Activists Lay Down Their Arms as Companies Cope With Coronavirus Spread

29 Marzo 2020 - 3:59AM

Noticias Dow Jones

By Corrie Driebusch

Being a shareholder activist investor isn't such a good look

right now.

Executives are struggling to keep their companies afloat and

their workers employed as the coronavirus spreads, and activists'

demands in many cases seem less pertinent than they did just a few

weeks ago. That's led many of the investors to walk away from

campaigns or settle them early.

Last week, Carl Icahn agreed to end his campaign to oust the

entire board of beleaguered oil company Occidental Petroleum Corp.,

settling instead for two seats and a say in choosing a third.

Starboard Value LP reached a settlement with Box Inc. that will put

three independent directors on the cloud-software company's

board.

Elliott Management Corp. recently ended its opposition to

Capgemini SE's bid for Altran Technologies SA, saying in a

regulatory filing it's willing to sell its Altran shares to the

French consulting firm.

Elliott -- like Mr. Icahn and Starboard, one of the most feared

activists in corporate America -- is seeing more opportunities for

behind-the-scenes, "constructive" ways to work with companies, a

person familiar with the matter said. That could mean helping shore

up their finances by buying up the companies' beaten-down bonds or

equity.

The shift comes at a normally busy time for activists, known as

proxy season, when they have the opportunity to nominate directors

ahead of annual meetings that tend to take place in the spring.

This year, however, it falls as companies are focused on keeping

employees safe and making payroll as revenue dissipates.

"Companies right now are struggling to keep workforces

together," said Edward McCarthy of D.F. King & Co., who

canvasses shareholders to gather votes in proxy contests. "To take

away from that is just bad for everyone."

Activist hedge funds, for their part, are struggling with the

whipsawing stock market. An index of their performance tracked by

data group HFR was down by about 11% through the end of February,

the most up-to-date information available. A greater drop could be

coming in March, as the S&P 500 has fallen more than 14%.

Some activists with concentrated portfolios are under even more

pressure. Mantle Ridge LP, run by a former lieutenant of William

Ackman who tends to hold positions for many years, has been

buffeted by a steep decline in shares of Aramark Corp. Mantle Ridge

owns a roughly 18% stake in the food-service giant, whose shares

have fallen by more than 50% this year as schools and other

institutions across the country shut down.

"Any single major bet is a bold move," said Bill Anderson of

Evercore Inc., one of the top activism-defense bankers. "And for

the short term, any bold move can be scary."

While this proxy season may be quieter than usual, it could give

way to a busy period for corporate raiders should share prices

remain low and the challenges companies now face linger.

Not all activists are retiring from the battlefield. Some

privately argue that in a crisis it matters even more to have good

managers, making it necessary in certain situations to press

on.

Starboard, led by Chief Executive Jeff Smith, recently published

a letter to eBay Inc.'s board confirming an earlier Wall Street

Journal report that it has nominated directors to the board of the

online marketplace and urging it to search for an external CEO.

Starboard acknowledged the unique period the world is in, with

Peter Feld, managing member of the company, signing the letter

"Best regards and stay healthy."

In its response, eBay said it was disappointed that Starboard

decided to announce its nominations "amidst the global Covid-19

pandemic while the board and management are trying to focus on the

business, employee health and safety, and the important CEO search

and portfolio review that are under way."

"With the volatility and the virus, it's going to be slower this

spring, sure, but that doesn't mean 2020 is a washout," said Bruce

Goldfarb, head of Okapi Partners LLC, a proxy-solicitation firm

that helps activists and companies communicate with

shareholders.

Either way, many companies are taking no chances. Some are

seeking standstill agreements with activists or settlements that

they might not otherwise have agreed to, advisers say. Others are

attempting to delay their annual meetings.

Still others, fearful that rivals or activists may take

advantage of their beaten-down stock prices to take big stakes they

can use to wield influence, are rushing to adopt so-called poison

pills, with implementation of the defense tool lately spiking to a

rate unseen in years.

Write to Corrie Driebusch at corrie.driebusch@wsj.com

(END) Dow Jones Newswires

March 29, 2020 05:44 ET (09:44 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

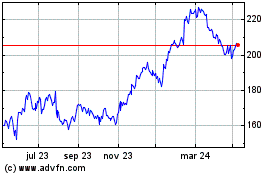

Capgemini (EU:CAP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

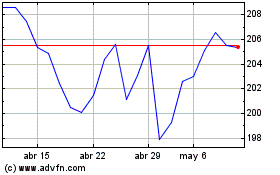

Capgemini (EU:CAP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024