Stock Investors Buy Into Corporate Bond Surge

30 Marzo 2020 - 1:38PM

Noticias Dow Jones

By Matt Wirz

Companies ranging from Oracle Corp. to Nike Inc. are borrowing

record amounts in the investment-grade bond market to build cash

before the full impact of the novel coronavirus hits the U.S.

economy. Much of the new debt is being purchased by an unusual type

of buyer: stock investors.

"There is a rotation from a number of nontraditional investors

out of other asset classes like high yield, distressed debt and

equities into investment grade," said Andrew Karp, head of

investment-grade capital markets at Bank of America Corp. "Among

other reasons, it's a place to hide from volatility."

Issuance of investment-grade bonds in the U.S. hit about $65.5

billion last week, roughly 10% higher than the previous high-water

mark reached in 2013, according to data from Dealogic.

Retail-oriented giants like Nike and Home Depot Inc. were among

the biggest initial borrowers -- issuing $6 billion and $5 billion,

respectively -- but the pace of new deals remains high, with names

like technology company Oracle and food-services provider Sysco

Corp. joining the fray Monday.

Nontraditional buyers are accounting for as much as one-quarter

of the orders for the new investment-grade bonds Bank of America is

selling, Mr. Karp said. The bank arranged Nike's deal, among

others.

Investment-grade bond prices fell sharply in March as some fund

managers sold out to meet client redemptions, pushing yields up and

making the debt more attractive to buyers like hedge funds that

normally focus on stocks. Many investors became more willing to buy

the bonds after the U.S. Federal Reserve announced its own plans to

start purchasing highly rated corporate debt to bolster the market.

Bond yields rise when prices fall.

The yield of a Bloomberg Barclays index of U.S. investment-grade

corporate bonds was about 3.7% on Friday, down from its recent peak

of 4.58% on March 20, but still well above its level of 2.43% at

the end of February, according to data from FactSet. The index

declined about 8.5% in March through Friday, a relatively steep

decline compared with a 15% fall in the much riskier stocks of the

S&P 500.

Foreign fund managers are also stepping into U.S. corporate

bonds because their hedging cost in dollars has declined even as

investment-grade bond yields have jumped. Bonds issued by banks

were among the biggest gainers Monday, with Wells Fargo & Co.'s

bond due 2051 jumping about 4.5 cents on the dollar to 122,

according to data from MarketAxess.

U.S. Government bond yields fell Monday morning despite gains in

stocks, showing that investors remain concerned about the virus's

long-term economic impact. The 10-year Treasury yield was around

0.624%, down from 0.744% Friday, according to data from

Tradeweb.

The U.S. dollar rose, in contrast to the U.K. pound and South

African rand, after both countries were hit by sovereign

credit-rating downgrades. The WSJ Dollar index, which measures the

U.S. currency against a basket of 16 foreign currencies was up 0.6%

to 93.73 Monday, rebounding slightly from its roughly 4% loss in

the previous four trading days.

Write to Matt Wirz at matthieu.wirz@wsj.com

(END) Dow Jones Newswires

March 30, 2020 15:23 ET (19:23 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

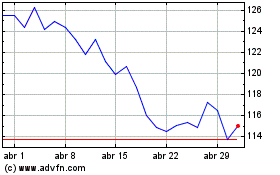

Oracle (NYSE:ORCL)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Oracle (NYSE:ORCL)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024