TIDMTRCS

RNS Number : 4587I

Tracsis PLC

02 April 2020

Tracsis plc

('Tracsis', 'the Company' or 'the Group')

Unaudited Interim results for the six months ended 31 January

2020

Tracsis, a leading provider of software, hardware and services

for the rail, traffic data and wider transport industries, is

pleased to announce its unaudited interim results for the six

months ended 31 January 2020.

Financial Highlights:

-- Revenue increased 41% to GBP26.4m (2019: GBP18.8m)

-- Adjusted EBITDA* of GBP5.6m (2019: GBP4.2m), after adoption

of IFRS 16 in the current period

-- Adjusted EBITDA* increased 23% to GBP5.2m (2019: GBP4.2m) on

a like for like basis, excluding IFRS 16

-- Operating profit before exceptional items increased 8% to GBP2.6m (2019: GBP2.4m)

-- Cash balances of GBP26.0m (31 July 2019: GBP24.1m, 31 January 2019: GBP18.7m)

-- Interim dividend deferred, pending a further review later in the year

Operational Highlights:

-- Strong H1 performance from all parts of the Group especially

our Traffic and Data division which had a strong start to the

year

-- Acquired businesses in 2019, Compass Informatics, CTM and

Bellvedi all performed well with integration and synergy savings

already being realised

-- Continued investment in technology base across all areas of the business

-- Several large tenders in the final stages of negotiation

across our Rail Technology division

Post period end Highlights:

-- Acquisition of iBlocks Limited in March 2020 which adds new

capabilities and products to our Rail Technology product offering

especially in the areas of smart ticketing

-- Important initial contract win for OnTrac (our risk and

safety management software business) which is expected to result

later this year in a multi-year enterprise wide licence

deployment

-- Covid-19 has had an immediate impact on our Events and

Traffic Data business units and as a result we have taken a series

of immediate actions to mitigate the impact as much as possible

Chris Barnes, Chief Executive Officer, commented:

"We are pleased with the first half performance which was in

line with expectations. All of the acquisitions from 2019 performed

well, and we were also delighted in March to have completed the

iBlocks acquisition which increases our rail technology product

portfolio and takes us into exciting new areas of the rail

industry. Despite the recent Covid-19 crisis, our Rail Technology

& Services business currently remains resilient and we are in

the final stages of negotiating several large multi-year software

and hardware contract opportunities. Our Traffic & Data

Services division is however being majorly impacted by Covid-19 and

as a result we have taken a series of actions to mitigate the

impact on the business as much as possible, with the full year

outcome currently under review. The Group continues to have

substantial cash balances and strong cash flow."

(*) EBITDA full definition and reconciliation is presented at

note 9. Reconciliation of the impact of IFRS 16 is included in note

3

Enquiries:

Tracsis plc Tel: 0845 125 9162

Chris Barnes, CEO / Max Cawthra, CFO

finnCap Ltd Tel: 020 7220 0500

Christopher Raggett / Charlie Beeson, Corporate Finance

Andrew Burdis, Corporate Broking

The information communicated in this announcement is inside

information for the purposes of Article 7 of the Market Abuse

Regulation (EU) No. 596/2014.

Chairman & Chief Executive Officer's Report

Introduction

The Group has reported a further period of growth, with a strong

performance across both divisions which is in line with

expectations, and provides a good platform for delivery of full

year results.

The Group adopted IFRS 16 for the first time this period, and

the impact of this on the Income Statement is summarised below. The

impact on the Balance Sheet as at 31 January 2020 was to recognise

a 'Right of Use Asset' of GBP1.0m, and a 'Lease Liability' of

GBP1.1m.

2020 2020 2019

As reported Pre- IFRS Pre- IFRS

16 16

GBPm GBPm GBPm

-------------------------- ------------ ---------- ----------

Revenue 26.4 26.4 18.8

Adjusted EBITDA (note 9) 5.6 5.2 4.2

Adjusted Pre-Tax Profit

(note 9) 4.8 4.8 3.9

Profit before tax 2.4 2.4 2.1

-------------------------- ------------ ---------- ----------

Trading Progress and Prospects

A summary of performance in the period is as follows:

Rail Technology & Services

Summary segment results:

Revenue GBP11.9m (H1 2019: GBP9.9m)

EBITDA GBP4.1m (H1 2019: GBP3.5m)

Profit before Tax GBP3.9m (H1 2019: GBP3.5m)

Software & Consultancy

Total revenues from the Group's rail software, hosting and

consulting offerings were GBP9.6m (2019: GBP7.9m) taking account of

all of the various revenue streams. The revenue contribution from

Bellvedi was GBP0.7m, and therefore like for like revenues were

GBP8.9m giving organic growth of some 13% on the previous period.

Software sales again benefited from high renewal rates for existing

products, and also income from multi-year contract wins from

previous years which we are currently implementing for our clients.

Bellvedi has performed well since acquisition and remains a key

part of our TRACS Enterprise offering.

As highlighted previously, the Group continues to invest heavily

in our technology base, and continues to make good progress

developing the next generation of products for the transport

industry. We remain focused on the following key areas:

-- Operational performance software - TRACS Enterprise and a

range of standalone product solutions

-- Safety and Risk Management Software - Rail Hub and VR on demand capability

-- RCM data acquisition software - Centrix

-- Activity Based Ticketing software - smartTIS

-- Automated Delay Repay software - One Click and smartREPAY

During the Covid-19 crisis, we currently continue to work

remotely on a business as usual basis with all of our rail clients.

We continue to see good levels of interest in our software

solutions and we are in the final stages of negotiating several

large multi-year software licencing contracts which we expect to

close over the coming weeks. We do though expect an impact in our

delay repay businesses where revenues will be impacted by the

significant decline in rail passenger numbers.

Remote Condition Monitoring

Revenues of GBP2.3m were ahead of the previous year (2019:

GBP2.0m), which represents very good trading in the core UK market

and organic growth of 15% on the previous period. As we entered the

new Network Rail Control period, past experience would suggest a

sharp reduction in revenues in the first year, but this has not

materialised as yet. Our Remote Condition Monitoring business

benefited from an extremely strong second half performance in 2019

and this is unlikely to repeat in 2020 given the buying patterns of

the business' key customer, but nonetheless current trading remains

solid and in line with expectations.

We are expecting imminent product type approval of a new RCM

product which is designed to support Network Rail and others in

their implementation of a risk-based maintenance approach linked to

broader condition monitoring.

Our key concern with regards Covid-19 is whether we will be

impacted by the closure of partner production facilities in the UK

due to the future tightening of government lockdown restrictions,

and we continue to monitor this situation.

Traffic & Data Services (T&DS)

Summary segment results:

Revenue GBP14.5m (H1 2019: GBP8.9m)

EBITDA GBP1.5m (H1 2019: GBP0.7m)

Profit before Tax GBP0.9m (H1 2019: GBP0.2m)

Our Traffic & Data Services division has historically been

highly second-half weighted given the timing of our events work and

also the timing of other traffic surveys. However, H1 performance

was good and ahead of expectations, with organic growth of 6%.

There was also a very strong contribution from the acquired

businesses CTM and Compass Informatics, where integration is

progressing well. These businesses contributed around GBP5.1m of

additional revenue versus the same period last year which was ahead

of expectations.

Our Traffic Data business performed well in H1 with an

increasing focus on data analytics and the utilisation of the

technology solutions developed in partnership with Vivacity Labs.

The business secured a large multi-year contract in Ireland and

continues to win work across a wide UK transport client base.

Compass Informatics has performed well in the period, working on

a combination of long term projects with its Irish client base, and

also exciting projects for UK based utility companies. We have also

invested in a business development team to pursue opportunities in

the UK which seeks to exploit cross selling opportunities with our

existing UK traffic and transport client base.

Our events businesses SEP and CTM both performed well in H1, in

particular CTM which has delivered a very strong first half

performance supported by multi-year client contracts at fixed

venues and also some other positive trading.

We have also been investing in our technology base with a focus

in three areas:

-- Automated rail passenger counts software - PCDS

-- Event traffic monitoring and management - Tracsis Live Technology (TLT)

-- Traffic insights / path tracing - Felicity portal

Covid-19 has had an immediate impact on our events and traffic

data business units, which will have a major impact on H2

performance. A number of large UK events have now been cancelled or

postponed to the Autumn and this trend is continuing. We are also

seeing significant disruption to our Traffic Data collection and

Passenger Analytics activities that were scheduled to take place

over the coming weeks, given road traffic and rail passenger

activity will be heavily reduced and hence not representative. As a

result, we have taken a series of immediate actions to mitigate the

impact as much as possible through a reduction in casual labour

costs, the redeployment of staff, reducing all discretionary spend,

and taking advantage of the Government's Job Retention scheme. We

continue to look at a range of medium to long term structures for

this Division depending on the full impact of the Covid-19

crisis.

Overseas

The acquisition of Compass Informatics during the previous year,

has increased our Ireland presence significantly. Slow progress

continues to be made in other geographic areas where we operate,

though we continue to be fully occupied servicing our core UK

market in the short term.

Acquisitions

On 10 March we completed the acq uisition of iBlocks Limited, a

UK based software company that specialises in the provision of

smart ticketing solutions, automated delay repay and the

development of mission critical back office systems that are used

by the Rail Delivery Group, the wider community of train operating

companies (TOCs) and the rail supply chain. This acquisition

strategically aligns with our objective of strengthening our rail

product portfolio in areas where we can offer a unique market

proposition, gain access to strategically important partnerships

and leverage the cross-selling opportunities that exist across our

Rail Technology division.

Dividend

The Board has decided to defer the payment of the interim

dividend in view of the current Covid-19 crisis, and this decision

will be reviewed later in the year once the Group has more clarity

about the ongoing effects of the pandemic on the business. The

Board will consider what actions are in the best interests of

shareholders, and this could result in the combination of an

interim and full year dividend for the year ended 31 July 2020, or

the retention of cash in the business to invest in future growth

opportunities. The interim dividend would have had a cash cost of

around GBP0.3m had it been paid, which has therefore been retained

in the business.

Income statement

A summary of the Group's results is set out below.

Unaudited Unaudited Unaudited Audited

Six months Six months Six months Year

ended ended ended ended

31 January 31 January 31 January 31 July

2020 2020 2019 2019

As reported(1) Pre- IFRS Pre- IFRS Pre- IFRS

16 16 16

GBP'000 GBP'000 GBP'000 GBP'000

-------------------------- --------------- ----------- ----------- ----------

Revenue 26,365 26,365 18,750 49,219

Adjusted EBITDA (note 9) 5,586 5,230 4,239 10,514

Adjusted Pre-Tax Profit

(note 9) 4,805 4,766 3,873 9,683

Profit before tax 2,419 2,396 2,121 6,559

-------------------------- --------------- ----------- ----------- ----------

(1) The results for the six month period ended 31 January 2020

are not directly comparable with the prior year due to the adoption

of IFRS 16 leases. Further details are provided in note 3 to the

financial statements, which sets out the impact of the adoption of

IFRS 16 on the primary statements.

Sales revenue is analysed further below:

Unaudited Unaudited Audited

Six months Six months Year

ended Ended Ended

31 January 31 January 31 July

2020 2019 2019

GBP'000 GBP'000 GBP'000

---------------------------- ----------- ----------- --------

Rail Technology & Services 11,878 9,895 21,934

Traffic & Data Services 14,487 8,855 27,285

Total revenue 26,365 18,750 49,219

---------------------------- ----------- ----------- --------

Balance sheet

The Group continues to have significant levels of cash and

remains debt free. Cash balances at 31 January were GBP26.0m (31

January 2019: GBP18.7m, 31 July 2019: GBP24.1m). Cash generation

was good, though was naturally impacted by the unwinding of the

positive year end working capital movements from the previous year

end where cash generation was extremely strong, which were fully

anticipated, and related to larger than previous VAT payments given

the increased seasonal event work, revenue in advance and also

staff bonuses. A summary of cash flows is set out below:

Six months Six months Year

ended ended ended

31 January 31 January 31 July

2020 2019 2019

GBP'000 GBP'000 GBP'000

------------------------------ ----------- ----------- --------

Net cash flow from operating

activities 2,670 2,400 12,374

Net cash used in investing

activities (222) (3,937) (7,723)

Net cash used in financing

activities (507) (2,089) (2,876)

Movement during the period 1,941 (3,626) 1,775

------------------------------ ----------- ----------- --------

Outlook

The Board was pleased with the first half performance. We have

secured a number of new contract wins which will help to secure

future organic growth, and we are pleased to have secured the

recent iBlocks acquisition, which adds an exciting new product

range to our portfolio and enhances our overall Rail Technology

& Services offering which is well aligned to our future growth

strategy. Covid-19 clearly presents us with some significant

challenges to H2 performance and therefore full year outturn, in

particular within our Traffic & Data Services Division where

the impact has been most felt, though our Rail Technology &

Services Division currently remains resilient. The Group has

substantial cash balances and strong cash flow, and the Board

remain confident in the long term prospects for the business post

Covid-19, in view of the positive growth drivers in the transport

markets that the Group currently serves. Our key priority during

these unprecedented times is the health and wellbeing of our

employees, our clients and their families.

Chris Cole Chris Barnes

Non-Executive Chairman Chief Executive Officer

2 April 2020

Tracsis plc

Condensed consolidated interim income statement for the six

months ended 31 January 2020

Unaudited Unaudited

6 months 6 months Audited

ended 31 ended 31 Year ended

January January 31 July

2020 2019 2019

Note

GBP'000 GBP'000 GBP'000

Revenue 4 26,365 18,750 49,219

Cost of sales (10,463) (7,107) (20,163)

------------------------------- ----- ----------------------------------------------- ---------- -------------

Gross profit 15,902 11,643 29,056

Administrative costs (13,291) (9,411) (22,360)

Adjusted EBITDA * 4 5,586 4,239 10,514

Depreciation (781) (366) (831)

------------------------------- ----- ----------------------------------------------- ---------- -------------

Adjusted profit ** 4,805 3,873 9,683

Amortisation of intangible

assets (1,628) (990) (2,251)

Other operating income - - 260

Share-based payment charges (566) (474) (1,034)

------------------------------- ----- ----------------------------------------------- ---------- -------------

Operating profit before

exceptional

items 2,611 2,409 6,658

Exceptional items - (177) 38

------------------------------- ----- ----------------------------------------------- ---------- -------------

Operating profit 2,611 2,232 6,696

Finance income 42 29 58

Finance expense (30) (9) (21)

Share of result of equity

accounted investees (204) (131) (174)

Profit before tax 2,419 2,121 6,559

Taxation (472) (424) (1,488)

------------------------------- ----- ----------------------------------------------- ---------- -------------

Profit for the period 1,947 1,697 5,071

------------------------------- ----- ----------------------------------------------- ---------- -------------

Other comprehensive income (71) - 17

Total recognised income for

the period 1,876 1,697 5,088

------------------------------- ----- ----------------------------------------------- ---------- -------------

Earnings per ordinary share

Basic 5 6.76p 5.97p 17.78p

Diluted 5 6.56p 5.78p 17.26p

* Earnings before finance income, tax, depreciation,

amortisation, exceptional items, other operating income, and

share-based payment charges and share of result of equity accounted

investees - see note 9

** Earnings before finance income, tax, amortisation,

exceptional items, other operating income, share-based payment

charges, and share of result of equity accounted investees. - see

note 9

Tracsis plc

Condensed consolidated interim balance sheet as at 31 January

2020

Unaudited Unaudited Audited

At 31 January At 31

At 31 January July

2020 2019 2019

Note GBP'000 GBP'000 GBP'000

------------------------------------------- ----- -------------- -------------- --------

Non-current assets

Property, plant and equipment 2,579 2,476 2,678

Right of Use assets 985 - -

Intangible assets 37,184 31,550 38,812

Investments - equity 350 350 350

Loans due from associated undertakings 250 250 250

Investments in equity accounted investees 894 1,141 1,098

Deferred tax assets 744 634 667

------------------------------------------- ----- -------------- --------------

42,986 36,401 43,855

------------------------------------------- ----- -------------- -------------- ----------

Current assets

Inventories 384 357 381

Trade and other receivables 8,452 8,330 9,729

Cash and cash equivalents 26,045 18,703 24,104

------------------------------------------- ----- -------------- -------------- ----------

34,881 27,390 34,214

------------------------------------------- ----- -------------- -------------- ----------

Total assets 77,867 63,791 78,069

------------------------------------------- ----- -------------- -------------- ----------

Non-current liabilities

Finance lease and hire-purchase contracts 270 138 285

Lease Liabilities 419 - -

Contingent consideration payable 10 4,975 2,700 5,304

Deferred tax liabilities 5,701 4,520 5,942

11,365 7,358 11,531

------------------------------------------- ----- -------------- -------------- ----------

Current liabilities

Finance lease and hire-purchase contracts 287 119 277

Lease liabilities 644 - -

Trade and other payables 13,329 10,879 16,936

Contingent consideration payable 10 1,151 834 879

Current tax liabilities 793 495 505

------------------------------------------- ----- -------------- -------------- ----------

16,204 12,327 18,597

------------------------------------------- ----- -------------- -------------- ----------

Total liabilities 27,569 19,685 30,128

------------------------------------------- ----- -------------- -------------- ----------

Net assets 50,298 44,106 47,941

------------------------------------------- ----- -------------- -------------- ----------

Equity attributable to equity holders of the Company

Called up share capital 115 114 115

Share premium reserve 6,364 6,314 6,343

Merger reserve 3,921 3,627 3,921

Retained earnings 39,952 34,051 37,545

Translation reserve (54) - 17

------------------------------------------- ----- -------------- -------------- ----------

Net assets 50,298 44,106 47,941

------------------------------------------- ----- -------------- -------------- ----------

Tracsis plc - Consolidated statement of changes in equity

For the six months ended 31 January 2020

Share

Share Premium Merger Retained Translation

Capital Reserve Reserve Earnings Reserve Total

Unaudited GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------------------- ---------- ---------- ---------- ----------- -------------- --------

At 1 August 2018 113 6,243 3,160 32,593 - 42,109

Impact on initial application

of IFRS 15 (net of tax) - - - (713) - (713)

Adjusted balances at

1 August 2018 113 6,243 3,160 31,880 - 41,396

Total comprehensive income

for the period

Profit for the six month

period ended 31 January

2019 and total comprehensive

income - - - 1,697 - 1,697

-------------------------------- ---------- ---------- ---------- ----------- -------------- --------

Total Comprehensive income

for the period - - - 1,697 - 1,697

-------------------------------- ---------- ---------- ---------- ----------- -------------- --------

Transactions with owners

of the Company

Share based payment charges - - - 474 - 474

Exercise of share options 1 71 - - - 72

Shares issued as consideration

for business combinations - - 467 - - 467

-------------------------------- ---------- ---------- ---------- ----------- -------------- --------

Total transactions with

owners of the Company 1 71 467 474 - 1,013

-------------------------------- ---------- ---------- ---------- ----------- -------------- --------

At 31 January 2019 114 6,314 3,627 34,051 - 44,106

-------------------------------- ---------- ---------- ---------- ----------- -------------- --------

Audited

-------------------------------- ---- ------ ------ ------- ----- -------

At 1 August 2018 113 6,243 3,160 32,593 - 42,109

Impact on initial application

of IRS 15 (net of tax) - - - (667) - (667)

Adjusted balances at 1

August 2018 113 6,243 3,160 31,926 - 41,442

Total comprehensive income

for the period

Profit for the year ended

31 July 2019 - - - 5,071 - 5,071

Other comprehensive income

for the year ended 31

July 2019 - - - - 17 17

-------------------------------- ---- ------ ------ ------- ----- -------

Total Comprehensive income

for the period - - - 5,071 17 5,088

-------------------------------- ---- ------ ------ ------- ----- -------

Transactions with owners

of the Company

Dividends - - - (486) (486)

Share based payment charges - - - 1,034 1,034

Exercise of share options 1 100 - - 101

Shares issued as consideration

for business combinations 1 - 761 - 762

-------------------------------- ---- ------ ------ ------- ----- -------

Total transactions with

owners of the Company 2 100 761 548 - 1,411

-------------------------------- ---- ------ ------ ------- ----- -------

At 31 July 2019 115 6,343 3,921 37,545 17 47,941

-------------------------------- ---- ------ ------ ------- ----- -------

Tracsis plc - Consolidated statement of changes in equity

(continued)

For the six months ended 31 January 2020

Unaudited Share

Share Premium Merger Retained Translation

Capital Reserve Reserve Earnings Reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 August

2019 115 6,343 3,921 37,545 17 47,941

Impact on

initial

application

of IFRS 16

(net of

tax) - note 3 - - - (106) - (106)

--------------- ---------- --------- ---------- ----------- ------------- --------

Adjusted

balances at

1 August 2019 115 6,343 3,921 37,439 17 47,835

--------------- ---------- --------- ---------- ----------- ------------- --------

Total

comprehensive

income for the

period

Profit for the

six

month period

ended

31 January

2020 - - - 1,947 - 1,947

Other

comprehensive

income for

the period

ended 31

January 2020 - - - - (71) (71)

--------------- ---------- --------- ---------- ----------- ------------- --------

Total

Comprehensive

income for

the period - - - 1,947 (71) 1,876

--------------- ---------- --------- ---------- ----------- ------------- --------

Transactions

with owners

of the Company

Share based

payment

charges - - - 566 - 566

Exercise of

share options - 21 - - - 21

--------------- ---------- --------- ---------- ----------- ------------- --------

Total

transactions

with owners

of the

Company - 21 - 566 - 587

--------------- ---------- --------- ---------- ----------- ------------- --------

At 31 January

2020 115 6,364 3,921 39,952 (54) 50,298

--------------- ---------- --------- ---------- ----------- ------------- --------

Tracsis plc

Condensed consolidated interim statement of cash flows for the

six months to 31 January 2020

Unaudited Unaudited

Six months Six months Audited

to to Year ended

31 July

31 Jan 2020 31 Jan 2019 2019

Note GBP'000 GBP'000 GBP'000

--------------------------------------------- ----- ------------ ------------ ------------

Operating activities

Profit for the period 1,947 1,697 5,071

Finance income (42) (29) (58)

Finance expense 30 9 21

Depreciation 781 366 831

Loss on disposal of plant & equipment - - 12

Non-cash exceptional items - - (99)

Other operating income - - (260)

Amortisation of intangible assets 1,628 990 2,251

Effect of foreign exchange adjustments (71) - 17

Share of result of equity accounted

investees 204 131 174

Income tax charge 472 424 1,488

Share based payment charges 566 474 1,034

--------------------------------------------- ----- ------------ ------------ ------------

Operating cash inflow before changes

in working capital 5,515 4,062 10,482

Movement in inventories (3) (104) (128)

Movement in trade and other receivables 1,219 (126) (1,349)

Movement in trade and other payables (3,571) (847) 4,877

--------------------------------------------- ----- ------------ ------------ ------------

Cash generated from operations 3,160 2,985 13,882

Interest received 42 29 58

Interest paid (30) (9) (21)

Income tax paid (502) (605) (1,545)

--------------------------------------------- ----- ------------ ------------ ------------

Net cash flow from operating activities 2,670 2,400 12,374

--------------------------------------------- ----- ------------ ------------ ------------

Investing activities

Purchase of plant and equipment (222) (445) (731)

Proceeds from disposal of plant and

equipment - - 165

Acquisition of subsidiaries (net of

cash acquired) - (3,092) (6,757)

Equity investments and loans to investments - (400) (400)

Net cash flow used in investing activities (222) (3,937) (7,723)

--------------------------------------------- ----- ------------ ------------ ------------

Financing activities

Dividends paid - - (486)

Proceeds from the exercise of share

options 21 72 101

Lease Liability payments (323) - -

Hire purchase repayments (148) (96) (342)

Payment of contingent consideration 10 (57) (2,065) (2,149)

--------------------------------------------- ----- ------------ ------------ ------------

Net cash flow used in financing activities (507) (2,089) (2,876)

--------------------------------------------- ----- ------------ ------------ ------------

Net increase/(decrease) in cash and

cash equivalents 1,941 (3,626) 1,775

Cash and cash equivalents at beginning

of period 24,104 22,329 22,329

Cash and cash equivalents at end of

period 26,045 18,703 24,104

--------------------------------------------- ----- ------------ ------------ ------------

Notes to the consolidated interim report

For the six months ended 31 January 2020

1 Basis of preparation

Tracsis plc (the 'Company') is a company domiciled in England.

The condensed consolidated interim financial report of the Company

as at and for the six months ended 31 January 2020 comprises the

Company and its subsidiaries (together referred to as the 'Group').

The principal activities of the Group are the provision of

software, services and technology for the rail industry ('Rail

Technology & Services'), along with traffic surveys, event

planning and traffic management, and data analytics including

software development ('Traffic Data & Services') (see note

4).

The condensed consolidated interim financial information should

be read in conjunction with the annual financial statements for the

year ended 31 July 2019, which have been prepared in accordance

with International Financial Reporting Standards ("IFRS") as

adopted by the European Union.

The interim financial information for each of the six month

periods ended 31 January 2020 and 31 January 2019 has not been

audited and does not constitute statutory accounts within the

meaning of section 435 of the Companies Act 2006. The information

for the year ended 31 July 2019 does not constitute statutory

accounts within the meaning of section 435 of the Companies Act

2006, but is based on the statutory accounts for that year, on

which the Group's auditors issued an unqualified report and which

have been filed with the Registrar of Companies.

The principal risks and uncertainties are largely unchanged from

the previous year end with the exception of the Covid-19 threat

which is new in the current year. These risks and uncertainties are

expected to be unchanged for the remainder of the financial year,

Further details are provided on pages 9 to 12 of the Annual Report

& Accounts for the year ended 31 July 2019. The Board considers

risks on a periodic basis and has maintained the key risks as

follows, on a Group wide basis:

-- Covid-19 - short term disruption to the T&DS Division and

potentially the wider Group, and the potential for future economic

slowdown in the medium term

-- Impact of EU Referendum

-- Rail industry structure changes

-- Reduced government spending

-- Reliance on certain key customers

-- Competition

-- Attraction and retention of key employees

-- Technological changes

-- Customer pricing pressure

-- Project delivery

-- Health & Safety

-- Brand reputation

-- Integration risk

The condensed consolidated interim financial information was

approved for issue on 2 April 2020.

2 Accounting Policies

The accounting policies applied by the Group in these interim

financial statements are the same as those applied by the Group in

its audited consolidated financial statements for the year ended 31

July 2019 and which will form the basis of the 2020 Annual Report

except as described below. The basis of consolidation is set out in

the Group's accounting policies in those financial statements.

The preparation of the interim financial statements requires

management to make judgements, estimates and assumptions that

affect the application of accounting policies and the reported

amounts of assets and liabilities, income and expenses. Estimates

and judgements are continually evaluated and are based on

historical experience and other factors, such as expectations of

future events and are believed to be reasonable under the

circumstances. Actual results may differ from these estimates. In

preparing these interim financial statements, the significant

judgements made by management in applying the Group's accounting

policies and the key sources of estimation uncertainty were the

same as those applied to the audited consolidated financial

statements for the year ended 31 July 2019.

3 Changes in accounting policies

The following amendments to financial reporting standards were

adopted from 1 August 2019, the start of the new financial year.

None of them have had a significant impact on the Group other than

IFRS 16 which is detailed in further below:

-- IFRS 16 Leases

-- IFRIC 23 Uncertainty over Income Tax Treatments

IFRS 16 Leases

The Group has adopted IFRS 16 "Leases" from 1 August 2019. It

has brought most leases on to the balance sheet, eliminating the

distinction between operating leases and finance leases, and

recognising a right-of-use asset and a corresponding lease

liability. Rentals on operating leases which were previously

charged to the income statement, have been replaced by depreciation

charge on the asset and interest expense on the lease liability.

The Group has adopted IFRS 16 using the modified retrospective

approach with the cumulative effect of initially adopting IFRS 16

recognised as an adjustment to retained earnings at 1 August 2019

with no restatement of comparative information. The group has

applied the practical expedient to grandfather the definition of a

lease on transaction. This means that it has applied IFRS 16 to all

contracts entered into before 1 August 2019 and identified as

leases in accordance with IAS 17 and IFRIC 4.

3 Changes in accounting policies (continued)

Impact on Retained Earnings at 1 August 2019

GBP'000

------------------------------------------- -------

Recognition of Property, Plant and

Equipment 1,302

Trade and other receivables (rent

prepaid) (58)

Trade and other payables (rent accrual

derecognised) 36

Current lease liabilities (628)

Non-current lease liabilities (758)

Retained earnings (106)

------------------------------------------- -------

Impact on the condensed consolidated interim income statement

for the six months ended 31 January 2020:

As reported Adjustments Amounts

(IFRS 16) pre- IFRS

16

GBP'000 GBP'000 GBP'000

Revenue 26,365 - 26,365

Cost of sales (10,463) - (10,463)

-------------------------------------- ------------ ------------ -----------

Gross profit 15,902 - 15,902

Administrative costs (13,291) (39) (13,330)

-------------------------------------- ------------ ------------ -----------

Adjusted EBITDA * 5,586 (356) 5,230

Depreciation (781) 317 (464)

-------------------------------------- ------------ ------------ -----------

Adjusted profit ** 4,805 (39) 4,766

Amortisation of intangible assets (1,628) - (1,628)

Other operating income - - -

Share-based payment charges (566) - (566)

-------------------------------------- ------------ ------------ -----------

Operating profit before exceptional

items 2,611 (39) 2,572

Exceptional items - - -

------------------------------------- ------------ ------------ -----------

Operating profit 2,611 (39) 2,572

Finance income 42 - 42

Finance expense (30) 16 (14)

Share of result of equity accounted

investees (204) - (204)

Profit before tax 2,419 (23) 2,396

Taxation (472) - (472)

-------------------------------------- ------------ ------------ -----------

Profit for the period 1,947 (23) 1,924

-------------------------------------- ------------ ------------ -----------

Other comprehensive income (71) - (71)

Total recognised income for the

period 1,876 (23) 1,853

-------------------------------------- ------------ ------------ -----------

3 Changes in accounting policies (continued)

Impact on the condensed consolidated interim balance sheet as at

31 January 2020:

As reported Amounts

(IFRS 16) Adjustments pre- IFRS

16

GBP'000 GBP'000 GBP'000

Non-current assets

Property, plant and equipment 2,579 - 2,579

Right of Use assets 985 (985) -

Intangible assets 37,184 - 37,184

Investments - equity 350 - 350

Loans due from associated

undertakings 250 - 250

Investments in equity accounted

investees 894 - 894

Deferred tax assets 744 - 744

------------------------------------------ ------------ --------------

42,986 (985) 42,001

------------------------------------------ ------------ -------------- -------------

Current assets

Inventories 384 - 384

Trade and other receivables 8,452 53 8,505

Cash and cash equivalents 26,045 - 26,045

------------------------------------------ ------------ -------------- -------------

34,881 53 34,934

------------------------------------------ ------------ -------------- -------------

Total assets 77,867 (932) 76,935

------------------------------------------ ------------ -------------- -------------

Non-current liabilities

Hire-purchase contracts 270 - 270

Lease liabilities 419 (419) -

Contingent consideration payable 4,975 - 4,975

Deferred tax liabilities 5,701 - 5,701

11,365 (419) 10,946

------------------------------------------ ------------ -------------- -------------

Current liabilities

Hire-purchase contracts 287 - 287

Lease liabilities 644 (644) -

Trade and other payables 13,329 48 13,377

Contingent consideration payable 1,151 - 1,151

Current tax liabilities 793 - 793

------------------------------------------ ------------ -------------- -------------

16,204 (596) 15,608

------------------------------------------ ------------ -------------- -------------

Total liabilities 27,569 (1,015) 26,554

------------------------------------------ ------------ -------------- -------------

Net assets 50,298 83 50,381

------------------------------------------ ------------ -------------- -------------

Equity attributable to equity holders of

the Company

Called up share capital 115 - 115

Share premium reserve 6,364 - 6,364

Merger reserve 3,921 - 3,921

Retained earnings 39,952 83 40,035

Translation reserve (54) - (54)

------------------------------------------ ------------ -------------- -------------

Net assets 50,298 83 50,381

------------------------------------------ ------------ -------------- -------------

4 Revenue and Segmental analysis

a) Revenue

Sales revenue is summarised below:

Six months Six months Year

ended ended Ended

31 January 31 January 31 July

2020 2019 2019

GBP'000 GBP'000 GBP'000

---------------------------- ----------- ----------- --------

Rail Technology & Services 11,878 9,895 21,934

Traffic & Data Services 14,487 8,855 27,285

Total revenue 26,365 18,750 49,219

---------------------------- ----------- ----------- --------

A geographical analysis of revenue is provided below:

Six months Six months Year

ended 31 ended 31 ended

January January 31 July

2020 2019 2019

GBP'000 GBP'000 GBP'000

------------------- ----------- ----------- ---------

United Kingdom 23,621 17,834 45,511

North America 75 101 106

Rest of the World 2,669 815 3,602

Total 26,365 18,750 49,219

------------------- ----------- ----------- ---------

b) Segmental Analysis

The Group has divided its results into two segments being 'Rail

Technology and Services' and 'Traffic & Data Services'. The

Group has a wide range of products and services and products and

services for the rail industry, such as software, hosting services,

consultancy and remote condition monitoring, and these have been

included within the Rail Technology & Services segment as they

have similar customer bases (such as Train Operating Companies and

Infrastructure Providers), whereas traffic data collection and

event planning & traffic management have similar economic

characteristics and distribution methods and so have been included

within the Traffic & Data Services segment.

In accordance with IFRS 8 'Operating Segments', the Group has

made the following considerations to arrive at the disclosure made

in these financial statements. IFRS 8 requires consideration of the

Chief Operating Decision Maker ("CODM") within the Group. In line

with the Group's internal reporting framework and management

structure, the key strategic and operating decisions are made by

the Board of Directors, who review internal monthly management

reports, budgets and forecast information as part of this.

Accordingly, the Board of Directors are deemed to be the CODM.

Operating segments have then been identified based on the

internal reporting information and management structures within the

Group. From such information it has been noted that the CODM

reviews the business as two operating segments, receiving internal

information on that basis. The management structure and allocation

of key resources, such as operational and administrative resources,

are arranged on a centralised basis.

Reconciliations of reportable segment revenues, profit or loss,

assets and liabilities and other material items

Information regarding the results of the reportable segment is

included below. Performance is measured based on segment profit

before income tax, as included in the internal management reports

that are reviewed by the Board of Directors. Segment profit is used

to measure performance. There are no material inter-segment

transactions, however, when they do occur, pricing between segments

is determined on an arm's length basis. Revenues disclosed below

materially represent revenues to external customers.

Six months ended 31 January 2020

Rail Technology Traffic

& Services & Data Unallocated

Services Total

GBP000 GBP000 GBP000 GBP000

--------------------------------------- ---------------- ---------- -------------- --------

Revenues

Total revenue for reportable

segments 11,878 14,487 - 26,365

Consolidated revenue 11,878 14,487 - 26,365

--------------------------------------- ---------------- ---------- -------------- --------

Profit or loss

EBITDA for reportable segments 4,122 1,464 - 5,586

Amortisation of intangible

assets - - (1,628) (1,628)

Depreciation (251) (530) - (781)

Share-based payment charges - - (566) (566)

Share of result of equity accounted

investees - - (204) (204)

Interest receivable/payable(net) (9) (8) 29 12

--------------------------------------- ---------------- ---------- -------------- --------

Consolidated profit before tax 3,862 926 (2,369) 2,419

--------------------------------------- ---------------- ---------- -------------- --------

Six months ended 31 January 2019

Rail Technology Traffic

& Services & Data Unallocated

Services Total

GBP000 GBP000 GBP000 GBP000

--------------------------------------- ---------------- ---------- -------------- --------

Revenues

Total revenue for reportable

segments 9,895 8,855 - 18,750

Consolidated revenue 9,895 8,855 - 18,750

--------------------------------------- ---------------- ---------- -------------- --------

Profit or loss

EBITDA for reportable segments 3,562 677 - 4,239

Amortisation of intangible

assets - - (990) (990)

Depreciation (69) (297) - (366)

Exceptional items - (177) - (177)

Share-based payment charges - - (474) (474)

Share of result of equity accounted

investees - - (131) (131)

Interest receivable/payable(net) - - 20 20

--------------------------------------- ---------------- ---------- -------------- --------

Consolidated profit before tax 3,493 203 (1,575) 2,121

--------------------------------------- ---------------- ---------- -------------- --------

Year ended 31 July 2019

Rail Technology Traffic

& Services & Data

Services Unallocated Total

GBP000 GBP000 GBP000 GBP000

------------------------------------ -------------------------- ---------- -------------- ---------

Revenues

Total revenue for reportable

segments 21,934 27,285 - 49,219

Consolidated revenue 21,934 27,285 - 49,219

------------------------------------ -------------------------- ---------- -------------- ---------

Profit or loss

EBITDA for reportable segments 6,932 3,582 - 10,514

Amortisation of intangible

assets - - (2,251) (2,251)

Depreciation (166) (665) - (831)

Exceptional items (60) (1) 99 38

Other operating income - - 260 260

Share-based payment charges - - (1,034) (1,034)

Interest receivable/payable(net) - - 37 37

Share of results of equity

accounted investees - - (174) (174)

Consolidated profit before tax 6,706 2,916 (3,063) 6,559

------------------------------------ -------------------------- ---------- -------------- ---------

31 January 2020

Rail Technology Traffic

& Services & Data

Services Unallocated Total

GBP'000 GBP000 GBP000 GBP000

------------------------------------ -------------------------- ---------- -------------- -----------

Assets

Total assets for reportable

segments (exc. cash) 5,418 6,982 - 12,400

Intangible assets and investments - - 38,678 38,678

Deferred tax assets - - 744 744

Cash and cash equivalents 10,479 4,750 10,816 26,045

Consolidated total assets 15,897 11,732 50,238 77,867

------------------------------------ -------------------------- ---------- -------------- -----------

Liabilities

Total liabilities for reportable

segments (10,893) (4,849) - (15,742)

Deferred tax - - (5,701) (5,701)

Contingent consideration - - (6,126) (6,126)

Consolidated total liabilities (10,893) (4,849) (11,827) (27,569)

------------------------------------ -------------------------- ---------- -------------- -----------

31 January 2019

Rail Technology Traffic

& Services & Data

Services Unallocated Total

GBP'000 GBP000 GBP000 GBP000

----------------------------------- -------------------------- ---------- -------------- ---------

Assets

Total assets for reportable

segments (exc. cash) 5,330 5,833 - 11,163

Intangible assets and investments - - 33,291 33,291

Deferred tax assets - - 634 634

Cash and cash equivalents 8,335 3,710 6,658 18,703

Consolidated total assets 13,665 9,543 40,583 63,791

----------------------------------- -------------------------- ---------- -------------- ---------

Liabilities

Total liabilities for reportable

segments (7,933) (3,698) - (11,631)

Deferred tax - - (4,520) (4,520)

Contingent consideration - - (3,534) (3,534)

Consolidated total liabilities (7,933) (3,698) (8,054) (19,685)

----------------------------------- -------------------------- ---------- -------------- ---------

31 July 2019

Rail Technology Traffic

& Services & Data

Services Unallocated Total

GBP'000 GBP000 GBP000 GBP000

----------------------------------- -------------------------- ---------- -------------- ---------

Assets

Total assets for reportable

segments (exc. cash) 3,257 9,531 - 12,788

Intangible assets and investments - - 40,510 40,510

Deferred tax assets - - 667 667

Cash and cash equivalents 12,866 5,817 5,421 24,104

Consolidated total assets 16,123 15,348 46,598 78,069

----------------------------------- -------------------------- ---------- -------------- ---------

Liabilities

Total liabilities for reportable

segments (10,568) (7,435) - (18,003)

Deferred tax - - (5,942) (5,942)

Contingent consideration - - (6,183) (6,183)

Consolidated total liabilities (10,568) (7,435) (12,125) (30,128)

----------------------------------- -------------------------- ---------- -------------- ---------

5 Earnings per share

Basic earnings per share

The calculation of basic earnings per share for the Half Year to

31 January 2020 was based on the profit attributable to ordinary

shareholders of GBP1,947,000 (Half Year to 31 January 2019:

GBP1,697,000, Year ended 31 July 2019: GBP5,071,000) and a weighted

average number of ordinary shares in issue of 28,795,000 (Half Year

to 31 January 2019: 28,406,000, Year ended 31 July 2019:

28,521,000), calculated as follows:

Weighted average number of ordinary shares

In thousands of shares

Six months Six months Year

ended 31 ended 31 ended

January January 31 July

2020 2019 2019

Issued ordinary shares at start of period 28,749 28,334 28,334

Effect of shares issued related to business

combinations - 7 54

Effect of shares issued for cash 46 65 133

Weighted average number of shares at end

of period 28,795 28,406 28,521

--------------------------------------------- ----------- ----------- ---------

Diluted earnings per share

The calculation of basic earnings per share for the Half Year to

31 January 2020 was based on the profit attributable to ordinary

shareholders of GBP1,947,000 (Half Year to 31 January 2019:

GBP1,697,000, Year ended 31 July 2019: GBP5,071,000) and a weighted

average number of ordinary shares in issue after adjustment for the

effects of all dilutive potential ordinary shares of 29,665,000

(Half Year to 31 January 2019: 29,359,000, Year ended 31 July 2019:

29,387,000).

Adjusted EPS

In addition, Adjusted Profit EPS is shown below on the grounds

that it is a common metric used by the market in monitoring similar

businesses. A reconciliation of this figure is provided below:

Six months Six months Year

ended 31 ended 31 ended

January January 31 July

2020 2019 2019

GBP'000 GBP'000 GBP'000

Profit attributable to ordinary shareholders 1,947 1,697 5,071

Amortisation of intangible assets 1,628 990 2,251

Share-based payment charges 566 474 1,034

Exceptional items - 177 (38)

Other operating income - - (260)

---------------------------------------------- ----------- ----------- ---------

Adjusted profit for EPS purposes 4,141 3,338 8,058

---------------------------------------------- ----------- ----------- ---------

Weighted average number of ordinary shares

In thousands of shares

-------------------------------------------- ------- ------- -------

For the purposes of calculating Basic

earnings per share 28,795 28,406 28,521

Adjustment for the effects of all dilutive

potential ordinary shares 29,665 29,359 29,387

-------------------------------------------- ------- ------- -------

Basic adjusted earnings per share 14.38p 11.75p 28.25p

Diluted adjusted earnings per share 13.96p 11.37p 27.42p

-------------------------------------------- ------- ------- -------

6 Seasonality

The Group offers a wide range of products and services within

its overall suite, meaning that revenues can fluctuate depending on

the status and timing of certain sales. Some of these are exposed

to high levels of seasonality for example:

-- The Group's Traffic & Data Services division derives

significant amounts of revenue from work taking place at certain

times of the year and is highly exposed to seasonality, in

particular for SEP and CTM which has a very high level of

seasonality based on the timing of events, but also Traffic Data

where work typically takes place when the weather conditions are

more predictable;

-- Ontrac and Compass Informatics both perform some significant

software development projects and the specific timing of these can

vary depending on the commercial terms;

-- Revenues from remote condition monitoring are also driven by

the size and timing of significant orders received from major

customers;

-- Finally, the timing of certain software licence renewals, new sales, and also major project implementations along with consultancy offerings can also impact on when work is performed, revenues are delivered and therefore recognised.

As such, the overall Group continues to be exposed to a high

degree of seasonality throughout the year and reporting period. The

impact of Covid-19 will have a significant impact on the second

half of the financial year, in particular the Traffic & Data

Services Division.

7 Dividends

The Board has decided to defer the payment of the interim

dividend in view of the current Covid-19 crisis, and this decision

will be reviewed later in the year once the Group has more clarity

about the ongoing effects of the pandemic on the business. The

Board will consider what actions are in the best interests of

shareholders, and this could result in the combination of an

interim and full year dividend for the year ended 31 July 2020, or

the retention of cash in the business to invest in future growth

opportunities. The interim dividend would have had a cash cost of

around GBP0.3m had it been paid, which has therefore been retained

in the business.

The cash cost of the dividend payments made is shown below:

Six months Six months Year

ended 31 ended 31 ended

January January 31 July

2020 2019 2019

GBP000 GBP000 GBP000

--------------------------------------- ------------ ------------ ---------

Final dividend for 2017/18 of 0.90p

per share paid - - 257

Interim dividend for 2018/19 of 0.80p

per share paid - - 229

Total dividends paid - - 486

--------------------------------------- ------------ ------------ ---------

The dividends paid or proposed in respect of each financial year

ended 31 July is as follows:

2020 2019 2018 2017 2016 2015 2014 2013 2012

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP000 GBP000 GBP000 GBP000

----------------- ---------- ---------- ---------- ---------- ---------- --------- --------- -------- -------

Interim dividend

for 2011/12 of

0.20p per share

paid - - - - - - - - 48

Final dividend

for 2011/12 of

0.35p per share

paid - - - - - - - - 87

Interim dividend - - - - - - - 75 -

for 2012/13 of

0.30p per share

paid

Final dividend - - - - - - - 102 -

for 2012/13 of

0.40p per share

paid

Interim dividend - - - - - - 89 - -

for 2013/14 of

0.35p per share

paid

Final dividend - - - - - - 119 - -

for 2013/14 of

0.45p per share

paid

Interim dividend - - - - - 106 - - -

for 2014/15 of

0.40p per share

paid

Final dividend - - - - - 164 - - -

for 2014/15 of

0.60p per share

paid

Interim dividend - - - - 137 - - - -

for 2015/16 of

0.50p per share

paid

Final dividend - - - - 195 - - - -

for 2015/16 of

0.70p per share

paid

Interim dividend - - - 167 - - - - -

for 2016/17 of

0.60p per share

paid

Final dividend - - - 225 - - - - -

for 2016/17 of

0.80p per share

paid

Interim dividend - - 198 - - - - - -

for 2017/18 of

0.70p per share

paid

Final dividend - - 257 - - - - - -

for 2017/18 of

0.90p per share

paid

Interim dividend - 229 - - - - - - -

for 2018/19 of

0.80p per share

paid

Final dividend - 287 - - - - - - -

for 2018/19 of

1.0p per share

paid

Interim dividend - - - - - - - - -

for 2019/20

proposed

The total dividends paid or proposed in respect of each

financial year ended 31 July is as follows:

2020 2019 2018 2017 2016 2015 2014 2013 2012

Total dividends

paid per share n/a 1.8p 1.6p 1.4p 1.2p 1.0p 0.8p 0.7p 0.55p

----------------- ------ ------ ------ ------ ------ ------ ------ ----- ------

8 Related party transactions

The following transactions took place during the year with other

related parties:

Purchase of Amounts owed to

goods and services related parties

H1 2020 H1 2019 FY 2019 H1 2020 H1 2019 FY 2019

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------------------- -------- -------- -------- -------- -------- --------

Leeds Innovation Centre Limited

(1) - 67 78 - 13 -

Nexus Leeds Limited (1) 115 - 73 5 - 19

Citi Logik Limited (2) - - - - - -

Nutshell Software Limited

(2) 63 107 254 - - 12

Vivacity Labs Limited (2) 176 101 202 51 69 36

WSP UK Limited 5 - - - - -

Sale of Amounts owed by

goods and services related parties

H1 2020 H1 2019 FY 2019 H1 2020 H1 2019 FY 2019

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------------- -------- -------- -------- -------- -------- --------

WSP UK Limited (3) 1,190 1,337 3,709 33 38 1,364

Citi Logik Limited (2) - - - - - -

Vivacity Labs Limited (2) 20 - - - - -

Nutshell Software Limited - - 10 - - -

(2)

(1) Leeds Innovation Centre Limited and Nexus Leeds Limited are

companies which is connected to The University of Leeds. Tracsis

plc rents its office accommodation, along with related office

services, from this company. All transactions took place at arm's

length commercial rates.

(2) Citi Logik Limited, Nutshell Software Limited and Vivacity

Labs Limited are related parties by virtue of the Group's

shareholding in these entities.

(3) WSP UK Limited (WSP) is a company which is connected to

Chris Cole who serves as non-executive Chairman of Tracsis plc and

also of WSP Global Inc, WSP's parent company. Sales to WSP took

place at arm's length commercial rates and were not connected to Mr

Cole's position at WSP.

9 Reconciliation of adjusted profit metrics

In addition to the statutory profit measures of Operating profit

and profit before tax, the Group quotes Adjusted EBITDA and

Adjusted profit. These figures are relevant to the Group and are

provided to provide a comparison to similar businesses and are

metrics used by Equities Analysts who cover the Group as they

better reflect the underlying performance of the group, and its

ability to generate cash. The largest components of the adjusting

items, being depreciation, amortisation, share based payments, and

share of associates are 'non cash' items and so separately analysed

in order to assist with the understanding of underlying trading.

Adjusted EBITDA is defined as Earnings before finance income, tax,

depreciation, amortisation, exceptional items, other operating

income, and share-based payment charges and share of result of

equity accounted investees. Adjusted EBITDA can be reconciled to

statutory profit before tax as set out below:

Six months Six months

ended 31 ended 31 Year ended

January January 31 July

2020 2019 2019

GBP'000 GBP000 GBP000

------------------------------------- ----------- ----------- -------------

Profit before tax 2,419 2,121 6,559

Finance income / expense - net (12) (20) (37)

Share-based payment charges 566 474 1,034

Exceptional items - 177 (38)

Other operating income - - (260)

Amortisation of intangible assets 1,628 990 2,251

Depreciation 781 366 831

Share of result of equity accounted

investees 204 131 174

Adjusted EBITDA 5,586 4,239 10,514

-------------------------------------- ----------- ----------- -------------

Adjusted profit is defined as Earnings before finance income,

tax, amortisation, exceptional items, other operating income,

share-based payment charges, and share of result of equity

accounted investees. Adjusted profit can be reconciled to statutory

profit before tax as set out below:

Six months Six months

ended 31 ended 31 Year ended

January January 31 July

2020 2019 2019

GBP'000 GBP000 GBP000

----------------------------- ----------- ----------- -------------

Profit before tax 2,419 2,121 6,559

Finance income / expense -

net (12) (20) (37)

Share-based payment charges 566 474 1,034

Exceptional items - 177 (38)

Other operating income - - (260)

Amortisation of intangible

assets 1,628 990 2,251

Share of result of equity

accounted investees 204 131 174

Adjusted profit 4,805 3,873 9,683

------------------------------ ----------- ----------- -------------

Adjusted EBITDA reconciles to adjusted profit as set out

below:

Six months Six months

ended 31 ended 31 Year ended

January January 31 July

2020 2019 2019

GBP'000 GBP000 GBP000

----------------- ----------- ----------- -------------

Adjusted EBITDA 5,586 4,239 10,514

Depreciation (781) (366) (831)

Adjusted profit 4,805 3,873 9,683

------------------ ----------- ----------- -------------

10 Contingent Consideration

During the financial year ended 31 July 2019, the Group acquired

Cash & Traffic Management Limited, Compass Informatics Limited

and Bellvedi Limited. Under the share purchase agreements in place

for each of these acquisitions, contingent consideration is payable

which is linked to the profitability of the acquired businesses for

a two to four year period post acquisition. The maximum amount

payable is GBP750,000 for Cash & Traffic Management Limited,

EUR2,000,000 for Compass Informatics Limited and GBP7,900,000 for

Bellvedi Limited. The fair value of the amount payable was assessed

at GBP600,000 for Cash & Traffic Management Limited,

GBP1,132,000 for Compass Informatics Limited and GBP4,057,000 for

Bellvedi Limited.

The movement on contingent consideration can be summarised as

follows:

31 January 31 January 31 July

2020 2019 2019

GBP000 GBP000 GBP000

--------------------------------------- ----------- ----------- --------

At the start of the year 6,183 3,265 3,265

Arising on acquisition - 2,334 5,789

Cash payment (57) (2,065) (2,149)

Release to Statement of Comprehensive

Income - - (722)

At the end of the year 6,126 3,534 6,183

--------------------------------------- ----------- ----------- --------

The ageing profile of the remaining liabilities can be

summarised as follows:

31 January 31 January 31 July

2020 2019 2019

GBP000 GBP000 GBP000

------------------------------- ----------- ----------- --------

Payable in less than one year 1,151 834 879

Payable in more than one year 4,975 2,700 5,304

Total 6,126 3,534 6,183

------------------------------- ----------- ----------- --------

11 Events after the Balance Sheet date

On 10 March 2020, the Group acquired iBlocks Limited for an

initial consideration of GBP14.0m plus additional performance

consideration linked to future performance. The Group is currently

evaluating the fair value of the assets and liabilities

acquired.

Statement of Directors' Responsibilities

The Directors confirm to the best of their knowledge that:

i) The condensed consolidated interim financial information has

been prepared in accordance with IAS 34 Interim Financial Reporting

as adopted by the European Union;

ii) The interim management report includes a fair review of the

information required by the FSA's Disclosure and Transparency Rules

(4.2.7 R and 4.2.8 R).

Financial statements are published on the Group's website in

accordance with legislation in the United Kingdom governing the

preparation and dissemination of financial statements, which may

vary from legislation in other jurisdictions. The maintenance and

integrity of the Group's website is the responsibility of the

Directors. The Directors' responsibility also extends to the

ongoing integrity of the financial statements contained

therein.

The Directors of Tracsis plc and their functions are listed

below.

Further information for Shareholders

Company number: 05019106

Registered office: Nexus

Discovery Way

Leeds

LS2 3AA

Directors: Chris Cole (Non-Executive Chairman)

Chris Barnes (Chief Executive Officer)

Max Cawthra (Group Finance Director)

Lisa Charles-Jones (Non-Executive Director)

Liz Richards (Non-Executive Director)

Mac Andrade (Non-Executive Director)

Company Secretary: Max Cawthra

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR BSGDSRDGDGGB

(END) Dow Jones Newswires

April 02, 2020 02:00 ET (06:00 GMT)

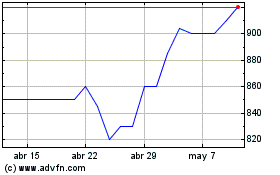

Tracsis (LSE:TRCS)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Tracsis (LSE:TRCS)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024