase 540,540 Class A Ordinary Shares. The Class B Ordinary Shares vote on a one

for ten basis; accordingly, Jurchen is entitled to an aggregate of 163,470,378 votes as indicated above. The Reporting Person

maintains the right to convert its Class B Ordinary Shares into Class A Ordinary Shares at any time, in its sole discretion,

on a one for one basis; following such conversion, the resulting Class A Ordinary Shares will retain the same one for one

voting power as all other Class A Ordinary Shares.

|

|

(2)

|

Represents

the voting power with respect to all of our Class A Ordinary Shares and Class B Ordinary Shares, voting as a single class.

Accordingly, the percentage is calculated based on the Issuer's prospectus filed with the Securities and Exchange Commission

pursuant to Rule 424(b)(5) on February 27, 2020, which discloses that there are 7,948,712 Class A Ordinary Shares and 22,437,754

Class B Ordinary Shares (such Class B Ordinary Shares entitled to 224,377,540 votes) outstanding immediately after the offering.

|

CUSIP

Number: G6096M106

|

(1)

|

Name

of Reporting Persons: Ian Huen (“Ian”)

|

|

|

|

|

|

S.S.

or I.R.S. Identification Nos. of above persons:

|

|

(2)

|

Check

the Appropriate Box if a Member of a Group (See Instructions)

|

|

|

|

|

|

(a)

|

☐

|

|

|

(b)

|

☐

|

|

(3)

|

SEC

Use Only

|

|

|

|

|

|

|

|

(4)

|

Source

of Funds (See Instructions)

|

|

|

|

|

|

OO

|

|

(5)

|

Check

if Disclosure of Legal Proceedings is required Pursuant to Items 2(d) or 2(e) ☐

|

|

|

|

|

|

|

|

(6)

|

Citizenship

or Place of Organization:

|

|

|

|

|

|

Hong

Kong

|

|

|

|

(7)

|

Sole

Voting Power:

|

|

|

|

|

|

|

Number

of

|

|

|

163,480,432

(1)

|

|

Shares

|

|

(8)

|

Shared

Voting Power:

|

|

Beneficially

|

|

|

|

|

Owned

By

|

|

|

0

|

|

Each

|

|

(9)

|

Sole

Dispositive Power:

|

|

Reporting

|

|

|

|

|

Person

With

|

|

|

163,480,432

(1)

|

|

|

|

(10)

|

Shared

Dispositive Power:

|

|

|

|

|

|

|

|

|

|

|

0

|

|

(11)

|

Aggregate

Amount Beneficially Owned by Each Reporting Person:

|

|

|

|

|

|

163,480,432

(1)

|

|

(12)

|

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares (see Instructions). ☐

|

|

|

|

|

|

|

|

(13)

|

Percent

of Class Represented by Amount in Row (11):

|

|

|

|

|

|

70.37%

(2)

|

|

(14)

|

Type

of Reporting Person (See Instructions):

|

|

|

|

|

|

IN

|

|

(1)

|

This

includes (i) 2,315,148 Class A Ordinary Shares owned by Jurchen, (ii) warrants held by Jurchen to purchase 540,540 Class A

Ordinary Shares, (iii) options granted to Ian to purchase 10,054 Class A Ordinary Shares, and (iv)16,061,469 Class B Ordinary

Shares owned by Jurchen. Excludes stock options that vest more than 60 days from the date hereof. Jurchen is wholly-owned

by Ian and its principal office address is at 17th Floor, Guangdong Investment Tower, 148 Connaught Road Central, Hong Kong

located. The Class B Ordinary Shares vote on a one for ten basis; accordingly, Ian is deemed to control an aggregate of 163,470,378

votes through Jurchen and 10,054 votes directly. The Reporting Person maintains the right to convert its Class B Ordinary

Shares into Class A Ordinary Shares at any time, in its sole discretion, on a one for one basis; following such conversion,

the resulting Class A Ordinary Shares will retain the same one for one voting power as all other Class A Ordinary Shares

|

|

(2)

|

Represents

the voting power with respect to all of our Class A Ordinary Shares and Class B Ordinary Shares, voting as a single class.

Accordingly, the percentage is calculated based on the Issuer's prospectus filed with the Securities and Exchange Commission

pursuant to Rule 424(b)(5) on February 27, 2020, which discloses that there are 7,948,712 Class A Ordinary Shares and 22,437,754

Class B Ordinary Shares (such Class B Ordinary Shares entitled to 224,377,540 votes) outstanding immediately after the offering.

|

CUSIP

Number: G6096M106

EXPLANATORY

NOTE

This

Amendment No. 2 to Schedule 13D (this “Schedule 13D/A”) amends and restates the statement on Schedule 13D filed

with the Securities and Exchange Commission (the “SEC”) on January 3, 2019, as amended by Amendment No. 1,

filed with the SEC on May 8, 2019 (the “Prior Filing”), with respect to Class A Ordinary Shares, $1.00 par

value per share (the “Ordinary Shares”), of Aptorum

Group Limited, a Cayman Islands exempted company with limited liability whose principal place of business is in Hong Kong (the

“Issuer” or the “Company”). The Issuer’s principal executive office is located at

17th Floor, Guangdong Investment Tower, 148 Connaught Road Central, Hong Kong. From

and after the date hereof, all references in the Prior Filing to the Prior Filing or terms of similar import shall be deemed to

refer to the Prior Filing as amended and supplemented by this Schedule 13D/A.

The

purpose of this filing is to revise the beneficial ownership previously reported for Ian Huen and Jurchen Investment Corporation,

the Reporting Persons included in the Prior Filing, and to update certain other related information in the Prior Filing.

CUSIP

Number: G6096M106

Item

1. Security and Issuer.

This

statement on Schedule 13D (the “Schedule”) relates to the Class A Ordinary Shares, $1.00 par value per share

(the “Class A Ordinary Shares”), of Aptorum Group Limited (formerly known as APTUS Holdings Limited and STRIKER

ASIA OPPORTUNITIES FUND CORPORATION), a Cayman Islands exempted company with limited liability whose principal place of business

is in Hong Kong (the “Company”), and is being filed jointly by Jurchen, and Ian (collectively, the “Reporting

Persons”). The Company also has Class B Ordinary Shares. The Class B Ordinary Shares vote on a one for ten basis, but

the holder can convert into Class A Ordinary Shares at any time, at his/her sole discretion, on a one for one basis.

The

Company’s principal offices are located at 17th Floor, Guangdong Investment Tower, 148 Connaught Road Central, Hong Kong.

Item

2. Identity and Background.

|

|

(a)

|

The

names of the persons filing this Statement (the “Reporting Persons”) are:

|

Ian

owns 100% equity interest in Jurchen, which holds 2,315,148 Class A Ordinary Shares, warrants (“Warrants”)

to purchase 540,540 Class A Ordinary Shares and 16,061,469 Class B Ordinary Shares of the Company.

|

|

(b)

|

The

principal business address of each Reporting Person is 17th Floor, Guangdong Investment Tower, 148 Connaught Road Central,

Hong Kong.

|

|

|

(c)

|

The

principal business of Jurchen is to act as an investment holding company.

|

|

|

|

|

|

|

|

The

principal business of Ian is Chief Executive Officer and Executive Director of the Company.

|

|

|

(d)

|

During

the past five years, none of the Reporting Persons or to the knowledge of the Reporting Persons, the persons identified in

this Item 2, have been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors).

|

|

|

(e)

|

During

the past five years, none of the Reporting Persons or to the knowledge of the Reporting Persons, the persons identified in

this Item 2, have been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as

a result of such proceeding was the subject to a judgment, decree or final order enjoining future violations of, or prohibiting

or mandating activities subject to, federal and state securities laws of findings any violation with respect to such laws.

|

|

|

(f)

|

Jurchen

is a company incorporated in the British Virgin Islands.

Citizenship

of Ian: Hong Kong

|

CUSIP

Number: G6096M106

Item

3. Source and Amount of Funds or Other Consideration.

The

aggregate purchase price for the shares currently beneficially owned by Jurchen was $26,307,596. The source of these funds was

the working capital of Jurchen.

Item

4. Purpose of Transaction

Jurchen/Ian

The

Issuer offered 1,351,350 Class A Ordinary Shares in a registered direct offering at a per share offering price of $7.40. The Issuer

has announced that it intends to use the net proceeds from the offering for improving its existing business, working capital and

other general corporate purposes. Jurchen used working capital in the amount of $4,000,000 for the purchase of 540,540 Class A

Ordinary Shares and Warrants to purchase 540,540 Class A Ordinary Shares in this offering. Following such transfer, Jurchen holds

the shares reported herein (2,315,148 Class A Ordinary Shares, Warrants to purchase 540,540 Class A Ordinary Shares and 16,061,469

Class B Ordinary Shares) (the “Jurchen Securities”). The Warrants will be exercisable immediately following

the date of issuance for a period of seven years at an initial exercise price of $7.40.

The

Jurchen Securities owned by Ian and Jurchen have been acquired for investment purposes. Jurchen and/or Ian may make further acquisitions

of Class A Ordinary Shares from time to time and, subject to certain restrictions, may dispose of any or all of the Class A Ordinary

Shares held by Jurchen and/or Ian at any time depending on an ongoing evaluation of the investment in such securities, prevailing

market conditions, other investment opportunities and other factors. However, such shares are subject to certain lock-up restrictions

as further described in Item 6 below.

Item

5. Interest in Securities of the Issuer

|

|

a.

|

The

aggregate number and percentage of the Company’s Class A Ordinary Shares and Class B Ordinary Shares owned by each Reporting

Person named herein is calculated based on the Issuer's prospectus filed with the SEC pursuant to Rule 424(b)(5) on February

27, 2020, which discloses that there are 7,948,712 Class A Ordinary Shares and 22,437,754 Class B Ordinary Shares (such Class

B Ordinary Shares entitled to 224,377,540 votes) outstanding immediately after the offering.

|

CUSIP

Number: G6096M106

|

|

|

The

beneficial ownership of each of the Reporting Persons is:

|

|

|

i.

|

Jurchen:

163,470,378 (70.36%).

|

|

|

ii.

|

Ian:

163,480,432 (70.37%) 163,470,378 through Jurchen and 10,054 directly.

|

|

|

b.

|

Ian

is deemed to have sole voting power, to vote or direct the vote of and to dispose or direct the disposition of the 163,480,432

votes reported herein.

|

|

|

c.

|

There

have been no other transactions in the Class A Ordinary Shares effected by the Reporting Persons during the past 60 days.

|

|

|

d.

|

No

person other than the Reporting Persons has the right to receive or the power to direct the receipt of dividends from, or

the proceeds from the sale of, the shares reported as being beneficially owned (or which may be deemed to be beneficially

owned) by the Reporting Persons.

|

Item

6. Contracts, Arrangements, Understandings or Relationships With Respect to Securities of the Issuer.

The

following descriptions are qualified in their entirety by the agreements and instruments included as exhibits to this Schedule.

The

Reporting Persons are parties to an agreement with respect to the joint filing of this Schedule and any Schedules hereto. A copy

of such agreement is attached as Exhibit 99.1 and is incorporated by reference herein.

The

Reporting Persons are also subject to a lock-up agreement. In connection with the Company’s registered direct offering of

its Class A Ordinary Shares, the Reporting Persons signed lock-up agreements which, subject to certain exceptions, prevent them

from selling or otherwise disposing of any of our shares, or any securities convertible into or exercisable or exchangeable for

shares for a period of not less than 90 days after the closing date of the offering, without first obtaining the written consent

of the placement agent (the “Lock-Up Agreement”). A copy of the form of such agreement is attached as Exhibit

99.2 and is incorporated by reference herein.

On

February 28, 2020, Jurchen entered into the Securities Purchase Agreement. A copy of such agreement and form of Warrant are attached

hereto as Exhibit 99.3 and Exhibit 99.4, respectively, and are incorporated by reference herein.

CUSIP

Number: G6096M106

Item

7. Material to Be Filed as Exhibits.

The

following are filed herewith as Exhibits to the Schedule 13D:

*

filed herewith

CUSIP

Number: G6096M106

Signature

After

reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true,

complete and correct.

Date:

March 10, 2020

|

|

|

|

|

Jurchen

Investment Corporation

|

|

|

|

|

|

By:

|

/s/ Ian Huen

|

|

|

|

Name:

Ian Huen

|

|

|

|

Title:

Director

|

|

|

|

|

|

|

By:

|

/s/ Ian Huen

|

|

|

|

Name:

Ian Huen

|

|

9

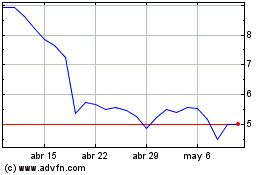

Aptorum (NASDAQ:APM)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Aptorum (NASDAQ:APM)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024