Baker Steel Resources Trust Ltd Net Asset Value(s) (9339I)

07 Abril 2020 - 1:00AM

UK Regulatory

TIDMBSRT

RNS Number : 9339I

Baker Steel Resources Trust Ltd

07 April 2020

BAKER STEEL RESOURCES TRUST LIMITED

(Incorporated in Guernsey with registered number 51576 under the

provisions of The Companies (Guernsey) Law, 2008 as amended)

7 April 2020

31 March 2020 Unaudited NAV Statement

Net Asset Value ("NAV")

Baker Steel Resources Trust Limited (the "Company") announces

its unaudited net asset value per share at 31 March 2020:

Net asset value per Ordinary Share: 67.3 pence

The NAV per share decreased by 8.4% against the NAV at 28

February 2020, largely as a result of the decision to review the

valuation of the unlisted investments following the recent

volatility in world markets associated with the Covid-19 virus

pandemic.

The Company had a total of 106,462,502 Ordinary Shares in issue

with a further 700,000 shares held in treasury

as at 31 March 2020 .

Portfolio Update

The Company's top 12 investments at 31 March 2020 were as

follows as a percentage of NAV:

Bilboes Gold Limited 18.7%

Futura Resources Ltd 16.4%

Polar Acquisition Ltd 10.4%

Tungsten West Limited 9.8%

Cemos Group plc 8.7%

Mines & Metals Trading Peru PLC 5.7%

Polymetal International Plc 4.7%

Nussir ASA 4.1%

Black Pearl Limited Partnership 3.9%

Anglo Saxony Mining Limited 3.8%

Sarmin Minerals Exploration 3.2%

PRISM Diversified Ltd 2.1%

Other Investments 7.6%

Net Cash, Equivalents and Accruals 1.1%

Investment Update

Full Year Adjustments to Carrying Values

The Company normally reviews the valuation of its unlisted

holdings at the half-year and full year-ends. However due to the

recent market volatility and extraordinary situation brought about

by the COVID-19 pandemic, the Board considered it prudent to

undertake a similar review at the end of the first quarter. This

review is not as comprehensive as undertaken at the year-end but

uses the same methodology. It takes into account general market

movements in mining equities, as well as specific factors, and an

assessment of whether these should impact the carrying values of

the Company's unlisted holdings. In order to quantify how the share

price of a particular unlisted stock might have moved during the

period had it been listed, the Investment Manager maintains an

index of comparable listed companies for each unlisted investment.

In addition, the Investment Manager updates its royalty models for

the royalty interests the Company owns in Futura Resources and

Polar Acquisition Limited ("PAL") to take account of the latest

estimated production profiles of the underlying projects and

commodity prices. The net present values produced by these royalty

models are then discounted for development risk to arrive at a

valuation.

This review has led to an 8.4% reduction in the NAV of the

portfolio with gold companies such as Bilboes and Polymetal faring

best and those investee companies with metals and minerals required

for industry having been impacted the most. Although it is unclear

how long the worldwide lockdown from COVID-19 will continue, the

mining industry and metals should recover thereafter to provide the

materials for expected government stimuli through infrastructure

programmes. The next planned review of the unlisted investments

will be at 30 June 2020.

Nussir ASA ("Nussir")

During March 2020, Nussir completed a positive definitive

feasibility study ("DFS") into its Nussir/Ulveryggen copper project

in northern Norway. The DFS was based on a mine producing

approximately 15,000 tonnes of copper per annum with a maximum

pre-production cash requirement of US$86.7 million. At a long term

copper price of US$6,500 per tonne the economic model gave a net

present value using a 6% discount rate ("NPV(6%)") of US$132.6

million with an internal rate of return ("IRR") of 23%. An upside

case on the basis that the Inferred Resources are converted into

the Indicated category gave an NPV(6%) of US$189.8 million. Nussir

is fully licenced and will now examine its options as to the best

way to fund the mine development and realise the value of the

project as well as investigating the potential to develop the mine

using electric mining and haulage equipment.

Further details of the Company and its investments are available

on the Company's website www.bakersteelresourcestrust.com

Enquiries:

Baker Steel Resources Trust Limited +44 20 7389 8237

Francis Johnstone

Trevor Steel

Numis Securities Limited +44 20 7260 1000

David Benda (corporate)

James Glass (sales)

The Net Asset Value ("NAV") figure stated is based on unaudited

estimated valuations of the underlying investments and not

necessarily based on observable inputs. Such estimates are not

subject to any independent verification or other due diligence and

may not comply with generally accepted accounting practices or

other generally accepted valuation principles. In addition, some

estimated valuations are based on the latest available information

which may relate to some time before the date set out above.

Accordingly, no reliance should be placed on such estimated

valuations and they should only be taken as an indicative guide.

Other risk factors which may be relevant to the NAV figure are set

out in the Company's Prospectus dated 26 January 2015.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

NAVGZGGDFVDGGZM

(END) Dow Jones Newswires

April 07, 2020 02:00 ET (06:00 GMT)

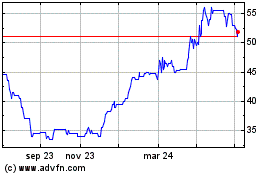

Baker Steel Resources (LSE:BSRT)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

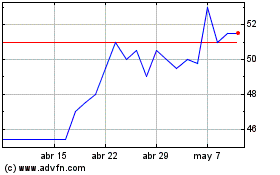

Baker Steel Resources (LSE:BSRT)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024