Indian Rupee Appreciates To 1-week High Versus U.S. Dollar After RBI Rate Cut

26 Marzo 2020 - 8:28PM

RTTF2

The Indian rupee drifted higher against the U.S. dollar in

morning deals on Friday, after the Reserve Bank of India reduced

its key interest rates unexpectedly and unveiled measures to

improve liquidity to mitigate the economic downturn caused by the

spread of coronovirus.

The repo rate was cut by 75 basis points to 4.40 percent, with

immediate effect, the bank said in a statement.

Accordingly, the marginal standing facility, or MSF rate and the

Bank Rate were reduced to 4.65 percent from 5.40 percent.

Further, widening the liquidity adjustment facility corridor,

the central bank trimmed the reverse repo rate by 90 basis points

to 4.00 percent.

The bank reduced the cash reserve ratio by 100 basis points to

3.00 percent.

The MPC decided to continue with the accommodative stance as

long as it is necessary to revive growth and mitigate the impact of

coronavirus, or covid-19, on the economy.

The rupee moved up to 74.21 against the greenback, its biggest

level since March 20. The pair had ended Thursday's trading at

74.94. The next key resistance for the rupee is located around the

72.00 level.

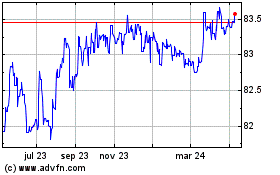

US Dollar vs INR (FX:USDINR)

Gráfica de Divisa

De Mar 2024 a Abr 2024

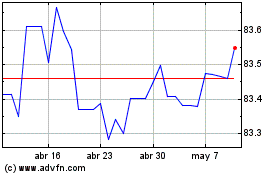

US Dollar vs INR (FX:USDINR)

Gráfica de Divisa

De Abr 2023 a Abr 2024